Our advanced Retirement Calculator can help you understand why it’s important to factor market volatility in your retirement planning

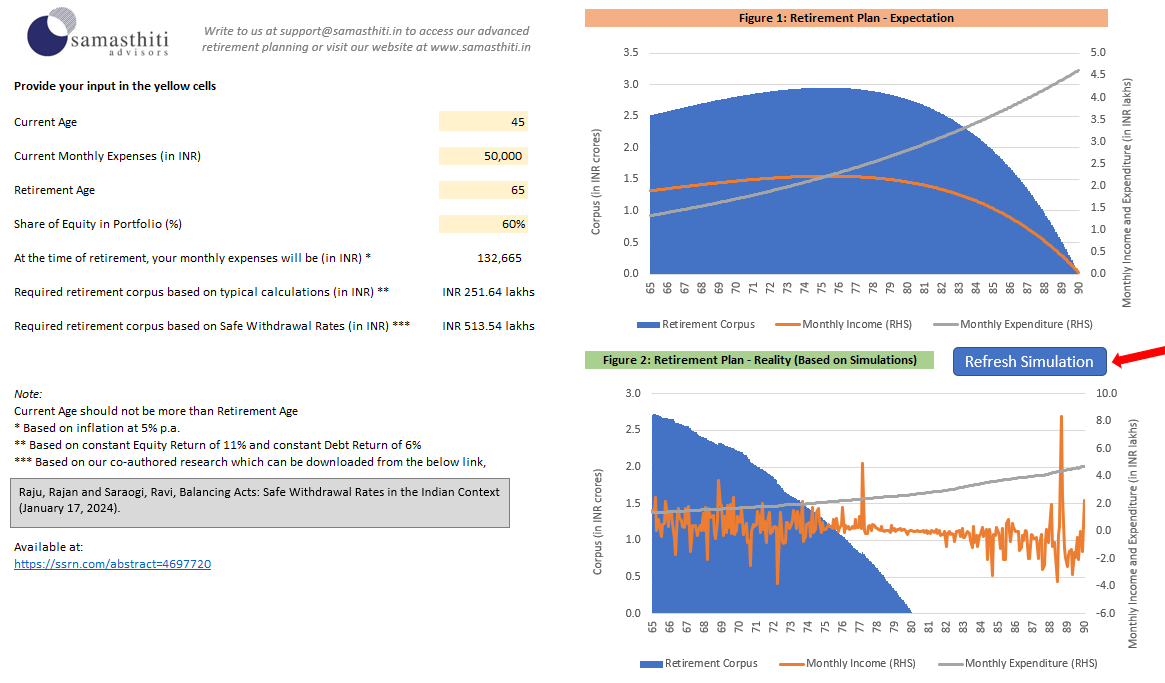

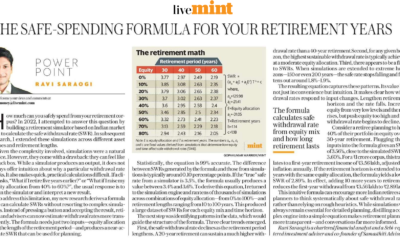

To construct a retirement plan, various assumptions need to be made. This includes assumptions for equity returns, debt returns and inflation. A critical mistake that is made when making these assumptions is that a Retirement Portfolio will earn the same equity and debt returns each year, and will withstand the same inflation.

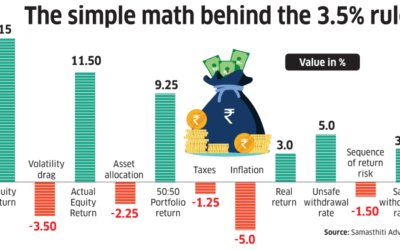

Reality will be very different. Your Retirement portfolio will face different equity and debt returns each year, as well as different inflation. This is called the ‘Sequence of Return’ risk, and without factoring this risk, you cannot calculate the required Retirement Corpus.

Our Retirement Calculator has been built to illustrate this point. It calculates the required retirement corpus based on constant equity return, debt return and inflation. To check if this corpus is accurate, the tool has a built-in simulator which simulates actual equity and debt return.

You will notice that in most cases, the required retirement corpus is not adequate. The retirement corpus exhausts itself before the life expectancy of the retiree. This is because typical retirement computations do not factor in market volatility.

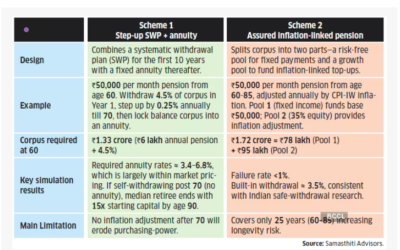

To help you better plan for your retirement, the tool also provides the required retirement corpus which takes market volatility into account. This is done by using the Safe Withdrawal Rate approach, the detailed methdology for which has been provided in our co-authored reserach.

If you face any challenges in using the calculator, do let us know at support@samasthiti.in or drop a comment below!

The file requires Excel Macros to run. You will need to enable Macros after installing the file. Please click here to understand how to do this.

Hi Ravi, super helpful. I have a question on your model assumptions. lets say I am 50 and want to retire at 55…my current expenses includes school fees et.al. for 2 kids…who will go to college for which i have an expense idea. what do i include in themonthly inout cell…with or without the school expenses for the remaining years of school…similarly, how do i factor in some event based expenses like university expenses, children’s weddings etc…those are not monthly expenses. curious where does all f this get accounted for in your x*33 calculation.

thanks.

Ayon

Hi Ayon, you can use our new Retirement Simulator now which is more advanced,

https://samasthiti.in/retirement-calculator/

You only need to factor expenses which will be incurred during retirement. The Retirement Simulator tells you about corpus requirements for retirement expenses, for other expenses, you need to plan separately.

Dear Team,

I want to invest 12L which is parked in my bank savings account. But I’m confused which fund I can invest or whether I can invest in lumpsum or do more sips.

Can you pls guide me on this?

Thanks!

I am 40 years old and i would like to have the option to have the retirement age as 40 as well. Your drop downs have only 55, 60 and 65?

Hi Hitesh, you can use our Retirement Simulator from the below link for increased options,

https://samasthiti.in/retirement-calculator/

Please use the recently uploaded new calcuator from the below link

https://samasthiti.in/retirement-calculator/

Samasthiti’s calculator shows how market timing impacts your retirement—plan wisely. Clear and impactful.

Hi,

When you say, “Current Monthly Expense”, what does this constitute?? Is it the family expenses or inclusive on Loan EMIs, SIPs, plus children expenses+rent+groceries+all..

Hi Ayan, thanks for your comment. The idea is to estimate the expenses you are incurring today which you will incur during your retiremnet as well. So, Loan EMIs (which will hopefully be over by the time one retires, SIPs and expenses relating to kids (if they become independent before retiremnet), can be removed.

I being a Sr citizen do feel necessity to talk to Samasthiti Adviser about retirement calculator& associated concerns of our financial requirement

Hi Anil, thanks for trying out the calculator. You can drop us an enquiry on our website.