It is important to understand the different routes you can take to invest in mutual funds so that you can make the best possible choice

In the previous post, we described the distinction between Direct and Regular plans of mutual funds. In this post, we will take a look at the different routes that you can take to invest in mutual funds. While they all eventually lead to an investment in mutual funds, each route has its own advantages and disadvantages. The route you take will determine the cost you pay, the service you get and most importantly, the odds of investing in a mutual fund which is right for you.

There are five routes that any investor can take to invest in mutual funds.

Investing through the mutual fund company’s website

Investing through online apps

Investing through platforms provide by Registrar and Transfer Agents (RTAs) of Mutual Funds

Investing through Distributors

Investing through Advisors

Let us examine each of these closely.

1. Investing through the mutual fund company’s website

Every mutual fund company (there are 44 mutual fund companies in India) has a website where you can not only access different types of information on mutual funds, but you can also invest in those mutual funds. For instance, below is the website of SBI Mutual Fund. On the home page, you see two options – “Quick Invest” and “Login”. Use either of these options, you can choose amongst a list of mutual funds and invest.

The website will ask you for certain basic details and after selecting your investment, you can pay through internet banking, and that’s it, your investment will be processed. Post investing, you can use the “Login” option to track your investments or do further buying/selling.

When you are directly investing with the mutual fund company, you are by-passing all intermediaries like your bank, distributor or an agent, and therefore, the mutual fund company will make available to you the “Direct” variant of the mutual fund.

As an investor in the “Direct” variant, the mutual fund company will charge you lower fee for managing your investments as it did not have to pay commission to any intermediary for procuring your investment (remember, you invested directly with the mutual fund company through its website, by-passing all intermediaries).

It is important to note that just because you are investing directly through the mutual fund company’s website does not necessarily mean your money will be invested in Direct plans. You need to make sure that you are selecting the Direct variant of the mutual fund you want to invest in. (Refer to our earlier post which describes how you can identify the variant of a mutual fund from its name).

2. Investing through online apps

One of the problems with visiting a mutual fund company’s website and investing is that if you want to invest in many different mutual funds, you must visit the websites of multiple different mutual fund companies. This will require you to create multiple logins at these websites. Also, not all mutual fund websites have a friendly user-interface.

To surmount these problems, there are many online apps which provide a centralized platform through which you can invest in multiple different mutual funds. Before investing through any online app, it is important to check if the app puts your money in Direct plans or Regular plans. If the app puts your money in Regular plans, it is essentially a distributor. (You can read more about this in route no. 4)

Apps which put your money in Direct plans are commonly referred to as “direct-MF” apps. Some of the popular direct-MF apps are Coin (by Zerodha), Groww, Kuvera, ET Money, Paytm Money, etc.

The above-mentioned direct MF apps do not currently charge their users anything for transacting on their platforms. This has both a positive and a negative. The positive is that you get to use a user-friendly app to seamlessly invest in mutual funds without paying any charge. The negative is that to earn revenue, these platforms may try to cross-sell other financial products to their users which may or may not be suitable for them.

Investors also need to be wary if the online platform has any vested interest in making investors invest in a particular mutual fund. For example, by favourably placing a particular mutual fund on the home screen, an online app can nudge investors towards a particular mutual fund.

Investing through online apps also makes you susceptible to changes in their policy. You can read our detailed article here published in The Economic Times about a recent episode where changes in the policy of an online app resulted in investor hardships.

3. Investing through platforms provide by Registrar and Transfer Agents (RTAs) of mutual funds

Registrar and Transfer Agents (RTAs) are record-keepers for mutual funds. They process transactions, maintain records, and act as the interface between investors and mutual funds. There are two RTAs in India that service mutual funds– CAMS and Karvy. Some mutual funds are serviced by CAMS while others by Karvy. Both CAMS and Karvy operate online platforms through which you can invest in mutual funds.

CAMS operates the platform myCAMS, while Karvy’s platform is called KFinTech. Between these two platforms, you can invest in any mutual fund and track your investments. The RTA platforms also allow you to raise service requests to mutual funds.

As these platforms are operated by mutual fund RTAs, they are secure, safe and reliable. You can invest in either the Direct variant or the Regular variant of mutual funds through these platforms.

Last year, both CAMS and Karvy came together to launch a single centralized platform MFCentral. This obviates the need to have registrations at two platforms (myCAMS and KFinTech), and instead investors can use MFCentral to invest across all the mutual funds as well as track all their investments at a single place.

4. Investing through Distributors

Mutual fund companies appoint individuals/organisations to distribute their mutual fund products. Such individuals/organisation are called “Mutual Fund Distributors (MFDs)” or in short, Distributors. As per regulations by our capital market regulator, Securities and Exchange Board of India (SEBI), such Distributors need to be registered with Association of Mutual Funds in India (AMFI).

When you invest through a Distributor, the mutual fund company puts your investment in the “Regular” variant, which has a higher cost associated with it. This is because the mutual fund company has to pay a commission to the Distributor. In effect, the commission the mutual fund company pays to a Distributor is collected from the investor by charging them a higher fee on their investments.

When investing through Distributors, it is recommended that you understand the cost you are paying in commissions. It is also important to assure yourself that the mutual funds being shown to you are suitable for you, and not necessarily those mutual funds which are earning the Distributor the highest commission.

5. Investing through an Advisor

You can also invest in mutual funds by working with an Advisor. An Advisor assists investors in identifying their financial goals, accessing their risk preference, and building an investment portfolio for them consisting of different financial products including mutual funds.

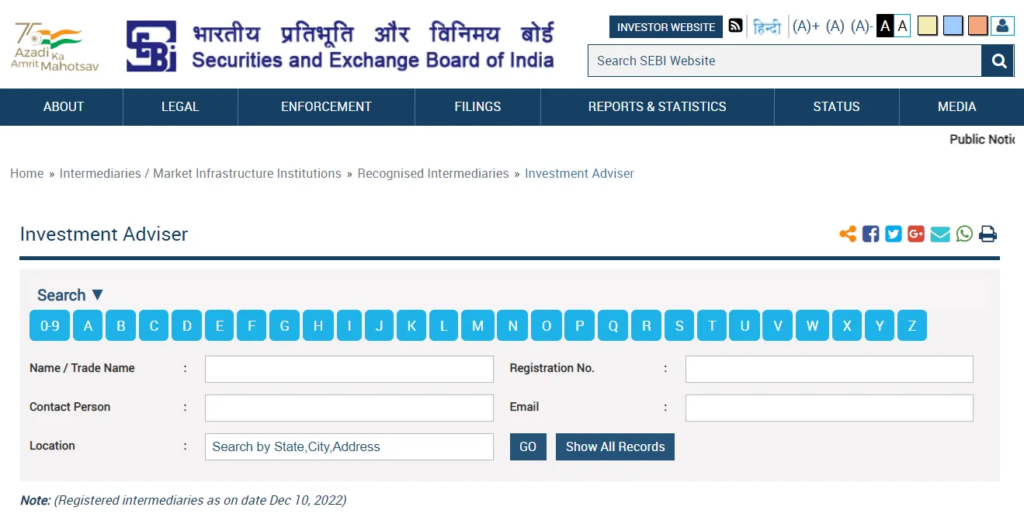

In India, all financial and investment advisors are required to obtain a Registered Investment Adviser (RIA) license from SEBI. You can check if your Advisor is registered from the below link,

Advisors can help investors invest in mutual funds by guiding them on how to use the different routes to invest. Advisors can also help investors invest in mutual funds through use of platforms like Bombay Stock Exchange (BSE) Star MF, National Stock Exchange (NSE) MF, or MF Utilities (which is a platform run jointly by all the mutual funds in India).

An Advisor is legally permitted to only recommend Direct plans of mutual fund to investors. This has two advantages. First, since Direct plans do not have any commissions, investors can be assured that the recommendation of the Advisor has not been influenced by commission payments. Second, Direct plans have lower fees which leads to substantial cost savings for investors.

Comparison

The below table provides a summary of the different routes and their advantages/disadvantages. It is important the investors evaluate each approach and choose the route wisely. Do-it-yourself (DIY) investors can look at the first three options as those are non-assisted ways of investing in mutual funds. For investors who require assistance, they can either work with a Distributor or engage with an Advisor.

Samasthiti Advisors: Our Approach

As an Advisor, we first try to understand our client’s requirement in detail and accordingly construct a customized mutual fund portfolio for them. Also, as an Advisor, we only recommend Direct plans of mutual funds. To make the investing experience seamless, we use the BSE Star MF platform (which is India’s largest mutual fund transaction platform) to help clients invest in select mutual funds.

Our Advisor registration and license details with SEBI can be accessed here.

0 Comments