New year starts with a bang!

Samasthiti Advisor’s Weekly Market Tracker – For the week ended Jan 12, 2024

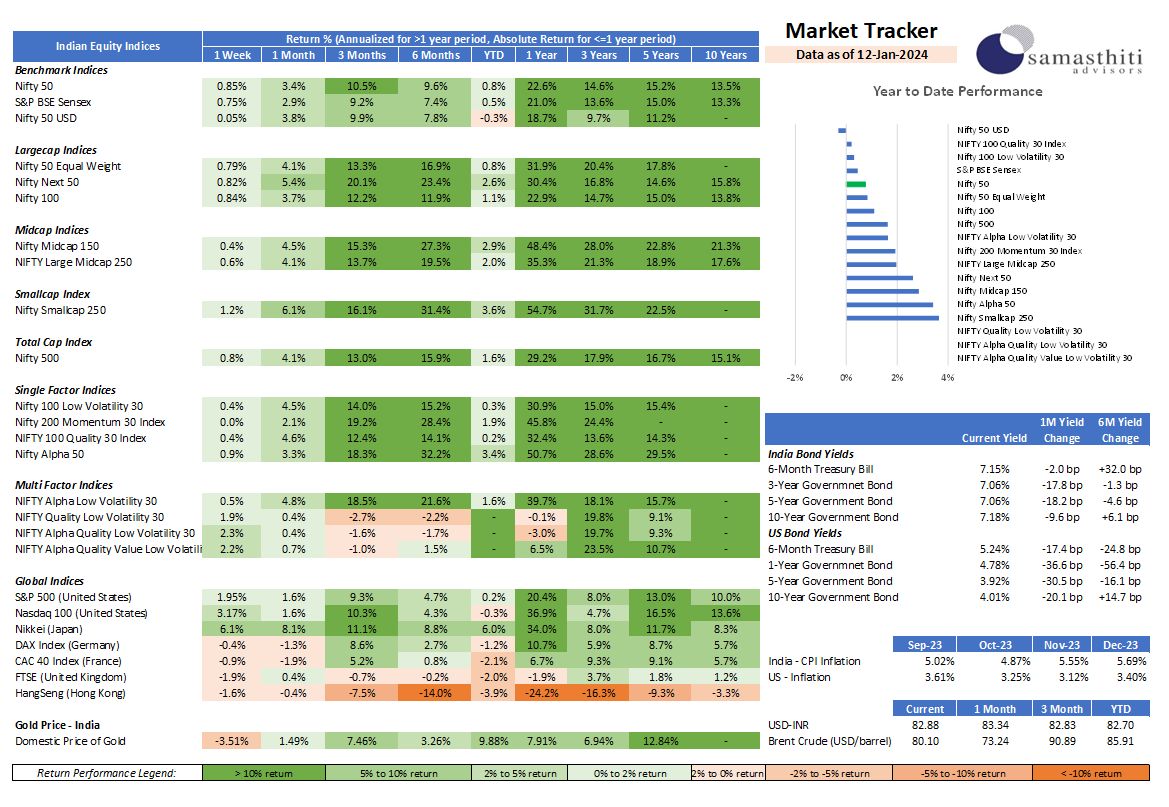

•Nifty 50 rose by 📉 0.85% over the last week. Meanwhile, Nifty Next 50 surged 0.82% in weekly gain fuelled by favourable Court verdict on the Adani group.

•India’s direct tax collection surged 19% to😍 in the current fiscal, exceeding last year’s gross collection by 25%. Notably, the current collections represents 87% of the FY24 budget estimates, signalling robust fiscal health.💰

•📈 Nasdaq soared 3.17%, and S&P 500 rose 1.95%, highlighting the US market strength. Inflation fears dimmed hopes for early Fed rate cuts. Meanwhile, Microsoft’s 1.6% gain propelled its valuation to $2.875 trillion, surpassing Apple at $2.871 trillion – its AI advantage steering a market valuation shift🌐💻

•📊 USD-INR at 82.88, strengthening from 83.34 in 1 month. The Indian Rupee strengthened on domestic market recovery and a weaker US dollar. A slight drop in crude oil prices further supported the Rupee. 📈.

•📈 Nikkei surges by 6.1%🎇 in a week, outperforming global peers. Japanese markets hit their highest levels since 1990, driven by strong domestic performance and a substantial net foreign inflow of 6.3 trillion yen in 2023, marking it the highest since 2014. 💹

•📉 Hang Seng drops 1.6% in a week amid China’s economic challenges. China reports its first annual export drop in seven years. Additionally, the Consumer Price Index falls 0.3%, below expectations, and also lower than the 0.5% fall seen in November. 💹

•📈 Indian 10-year bond yield remains stable at 7.17%; US at 3.97%, up by 11.6 basis points. The moderate surge in global bond yields, particularly in the US is propelled by higher-than-expected CPI data, robust labour market indicators, and a widening budget fiscal deficit of $510 billion😟.

•📈 Indian inflation surges to 5.69% in Dec, the highest in 4 months, compared to 5.55% in Nov. Notably, food prices contributed significantly to the increase. 📊.

•📈 US Inflation for December is at 3.30%, up from 3.12% in November. The consumer price index, rising 3.3%, marks the highest in three months. Inflation fears persist, stifling hopes for earlier Fed rate cuts.🌐

•🛢 Brent Crude at $78.64, up from $73.24 in 1 month. Oil prices surged as the US and UK conducted airstrikes on Houthi rebel targets in Yemen in response to their attacks on ships in the Red Sea. Geopolitical tensions amplify crude oil volatility. 💥💣

•Until next time, bye👋! 🌾 Wishing you a vibrant and joyful Pongal celebration, filled with prosperity, delicious feasts, and happy gatherings. 🌞🎉

0 Comments