And the best is yet to come!

We started Samasthiti with a simple idea – to provide honest financial planning services to everyone. As Samasthiti turns one, we wanted to give you all a peek into our journey and discuss the impact that we have had in the past year.

Right from the beginning, we were certain that we wanted to build a client-centric model. We knew that unless we catered to the real needs of our clients and helped them sort out their financial lives, we would not be contributing towards Samasthiti’s mission:

To democratize financial planning in India by providing unbiased and trustworthy financial services to everyone in need, and not just a privileged few.

In line with our mission, our model is based on two features. First, we do not to take any commissions from companies that sell financial products. We knew that taking commissions would come in the way of providing unbiased advise. Hence, Samasthiti’s entire revenue (every single penny of it) comes directly from our clients which allows us to provide advise that is truly unbiased.

The second feature is to charge a transparent fixed fee – and we determine this fee based on the scope of work involved and not the client’s portfolio size. As a fixed fee-only advisor, we do not size up clients depending on their wealth. This enables us to welcome any client irrespective of which income strata they come from – and not discriminate between low-income and high-income clients

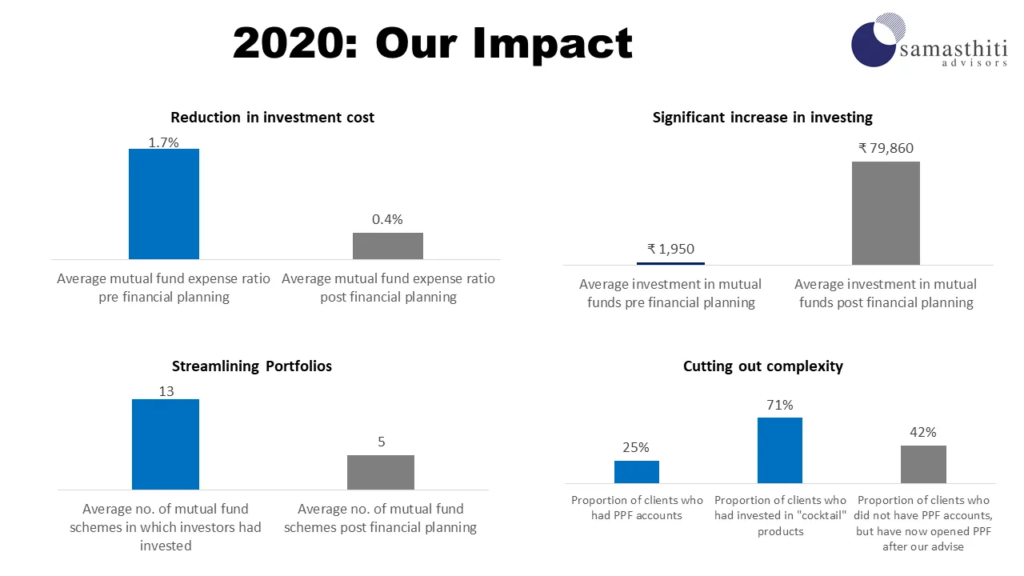

In the past year, it has become apparent that Samasthiti’s strength is its zero-commission and fixed fee model. We are delighted to share with you the impact that Samasthiti has made in the financial lives of its clients:

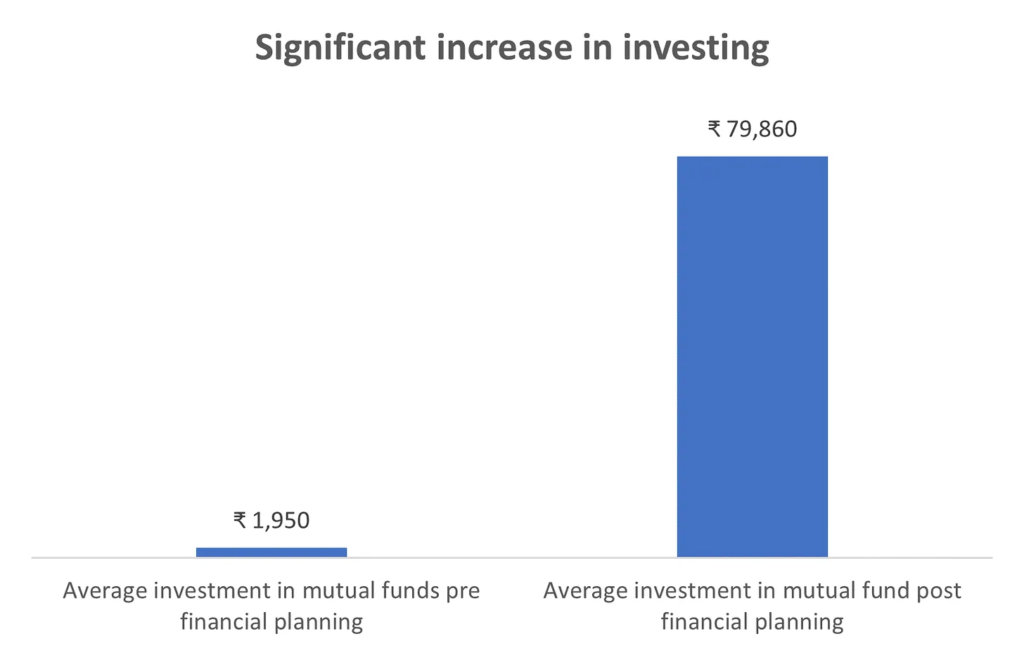

Over the last year, we have been able to increase clients’ savings in mutual funds from an average of less than INR 2,000 per month to an average of about INR 79,000 per month

Reduce the annual cost of clients’ mutual fund portfolios from an average of 1.7 percent to 0.4 percent

Streamline clients’ mutual fund portfolios by reducing exposure from an average of 13 mutual fund schemes to an average of 5 mutual fund schemes

Restrict clients’ exposure to cocktail investment products (that offer a multitude of benefits none of which is substantial) and get them to invest in simple but powerful investment products. For instance, close to half of our clients who did not have PPF accounts earlier, have now opened such an account and started contributing to it.

The Power of Planning

Most people save, but very few invest, and it was no different with our clients. We had clients who had accumulated savings in either their savings bank account or fixed deposits and left it there. This was despite the fact that they had very long-term financial goals and it made sense for them to invest, at least a part of their savings, in mutual funds. We also had clients who were not saving at all or had little clue where their money was going.

It was heartening to see the impact that our financial planning process has made. Most of our clients are surprised by how much more they are able to save now.

Among our client base, the average investment in mutual funds prior to their financial planning was barely INR 2,000 per month. Post our financial planning, this figure zoomed up to about INR 79,000 per month.

In most cases, this staggering increase is the result of one thing – taking out time to think about what is happening to their money for the first time in their life.

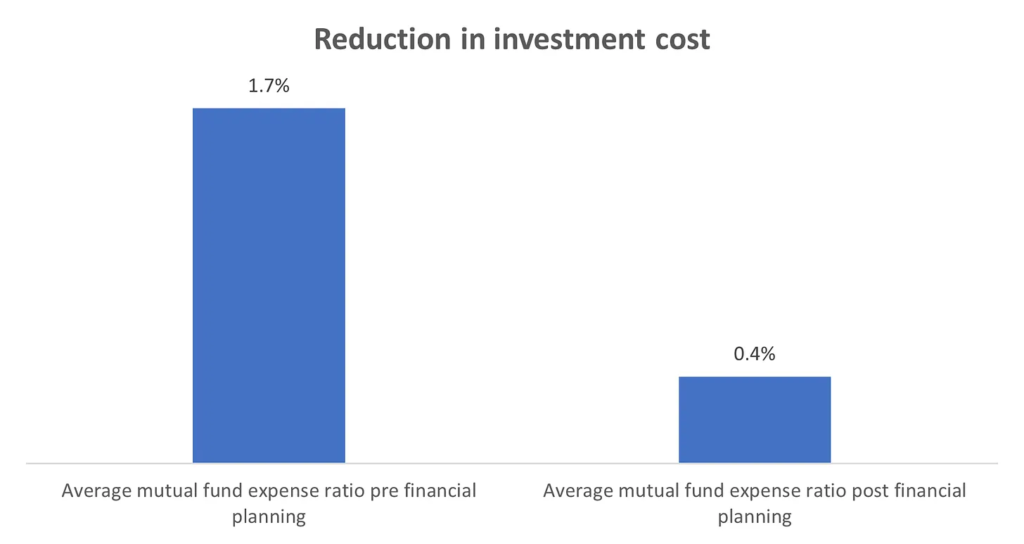

The Easiest Way to Earn Higher Returns is to Cut Costs

An average investor goes to great lengths to try and increase the return on their portfolios. Most of the times this desperate search for higher return increases our vulnerability to being mis-sold a risky financial product. We seem to be willing to jump many hula hoops in our quest for higher returns and we forget that one of the most powerful method of increasing our portfolio’s return is to cut costs.

Every financial product has a cost. This cost can be broken into two components – a part of the cost flows to the manufacturer of the financial product, and the other part to the intermediary who distributes the product in the market. All investors should look closely at these costs with a hawk eye.

At Samasthiti, we have been extremely finicky about costs. The reason is obvious – every penny saved in costs immediately flows into earning a higher return from your portfolio. Several of our clients are young who are investing for their retirement which is at least 20 years away and an annual saving of 1 percentage point in cost translates to an additional retirement corpus of more than 20 percent.

The average cost of our clients’ mutual fund portfolio was 1.7 percent per annum earlier, and this average has come down to 0.4 percent per annum post their financial planning exercise. This corresponds to a savings of more than 1 percentage points annually. This savings was achieved by not only enabling our clients to invest directly in financial products, bypassing all intermediaries, but also by avoiding high-cost financial products.

There’s more to it. A saving of 1 percent annually is only the tip of the iceberg. This is because an investment strategy that emphasises on being cost conscious will automatically avoid cocktail investment products and prioritize low cost, simple, efficient and robust financial products. Thus, being cost conscious is an investor’s best strategy to avoid ending up with an inferior investment product.

We cannot emphasize this enough – costs matter, a lot.

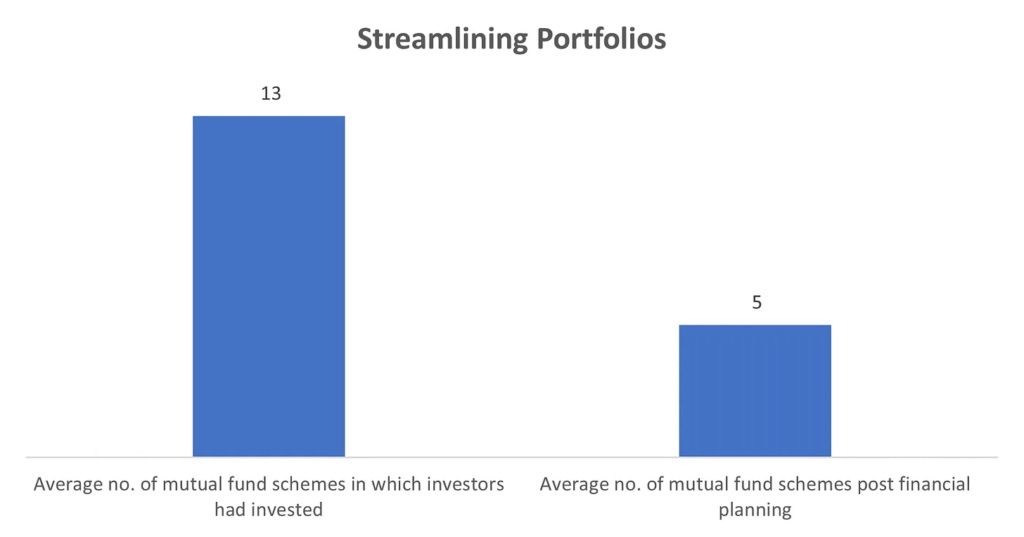

Spray and Pray

We always had an inkling that investors over-diversify when investing in mutual funds. This is because of the way mutual funds are sold in India. Every new mutual fund offer is marketed heavily on the back of fat upfront commissions. Even among the existing mutual fund schemes, the commission paid keeps changing depending on the marketing strategy of the mutual fund company and different schemes are promoted at different points of time. These perverse incentives encourage the average investor to invest in whatever is the flavour of the season – and the flavour keeps changing.

Thus, rather than identifying a few good mutual fund schemes and accumulating savings in them consistently, more often than not, investors are encouraged to spray their savings over a host of mutual fund schemes and pray.

During the course of the last year, we witnessed portfolios – some with more than 40 different mutual fund schemes! The exposure to a large number of mutual fund schemes is also a reflection of an abject lack of clarity in designing one’s portfolio.

In our financial planning process, we pay special attention to cleaning messy mutual fund portfolios. Through careful analysis, we have been able to streamline our clients’ mutual fund holding from an average of 13 different schemes to an average of 5 different schemes.

Simple is Powerful

Cocktail financial products are those that combine multiple objectives. The most common cocktail products are those that combine investment and insurance, like Unit-Linked-Insurance-Plans (ULIPs) or traditional LIC policies. Such products are a marketers’ delight as the product complexity allows for innovative but obfuscating packaging. Such products, though, struggle to achieve any of their objectives.

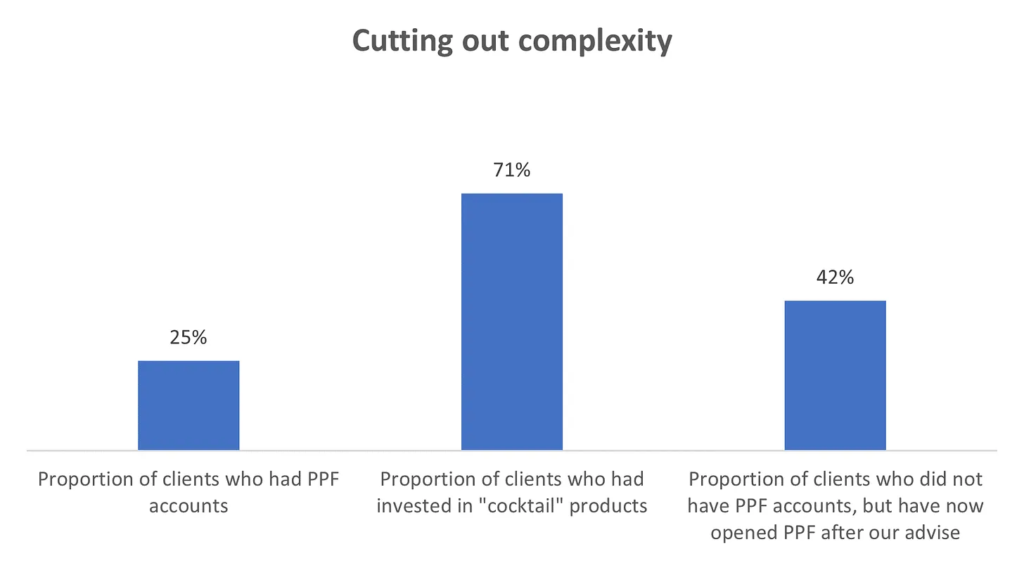

What is worse, the cocktail nature of their design provides a cover for charging high fees. These high fees enable the manufacturer of such products to pay attractive commissions on their sale. Little surprise then that an average retail investor’s portfolio will have a decent sprinkling of cocktail financial products. Among our client base, more than 70 percent of them either had an investment in a ULIP or a LIC policy.

Compare this to the fact that only about 25 percent of our clients had a Public Provident Fund (PPF) account when they approached us. This is despite the fact that PPF is one of the best investments you can make. Unfortunately, the simplicity of PPF is perceived as being boring, rather than being interpreted as its strength. Also, nobody wants to talk about PPF as there is no commission to be made on getting people to open PPF accounts. At Samasthiti, we strongly advise our clients, where applicable, to open a PPF account and contribute to it regularly.

Close to half our clients who did not earlier have PPF accounts, have now opened such an account and started contributing to it.

SO that pretty much sums up the year 2020 for us. While the year was extremely challenging for us, it is data like the above that has helped us keep our heads above water. It goes without saying that none of this would have been possible without the trust placed on us by our clients. And that alone makes everything worth its while.

Very good to know …