by Ravi Saraogi | Aug 14, 2025 | Finance

(A condensed version of this post was published in Mint on 13th July 2025 and can be accessed here...

by Ravi Saraogi | Jun 10, 2025 | Finance

(A condensed version of the below article was published in Mint on June 9, 2025, and can be accessed from the link below.)...

by Ravi Saraogi | Jun 4, 2025 | Finance

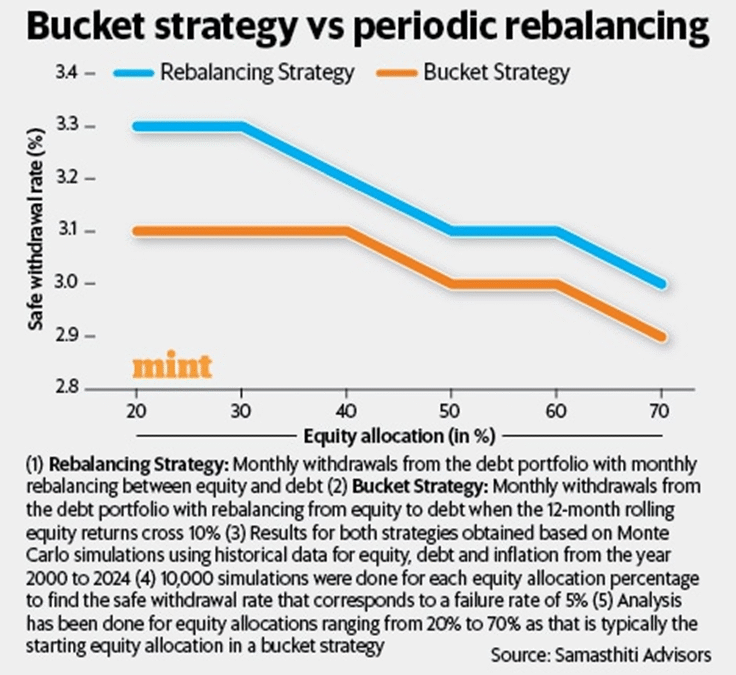

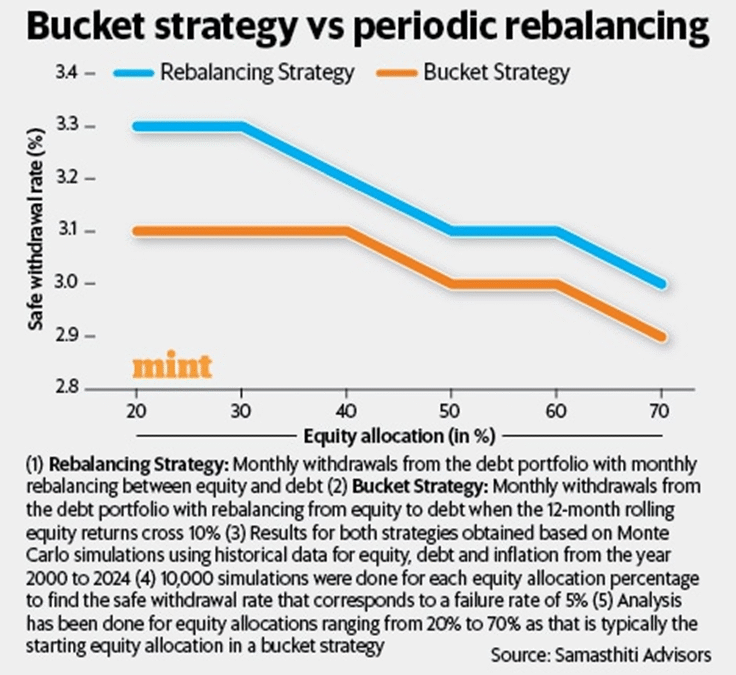

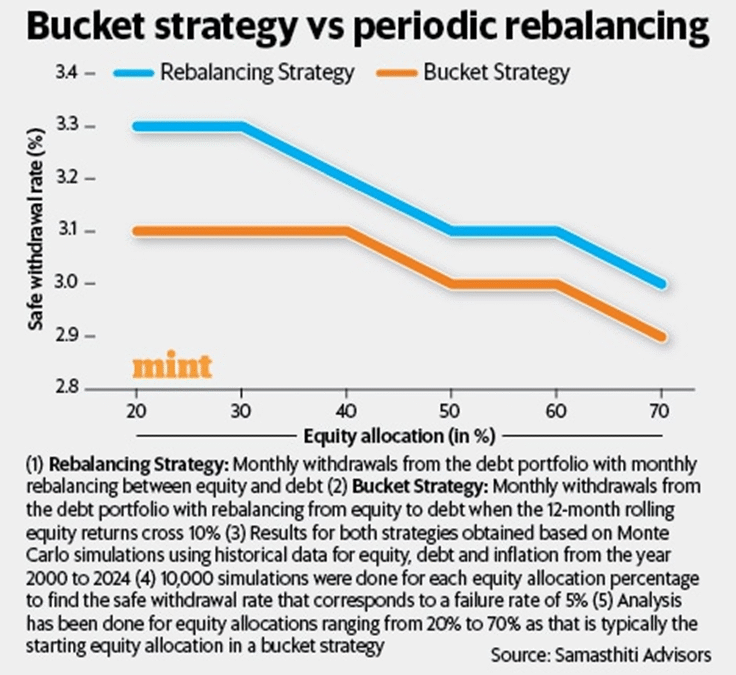

(A condensed version of the below article was published in Mint on June 1, 2025, and can be accessed from the link below.) https://www.livemint.com/money/personal-finance/why-historical-data-on-withdrawal-rate-misleads-indian-retirees-11748751509748.html Why History...

by Ravi Saraogi | May 24, 2025 | Finance

We are delighted to share that our co-authored paper with Rajan Raju, “Balancing Acts: Safe Withdrawal Rates in the Indian Context,” was awarded First Prize at the 1st International Research Conference on Pension (IRCP 2025), held on April 3–4, 2025, in New Delhi.Read...

by Samasthiti Advisors | Apr 24, 2025 | Finance

For Non-Resident Indians (NRIs) investing in Indian mutual funds, a recent development based on Double Taxation Avoidance Agreements (DTAAs) offers a potential tax advantage. The Income Tax Appellate Tribunal (ITAT) in Mumbai has ruled that capital gains arising from...

by Ravi Saraogi | Dec 27, 2024 | Finance

(A condensed version of the below article was published in BusinessLine on December 7, 2024 and can be accessed from the link below) https://shorturl.at/oBd1A How often have we heard the age-old investing motto – if you want to earn higher returns, you have to take...

Recent Comments