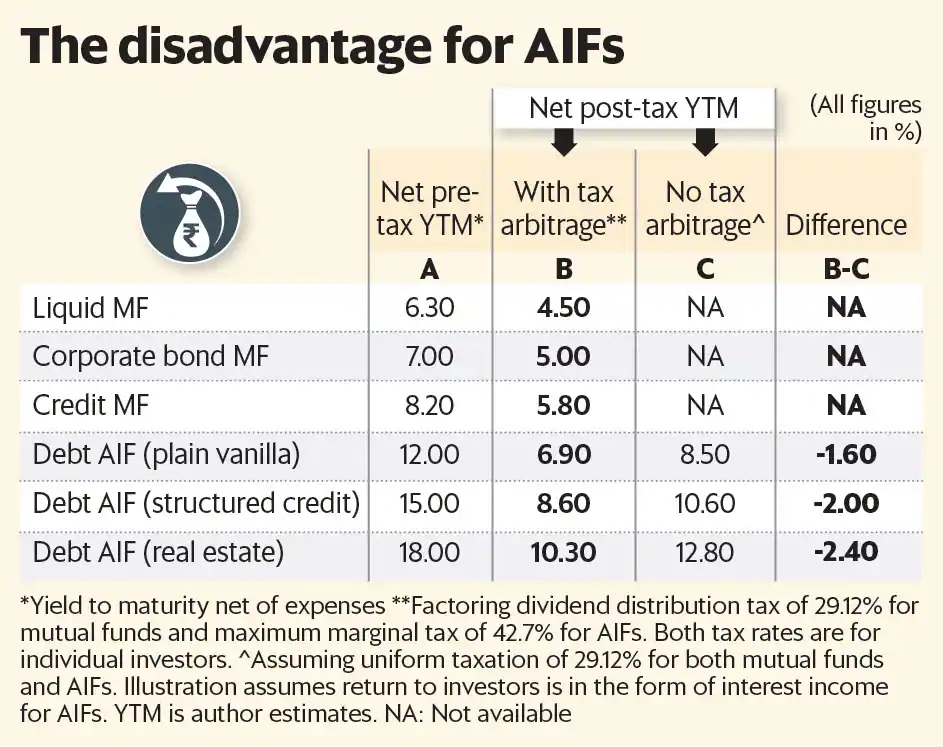

Tax arbitrage siphons away 1.6-2.4% of the returns in debt AIF compared to mutual funds

Robert King Merton, an American sociologist, coined the word “unintended consequences” to describe outcomes that were either not foreseen or intended of a purposeful action. Post the recent budget, foreign portfolio investors (FPIs) and alternative investment funds (AIFs) in India are learning about this phenomenon the hard way. The increase in marginal tax rate for the super-rich will negatively impact them though these vehicles were not the target of the tax increase.

Most FPIs invest in India through the trust or a limited liability partnership structures and are not recognized as corporate entities under the Income-tax Act. Hence, their income is taxed as per individual tax brackets. With the increase in surcharge now applicable for non-corporate entities, FPIs will see tax increase from 35.8% to 39% (for FPIs earning less than ₹5 crore) and from 35.8% to 42.7% (for FPIs earning more than ₹5 crore). Also, like FPIs, most AIFs (over 95%) in India are structured as trusts and, thus, will attract the provisions of the higher marginal tax rate. Equity AIFs will not be impacted by the increase in marginal tax rates as they pay capital gains tax—for listed equities, long-term capital gains tax is 10% and for unlisted equity, it is 20% with indexation. For debt AIFs, however, the impact could be significantly negative as interest income is clubbed with other income and taxed at maximum marginal rates.

The main problem for debt AIFs, though, is not that they will attract a higher tax rate. Given that the minimum investment amount for an AIF is ₹1 crore, most individual investors in an AIF are anyway in the top tax bracket. The problem is that they will be at a large tax disadvantage compared to mutual funds (MFs). This budget has unwittingly created a large tax arbitrage between debt AIFs and debt MFs. Consider a debt AIF which earns interest income. Earlier, that would have been taxed at 35.8%, now it will be taxed at 42.7%. On the other hand, a dividend plan of a debt MF will be taxed at dividend distribution tax (DDT) of only 29.12%. Thus, the tax arbitrage has increased from around 7 percentage points to around 14 percentage points now.

This could make the going difficult for debt AIFs that target a higher yield to maturity (YTM) by going down the credit rating curve. Investors are compensated for this higher risk through higher targeted returns. The tax arbitrage, however, will siphon away 1.6-2.4% of the returns in a debt AIF compared to MFs. Thus, a part of the higher return from a debt AIF, rather than going to investor as compensation for higher risk, is lost to tax disadvantage. This can skew the risk-return dynamic for an investor.

Debt AIFs in India have played a stellar role in deepening the Indian corporate bond market. While MFs primarily invest in high-rated credits, debt AIFs specialize in the financial intermediation of lower-rated credits. Given that the minimum investment size in an AIF is ₹1 crore, these privately-placed vehicles reach out only to high net-worth (HNI) and institutional investors—the investor base that is most suited to hold such risks. The budget proposal will also make it unattractive for HNIs to directly subscribe to bond issuances. If someone in the top tax bracket routes his investment through a dividend debt MF, it will attract DDT of 29.12% versus tax of 42.7% on interest income received from directly subscribed bonds.

The tax arbitrage between debt AIFs and debt MFs is unfortunate as the underlying investments are the same—debt securities. One can only hope that this is an unintended consequence of a budget proposal and will be rectified in due course. This can be done by including debt AIFs under the section for DDT applicable on debt MFs.

(This article was published in LiveMint on July 29, 2019 and can be accessed from the link https://www.livemint.com/money/personal-finance/budget-2019-has-led-to-a-huge-tax-arbitrage-between-debt-aifs-and-debt-mfs-1564422241423.html)

0 Comments