After the fall of zero-coupon bonds and MLDs, debt mutual funds were the last remaining product that offered a tax efficient way of investing in debt instruments. This last frontier has now fallen!

On March 14, 2023, I had published a detailed article with ET Prime explaining the tax changes in Market Linked Debentures (MLDs). I had ended the article with the below lines,

However, to cheer up investors who are still looking for the holy grail that transforms interest income to capital gains, there is still one product left which does this — the “growth” option while investing in debt mutual funds.

Well, looks like I spoke too soon.

In the amended Finance Bill 2023 passed by the Lok Sabha on March 25, the government sneakily inserted a clause removing the benefit of long-term capital gain taxation (LTCG) on debt mutual funds.

There has been no official communication from the Finance Ministry on the rationale behind the same. So, we are left to guess why such a drastic step was taken without any discussion.

To fully understand what has happened, we need to rewind the clock and uncover a little history.

A brief history on the quest for converting interest income to capital gains

One of the key issues of investing in debt instruments is that the interest income earned through such investments is taxed at the Maximum Marginal Rate (MMR) of the investor. So if you invest in a bond that gives you 8% interest, and you are in the 30% tax bracket, the post-tax interest earned is less than 5%. Thus, the taxation of plain-vanilla bonds is similar to taxation of interest income on fixed deposits.

Prior to 2002, one of the ways to prevent the gains from investing in a bond being taxed as interest income was to invest in zero-coupon bonds and sell it close to maturity. By doing this, an investor could book the accumulated interest as capital gains and pay only 10% tax.

To curb this practice, CBDT came up with a circular in 2002 which stopped this practice for zero-coupon bonds. However, the circular was not applicable on market-linked debentures (MLDs). Though MLDs are similar to zero-coupon bonds, in the sense that the gains are back-ended, the variable pay-off in MLDs make them different from the fixed interest rate of zero-coupon bonds.

After the 2002 CBDT circular took the sheen off zero-coupon bonds, the market gravitated towards MLDs as the next best product with favorable taxation. However, recently Budget 2023 closed the tax arbitrage on MLDs.

For long, there has been a quest to convert interest income to capital gains when investing in debt products. First zero-coupon bonds, and until recently MLDs, provided such avenues. The 2002 CBDT circular and Finance Bill 2023 has closed these avenues.

Recent change in taxation of debt mutual funds

The only product that remained which offered a way to convert interest income to capital gains was debt mutual funds. Debt mutual fund units held for more than 3 years were eligible for 20% LTCG tax with indexation benefit. Due to the indexation benefit, the cost price of the debt mutual fund units was adjusted for inflation, thereby bringing down the taxable capital gains.

Unfortunately, this last frontier has now fallen. The amended Finance Bill 2023 has closed the avenue for debt mutual fund investors to make use of LTCG taxation.

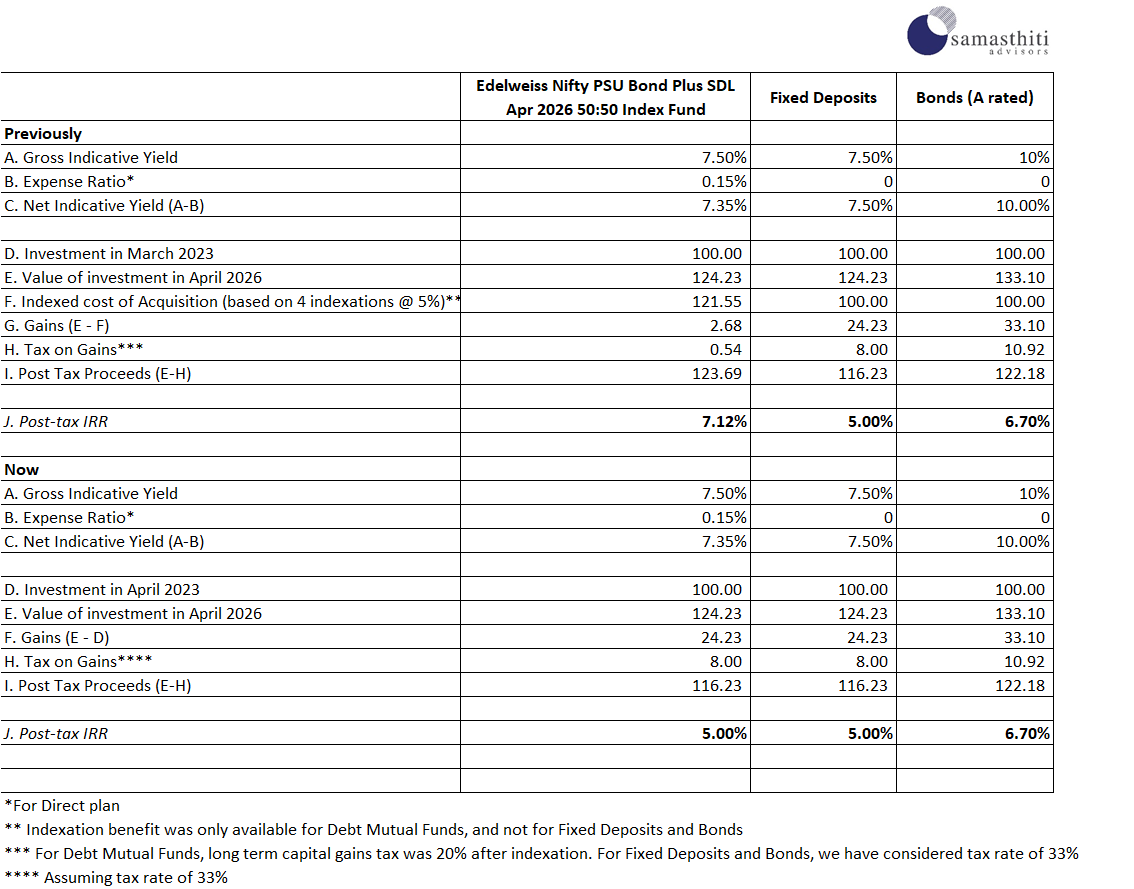

A simple example will illustrate the impact of this change in taxation. Below, we have provided the taxability of a debt mutual fund as compared to a fixed deposit or a direct bond investment.

(The illustration below ignores the fact that under the new tax regime, investors in debt mutual fund can defer taxes, and hence the IRR in a debt mutual fund will be higher than a comparable fixed deposit)

Previously, the debt mutual fund clearly scored above not only the fixed deposit, but also a typical A-rated bond with a much higher gross yield (and higher risk). Now, the debt mutual fund and the fixed deposit provide the same post-tax return. The A-rated bond provides the highest post-tax return, but that’s simply because it also has the highest gross yield.

Debt mutual funds still hold some tax advantages

Despite the tax changes, debt mutual funds still retain some advantages. The most important being that tax on debt mutual funds is payable only at the time of redemption, whereas, in the case of fixed deposits or direct bonds, the investor is required to accrue income each year and offer them for taxation. Thus, in the case of debt mutual funds, tax can be deferred until redemption.

Another advantage of debt mutual funds is that the redemption proceeds will include both the principal and the interest component, and the principal component of the redemption will be a tax deductible.

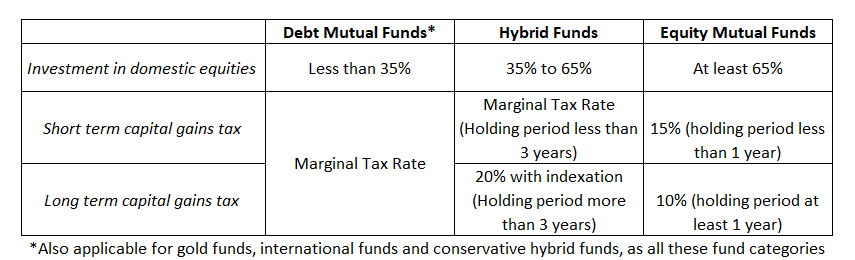

What does the tax classification of mutual funds look like now?

The tax classification of mutual funds has become more complex now. We now have three tax categories of mutual funds based on their proportion of investment in domestic equities.

Lastly

India’s bond market is relatively underdeveloped compared to its equity markets. Unlike the equity market which has good retail participation, the bond market in India is primarily an institutional market, with very limited retail participation. Of late, product innovations in debt mutual funds was beginning to attract retail particiaption. The benefit of LTCG taxation along with indexation was an important attraction for shifting from fixed deposits to debt mutual funds. The current change in taxation for debt mutual funds changes all this.

However, it would be premature to write off debt mutual funds. The versatility of debt mutual funds, despite the tax change, remains. Debt mutual funds offer a fantastic way to take exposure to a diversified portfolio of bonds, and this core functionality is not impacted by the tax change.

It is important to also note that the recent tax changes do not disadvantage debt mutual funds- they simply remove their more favourable taxation. We will need to wait and watch over the next few months to gauge the full impact of the tax change. Presumably, there could be product design changes in debt mutual funds to give them a hybird flavour and retain their favourable taxation.

The taxperson has played their move. Over to the mutual funds now.

0 Comments