For long, there has been a quest to convert interest income to capital gains when investing in debt products. First zero-coupon bonds, and until recently MLDs, provided such avenues. The 2002 CBDT circular and Finance Bill 2023 has closed these avenues.

The Union Budget 2023 has sprung a spanner in the wheels of market-linked debentures (MLDs). The budget has proposed to tax MLDs at maximum marginal rate (MMRs) and take away the benefit of long-term capital gains taxation applicable on MLDs.

There is significant confusion among investors who have invested in MLDs as to what they should do. Below, we intend to take a deep dive into MLDs and guide investors as to what they should or should not do.

What are MLDs?

One of the key issues of investing in direct bonds is that the interest income earned through such investments is taxed at MMRs. So if you invest in a bond that gives you 8% interest, and you are in the 30% tax bracket, the post-tax interest earned is less than 5%. Thus, the taxation of plain-vanilla bonds is similar to taxation of interest income on fixed deposits.

Prior to 2002, one of the ways to prevent the gains from investing in a bond being taxed as interest income was to invest in zero-coupon bonds and sell it close to maturity. By doing this, an investor could book the accumulated interest as capital gains. Given the tax arbitrage between interest income and capital gains, many wealth management outfits would arrange such a sale and buy-back of zero-coupon bonds for their clients.

To curb this practice, CBDT came up with a circular in 2002 which stopped this practice for zero-coupon bonds. However, the circular was not applicable on market-linked debentures (MLDs). Though MLDs are similar to zero-coupon bonds, in the sense that the gains are back-ended, the variable pay-off in MLDs make them different from the fixed interest rate of zero-coupon bonds.

What has changed in the latest budget?

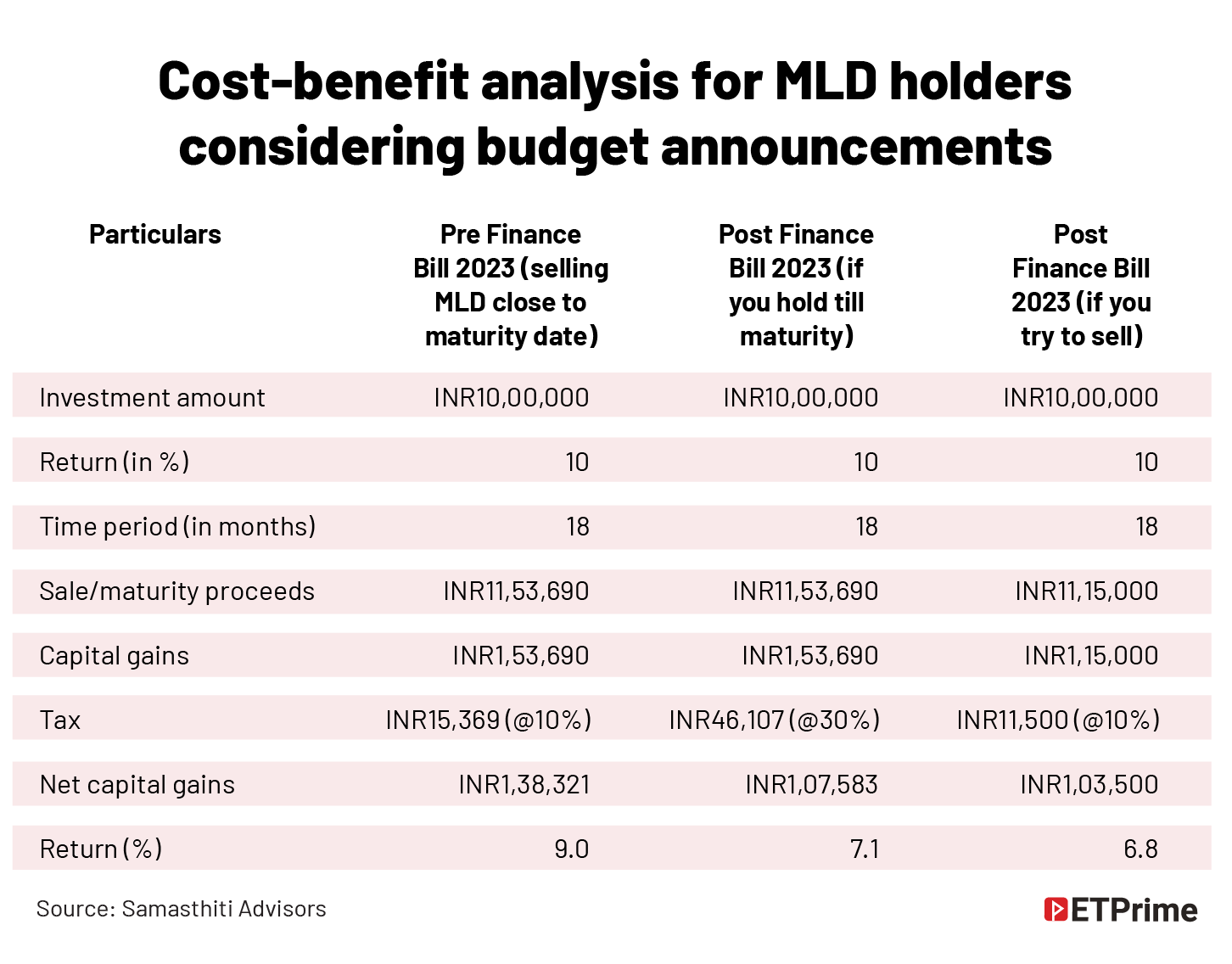

Prior to the Union Budget 2023, listed MLDs held for more than one year were eligible for 10% long term capital gain tax. What the budget has done is effectively make the taxation of MLDs similar to that of zero-coupon bonds. The Finance Bill 2023 states that any gain from MLDs, either through sale before maturity or the maturity proceeds, will be taxed as short-term capital gains. The provisions will be applicable from April 1, 2023.

This is a problem to investors who were intending to hold MLDs with an expectation of selling them after a year and pay only 10% long term capital gain tax. Going forward, gains from MLDs, irrespective of holding period, and irrespective of the nature of gains — whether maturity proceeds or capital gains, will be taxed at slab rates of the investor.

If you have invested in an MLD, what should you do?

Since the provisions of the Budget changes will be applicable from April 1, 2023, there is a rush by investors to sell their MLDs before March 31, 2023, and pay the lower long term capital gain tax. However, this is not easy as the secondary market for MLDs is very thin. Thus, not only will it be difficult to find buyers in the secondary market, but even if there are buyers, the price quoted by them will be low.

An investor in MLD needs to closely evaluate the price at which they can sell before March 31, and calculate the overall return they will make. It could be the case that the selling price is so low that it could be in the investor’s interest to hold the MLD till maturity and pay full tax on it.

It could be a better strategy for MLD investors to pay the higher tax rather than get entangled in a hasty exit. For instance, in the illustration above, the MLD investor is worse off by trying to sell at an unfavourable price rather than hold the MLD till maturity and pay full tax.

There has been heightened concern that change in MLD taxation has increased credit risk for issuers due to the closure of the MLD route for future fund raising. In most cases (and this is true for at least the higher-rated MLDs), the share of MLD borrowing in the issuer balance sheet is less than 5%-10%, which will not create re-financing risk for the issuer.

Do not try to self-arrange a dubious sale of the MLD you hold

Some investors are trying to self-arrange a secondary market exit for their MLDs by selling them to their spouse, friends or relatives. However, investors should note that there has to be a sound commercial basis for a transaction. A transaction carried out purely to avoid paying taxes can attract provisions of the General Anti-Avoidance Rule (GAAR) which is a law to prevent aggressive tax planning and to prevent tax evasion/tax leaks.

Looking to buy MLDs for short-term gains? Factor in TDS impact

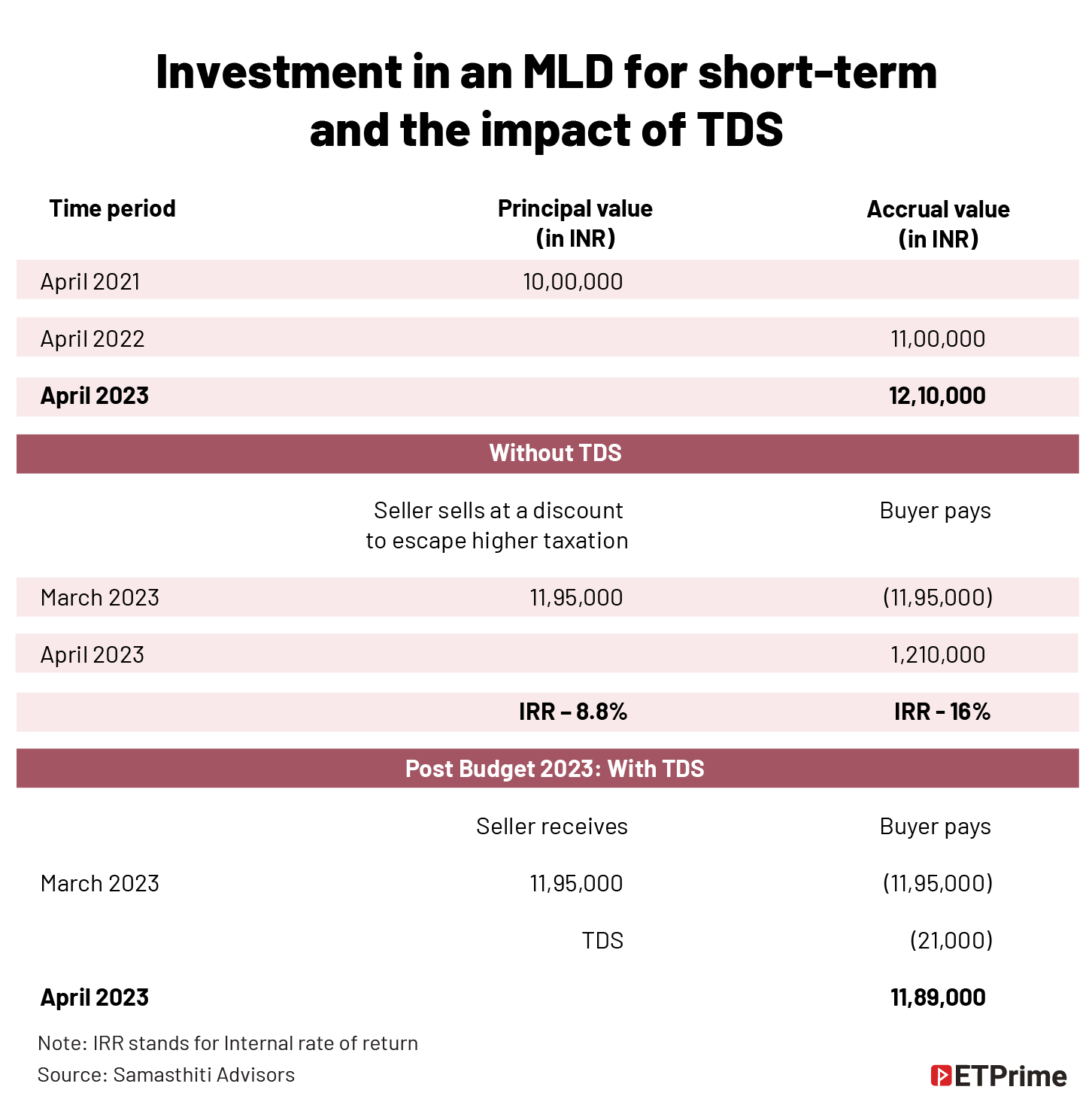

Several wealth management outfits are desperately trying to arrange a sale of MLDs for their HNI clients to unsuspecting buyers. If any counterparty is showing you an MLD to buy, you need to keep in mind that post Budget 2023, interest payment on bonds (including MLDs) will attract a TDS of 10%.

Thus, you will need to factor this TDS impact in the transaction price you negotiate. In most cases, the short-term opportunity for investing in MLDs look attractive without factoring in the TDS — once the TDS is brought into the picture, things go downhill.

For instance, in the illustration below, a buyer may be shown a short term opportunity to earn 16% annualised return by investing in an MLD just for a month. However, once the TDS aspect is considered, the buyer of the MLD receives lower maturity proceeds compared to the acquisition cost.

The bottom line

Change in MLD taxation announced in Budget 2023 presents problems for both the current investors as well as potential investors in this product. Rather than trying to be adventurous to avoid the repercussions of the tax change, the best strategy could be to do nothing.

Given that most MLDs were anyway at high gross yields, the post-tax yield even after the higher tax will still look attractive. For investors looking to make quick bucks through the opportunities shown by some wealth management outfits, it’s best to stay away. With interest rates rising in the economy, there is enough yield to be made in plain-vanilla debt products.

For long, there has been a quest to convert interest income to capital gains when investing in debt products. First zero-coupon bonds, and until recently MLDs, provided such avenues. The 2002 CBDT circular and Finance Bill 2023 has closed these avenues.

However, to cheer up investors who are still looking for the holy grail that transforms interest income to capital gains, there is still one product left which does this — the “growth” option while investing in debt mutual funds.

(This article was published in ETPrime on March 14, 2023 and can be accessed from the link https://economictimes.indiatimes.com/prime/money-and-markets/budget-2023-increased-taxes-on-market-linked-debentures-what-should-you-do-if-you-hold-them/primearticleshow/98614820.cms)

0 Comments