But you should opt for SIPs as they inculcate the discipline of investing regularly

When it comes to investing, there are no certainties. Therefore, it is important to evaluate any dictum related to investing with facts and data. One such dictum, which generally escapes scrutiny is that systematic investment plans (SIPs) reduce the risk of investing in equities. This statement has been repeated so often that it has attained a hallowed status. A close examination of data, however, reveals that SIPs do not reduce the risk of investing in equities.

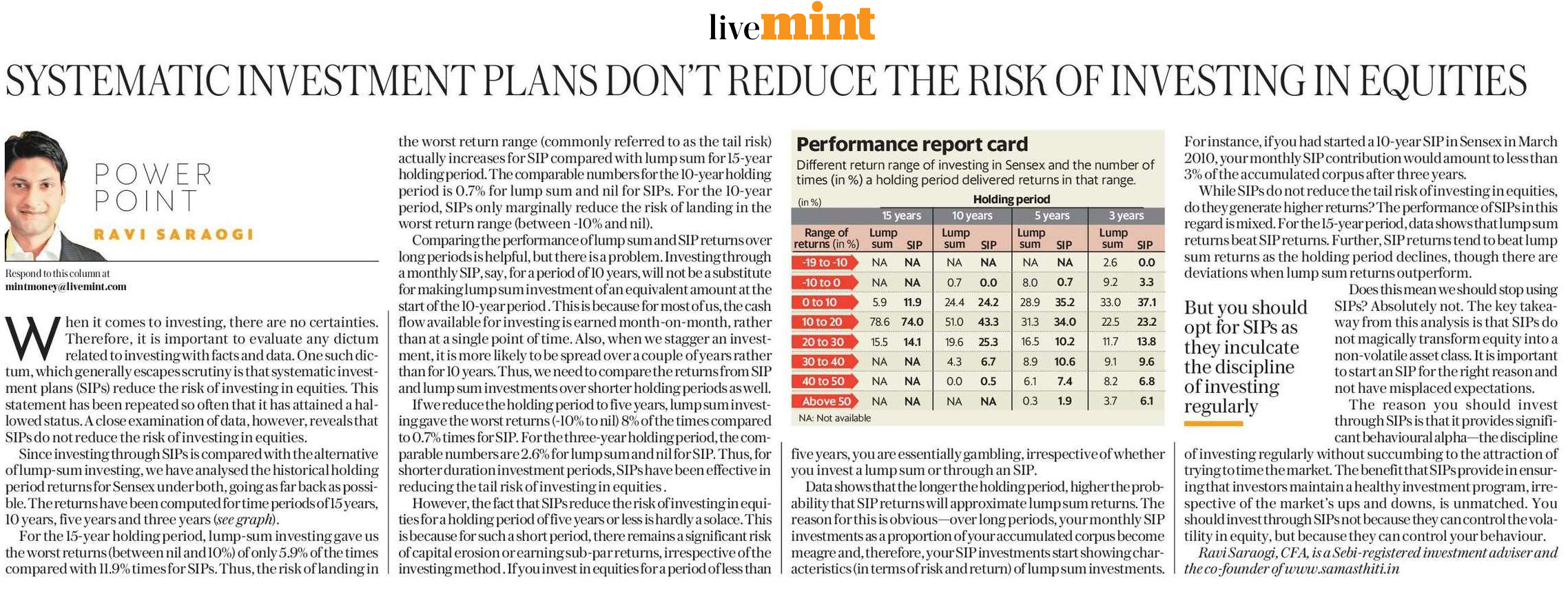

Since investing through SIPs is compared with the alternative of lump-sum investing, we have analysed the historical holding period returns for Sensex under both, going as far back as possible. The returns have been computed for time periods of 15 years, 10 years, five years and three years (see graph).

For the 15-year holding period, lump-sum investing gave us the worst returns (between nil and 10%) only 5.9% of the times compared with 11.9% times for SIPs. Thus, the risk of landing in the worst return range (commonly referred to as the tail risk) actually increases for SIP compared with lump sum for 15-year holding period. The comparable numbers for the 10-year holding period is 0.7% for lump sum and nil for SIPs. For the 10-year period, SIPs only marginally reduce the risk of landing in the worst return range (between -10% and nil).

Comparing the performance of lump sum and SIP returns over long periods is helpful, but there is a problem. Investing through a monthly SIP, say, for a period of 10 years, will not be a substitute for making lump sum investment of an equivalent amount at the start of the 10-year period . This is because for most of us, the cash flow available for investing is earned month-on-month, rather than at a single point of time. Also, when we stagger an investment, it is more likely to be spread over a couple of years rather than for 10 years. Thus, we need to compare the returns from SIP and lump sum investments over shorter holding periods as well.

If we reduce the holding period to five years, lump sum investing gave the worst returns (-10% to nil) 8% of the times compared to 0.7% times for SIP. For the three-year holding period, the comparable numbers are 2.6% for lump sum and nil for SIP. Thus, for shorter duration investment periods, SIPs have been effective in reducing the tail risk of investing in equities.

However, the fact that SIPs reduce the risk of investing in equities for a holding period of five years or less is hardly a solace. This is because for such a short period, there remains a significant risk of capital erosion or earning sub-par returns, irrespective of the investing method . If you invest in equities for a period of less than five years, you are essentially gambling, irrespective of whether you invest a lump sum or through an SIP.

Data shows that the longer the holding period, higher the probability that SIP returns will approximate lump sum returns. The reason for this is obvious—over long periods, your monthly SIP investments as a proportion of your accumulated corpus become meagre and, therefore, your SIP investments start showing characteristics (in terms of risk and return) of lump sum investments. For instance, if you had started a 10-year SIP in Sensex in March 2010, your monthly SIP contribution would amount to less than 3% of the accumulated corpus after three years.

While SIPs do not reduce the tail risk of investing in equities, do they generate higher returns? The performance of SIPs in this regard is mixed. For the 15-year period, data shows that lump sum returns beat SIP returns. Further, SIP returns tend to beat lump sum returns as the holding period declines, though there are deviations when lump sum returns outperform.

Does this mean we should stop using SIPs? Absolutely not. The key takeaway from this analysis is that SIPs do not magically transform equity into a non-volatile asset class. It is important to start an SIP for the right reason and not have misplaced expectations.

The reason you should invest through SIPs is that it provides significant behavioural alpha—the discipline of investing regularly without succumbing to the attraction of trying to time the market. The benefit that SIPs provide in ensuring that investors maintain a healthy investment program, irrespective of the market’s ups and downs, is unmatched. You should invest through SIPs not because they can control the volatility in equity, but because they can control your behaviour.

(This article was published in LiveMint on May 31, 2020 and can be accessed from the link https://www.livemint.com/money/personal-finance/systematic-investment-plans-don-t-reduce-the-risk-of-investing-in-equities-11590926968153.html)

0 Comments