While the math suggests that opting for a higher pension is a good idea, it is important to make a choice based on factors that are personal to you. These factors include flexibility of a retirement plan, inheritance planning, and tax among other things. Most importantly, the deadline is approaching, so one must act fast.

Have you opted for higher pension under the Employee Pension Scheme or EPS? The deadline to opt for higher pension under EPS is June 26, 2023.

Given that this deadline has been extended multiple times by the Employees’ Provident Fund Organisation (EPFO), this is perhaps the last window of opportunity to opt for higher pensions.

Since your choice will have far-reaching consequences on your retirement planning, it is important to consider all aspects — both the math and the behavioural ones — in deciding if you should opt for higher pensions.

The background

Providing a social security net has been an important policy objective.

A key cornerstone of this security net is economic self-sufficiency during retirement. Keeping this in mind — the EPFO was set up in 1952 to administer the Employees’ Provident Fund (EPF) scheme.

The employee and the employer both contribute 12% of the employee’s basic salary into the EPF. This monthly contribution compounds over many years to a healthy retirement corpus.

However, a key concern in the EPF scheme was that it provides a lumpsum corpus at retirement. There is a risk that the lump sum amount could be frittered away, misused, or poorly invested. To reduce the risk of retirees exhausting their retirement corpus before their life expectancy, the EPS was introduced by EPFO in 1995.

It was mandated that out of the 12% employer contribution, 8.33% will go into the employee’s EPS account and the balance 3.67% into their EPF account.

At the time of the introduction of the EPS in 1995, the maximum pensionable salary was fixed at INR5,000 per month. This means that even if your salary was higher, the 8.33% of employer’s contribution towards your EPS was calculated on the cap of INR5,000 per month.

Also, at the time of calculating the retirement pension, this statutory cap was used for calculation purposes.

In 1996, EPFO introduced the option to contribute to EPS based on actual salary. If your salary was higher, say INR15,000 per month, you had an option of contributing 8.33% to your EPS on this higher salary.

In this option, not only would your contribution to EPS be higher, but your pension will also be higher as your actual last drawn salary would be considered for deciding your retirement pension.

In 2014, EPFO carried out an amendment which capped pensionable salary at INR15,000 and the option to contribute to EPS based on a higher salary was removed. This amendment was challenged in various courts and the matter finally reached the Supreme Court (SC).

In November 2022, the SC upheld the amendments carried out by EPFO with respect to capping of the pensionable salary, but gave a one-time option to EPFO subscribers to contribute to EPS based on a higher salary.

Based on the SC order, you now have an option to make an application to EPFO to contribute to your EPS based on your actual salary and become eligible for a higher pension.

Contribution based on actual salary will lower accumulation in EPF

To examine if it is a good idea to opt for higher pension, let us take an example of an individual who starts working at the age of 25 with a basic salary of INR5 lakh with annual increment of 8%.

For this individual, 12% of her basic salary, which is INR60,000, will be her EPF contribution. The employer will match this INR60,000 contribution, which will be split between the individual’s EPF and EPS accounts.

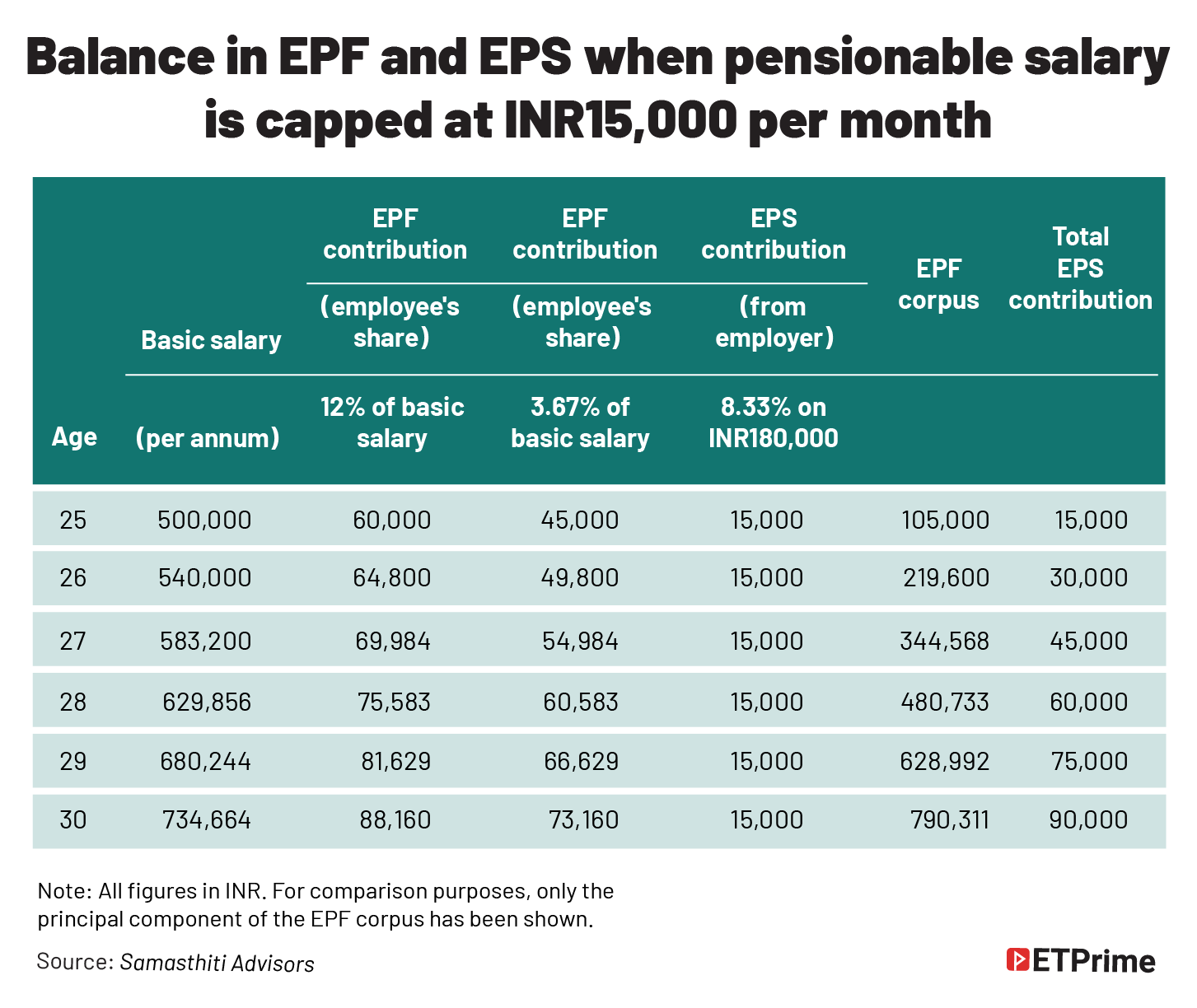

If we assume a cap of INR15,000 per month as pensionable salary, the employer will contribute INR1,250 per month (8.33% of INR15,000) into the individual’s EPS account. The annual contribution to EPS by the employer will be INR15,000.

Since the employer has to match the total employee contribution of INR60,000, the balance INR45,000 will be contributed by the employer into the individual’s EPF account.

The trajectory of the balance in the EPF and EPS account would be as shown in Table 1 below:

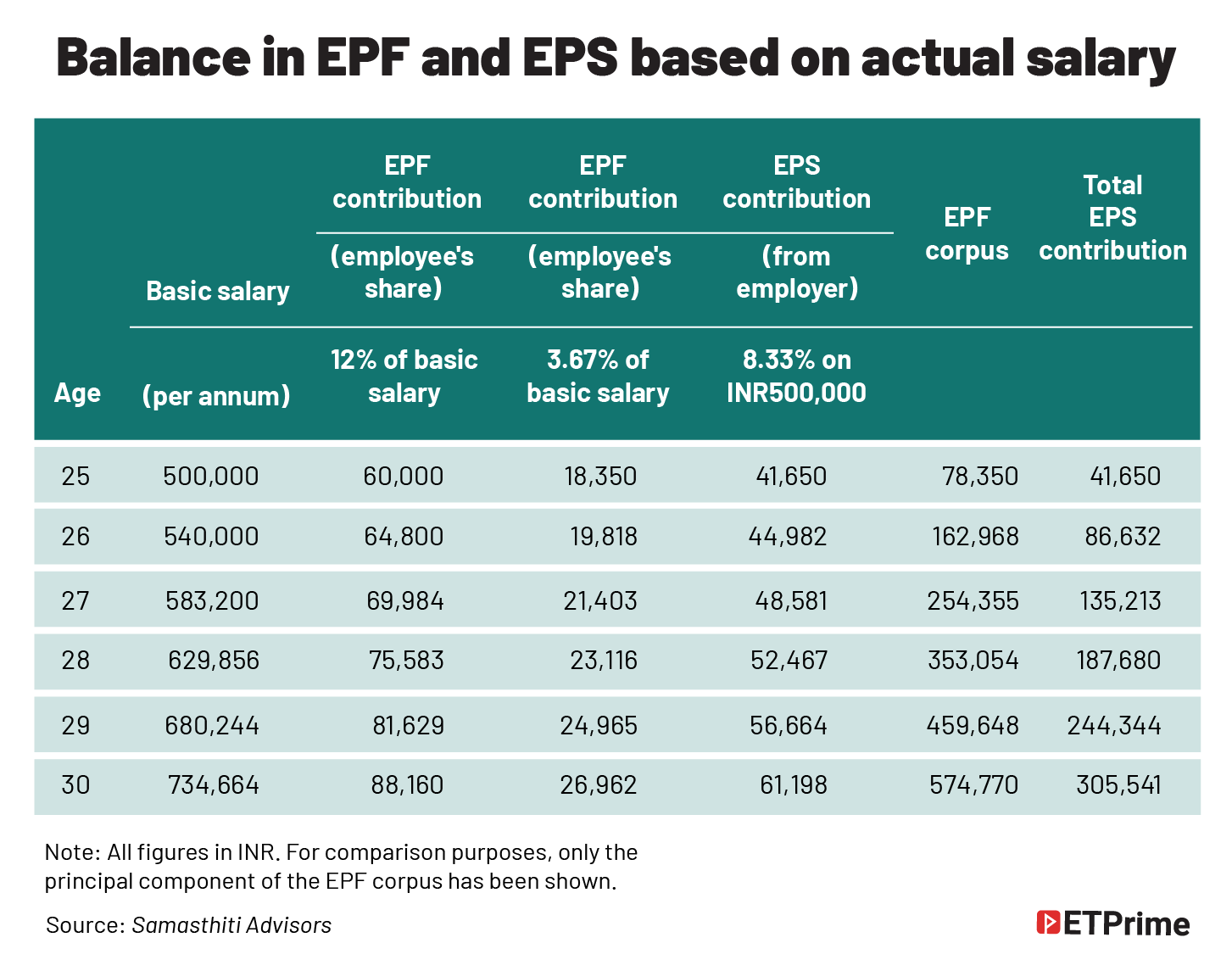

If the contribution to EPS is made on the basis of actual salary, the computations change as shown in Table 2 below:

The employee’s contribution to their EPF account remains the same. However, the employer’s contribution to EPS changes from INR15,000 each year in the previous scenario to INR78,350 in the first year.

This sharp increase in EPS contribution is due to the fact that 8.33% is being calculated now on actual salary and not on the statutory limit of INR15,000.

As can be seen in Table 2, when EPS deductions are made based on actual salary, there is a substantial increase in the contribution towards EPS, but it comes at the cost of a lower EPF corpus.

Thus, higher EPS contribution and the accompanying higher pension comes at the cost of a substantial depletion in EPF balance.

Contribution based on actual salary will enable higher pension

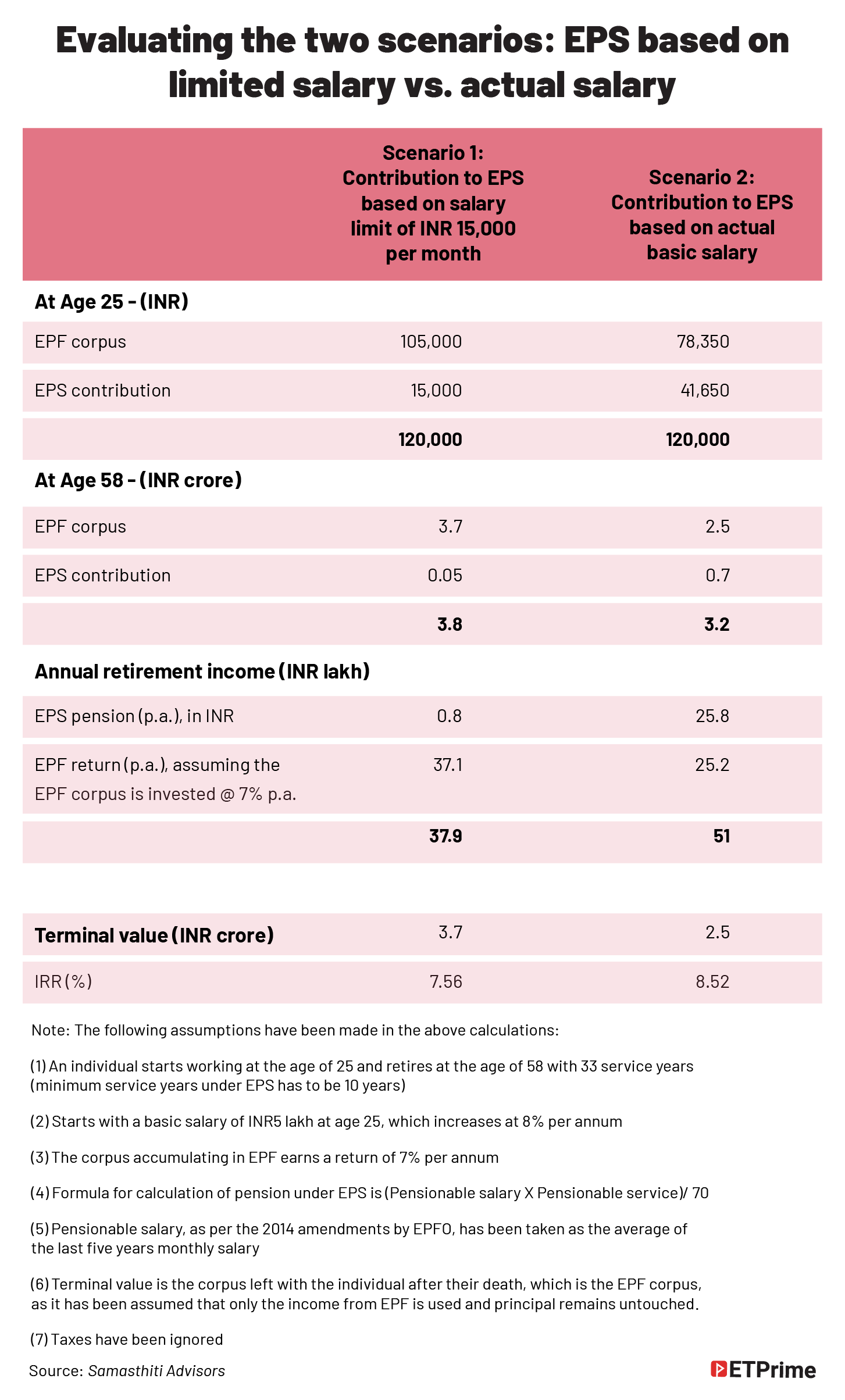

To understand whether the lower EPF balance for a higher pension is a worthwhile trade off, let’s continue with our illustration of a 25-year-old who earns INR5 lakh each year and gets an annual increment of 8%. Consider the retirement age to be 58 years of age. This is also the age at which an individual becomes eligible for pension from their EPS accounts.

If this individual was to contribute to her EPS based on actual salary, she will receive an annual pension of INR26 lakh each year in her retirement. This pension will be an attractive 40% of her last drawn salary.

If she were to contribute to her EPS based on the statutory limit of INR15,000 per month, she would receive a significantly lower pension of INR82,000 per year.

The scenario where a large pension is being received will be accompanied by a lower EPF corpus. Similarly, the scenario where a small pension is being received will be accompanied by a large EPF corpus.

To weigh the two scenarios, it is important to extend our analysis by taking into consideration all the cash flows pertaining to the matter — contribution to EPF, return on EPF, contribution to EPS, and the pension received from EPS from age 25 to an assumed life expectancy of age 85.

Once we have these cash flows for both the scenarios, we can calculate the Internal Rate of Return (IRR) and make a comparison.

Table 3, as illustrated below, provides this analysis.

Based on IRR computation, scenario 2 is a clear winner.

It may appear that the difference between the two scenarios is not material given that the difference in IRR is only about 1%. However, since this 1% annual difference is compounded over a very long period (from age 25 to the assumed life expectancy of age 85), it leads to a large difference in terminal value between the two scenarios.

Considering behavioural factors when making a decision

While the math suggests a clear winner, reality is always more complicated than a stylised illustration.

It is important to overlay behavioural considerations on top of math for making a prudent choice. The most important factor to keep in mind is that opting for EPS contribution based on actual salary will increase your pension and reduce your EPF balance.

This could obviate the need to undertake comprehensive retirement planning — the higher pension effectively becomes your retirement plan. However, if an individual is not opting for higher pension, it becomes imperative for them to undertake comprehensive retirement planning.

Another factor to consider is flexibility. In the case of opting for higher pension, the retiree loses the flexibility of designing a retirement plan as per her own requirement. The pension being offered by EPFO is not customisable.

The choice that you make also has implications on your inheritance planning. In the case of higher pension where the corresponding EPF balance is low, the ability of the individual to leave an inheritance is restricted. In the case of lower EPS contribution, the large EPF accumulation means a higher possibility of there being an inheritance.

Tax is another important factor to consider. Pensions are fully taxed, and hence, opting for higher pension can be more penalising from a tax point of view. In the first scenario, where the retirement kitty will primarily consist of a lump sum amount in EPF, the individual will have the flexibility of designing a more tax-efficient withdrawal plan from their retirement corpus.

For individuals targeting early retirement, or a career littered with sabbaticals, or breaks, opting for higher pension may not be the best approach. This is because the pension will depend on the last 60 months drawn salary. For early retirees, the pension at age 58 based on their salary structure from, say age 45 to age 50, could be sub-optimal.

Clearly, the quandary of whether you should opt for higher pension under EPS has no clear answer. As is often the case in personal finance, while the math helps in illuminating the discussion, your decision should ultimately depend on factors which could be deeply personal to you.

In this case, what is good for the goose may not be good for the gander.

(This article was published in ETPrime on June 23, 2023 and can be accessed from the link https://economictimes.indiatimes.com/prime/money-and-markets/higher-pension-under-eps-is-attractive-but-your-decision-should-depend-on-behavioural-factors-/primearticleshow/101196674.cms)

0 Comments