Bearishness continues in the equity markets over geo-political risks and persistent high rates in the US

Samasthiti Advisors‘ Weekly Market Tracker – For the week ended Oct 27, 2023

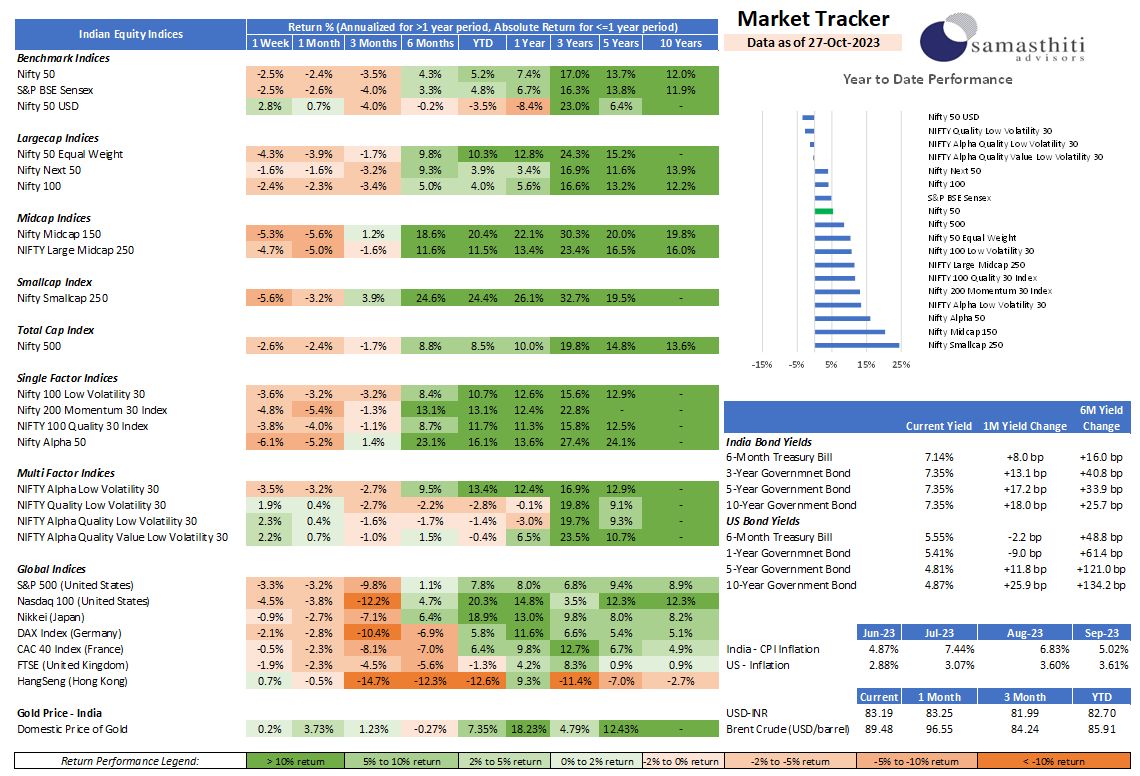

• Continuing from last week’s weakness, Nifty 50 lost 2.5% 😥over the just concluded week. Year-to-date, however, it’s still up 5.2%, but not a long way to go before the year-to-date returns turn negative. Nifty 50 USD returned an impressive 2.8% 😎 over the past week, courtesy the weakening INR.

• Smallcaps and Midcaps are finally coming under pressure🤢. Nifty Smallcap 250 is down 5.6% while Nifty Midcap 150 is down 5.3%. However, given the stupendous rally in these segments of the market, this can hardly be called a correction😒.

• Global equity markets also continue to be weak 😟. The S&P500 has declined by 3.3% in the last week and Nasdaq 100 is down 4.5%. Equity indices in other major economies show a similar trend. Markets will be looking for easing of geo-political risks and lowering of US bond yields🙏

• Bond yields in India have been high but rangebound🤞. 10-year Government bond yield in India stands at 7.35%. For anyone looking to lock in these yields for the next 10 years, a direct investment in G-Secs look attractive.

• Last week we posed the question: Will the US 10-year Government bond yield pierce the 5% mark🤯? And we have the answer – No. Yields have cooled down a bit. Currently, the 10-year US Government bond is hovering at 4.87%.

• The spread between the 10-year Government bond yield of US and India stands at a multi-year low of about 2.4%😨. Despite this, foreign investors have been net buyers of Indian debt – a good sign!

• INR last week was rangebound, though undoubtedly under pressure. High interest rates in the US means the outlook for INR remains weak and is currently at a record low of about 83 to a dollar. 😓

Until next time, goodbye and have a great weekend – all the best to Team India for their match with the reigning World Champions 🏏!

0 Comments