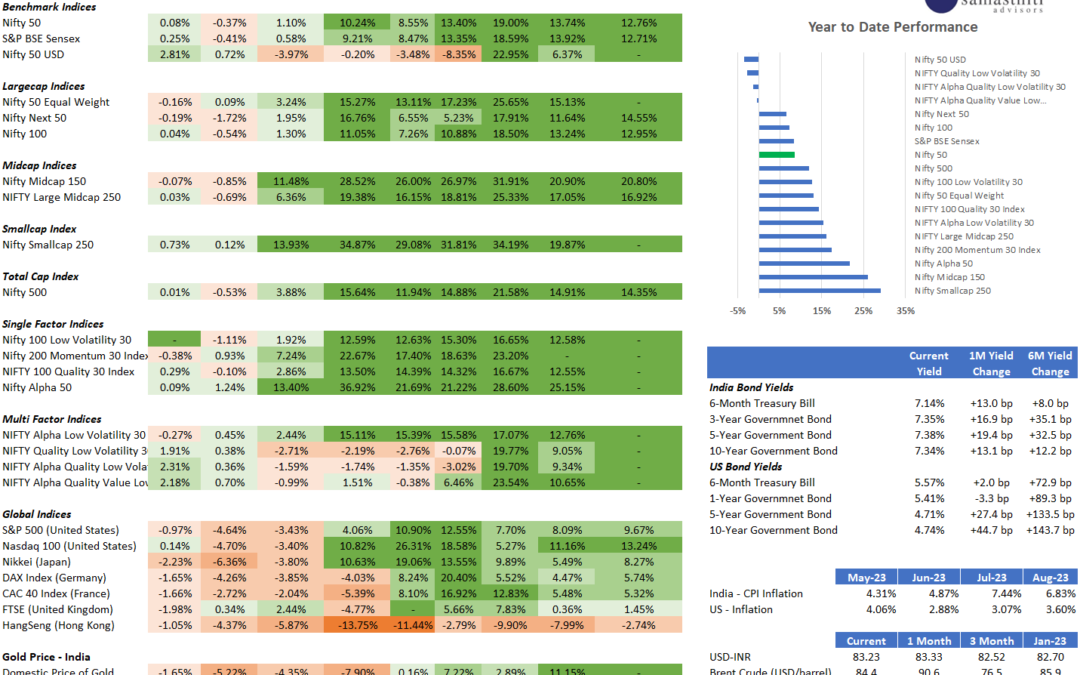

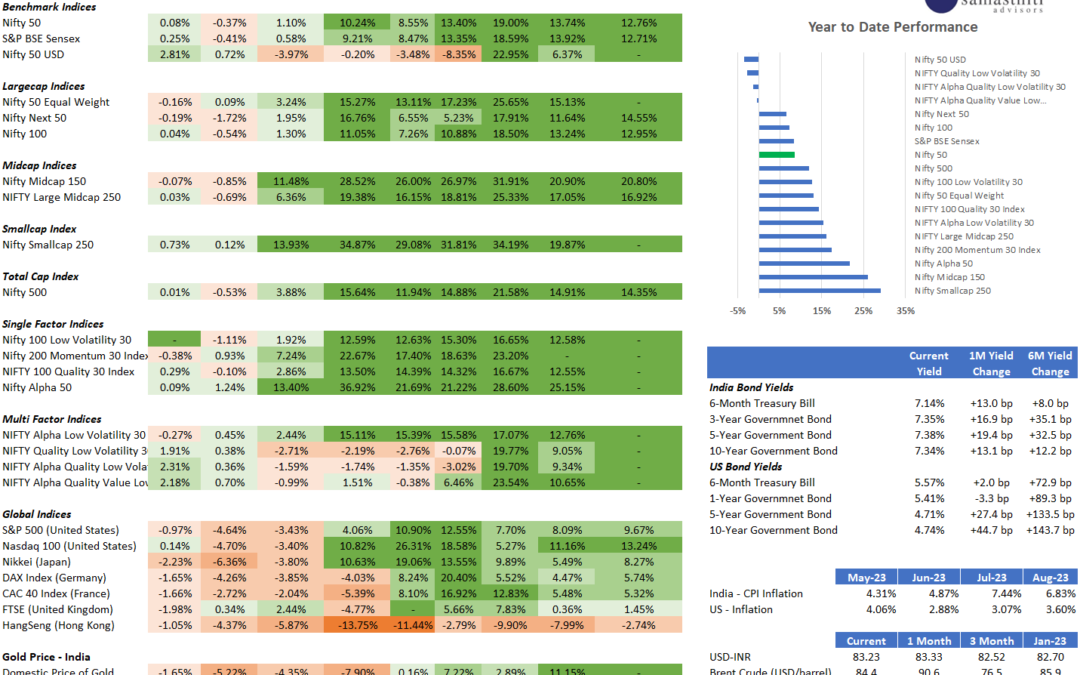

Samasthiti Advisor's Weekly Market Tracker – For the week ended Oct 6,2023

Indian equities continues to outperform even as the global equity outlook deteriorates

Indian equities continues to outperform even as the global equity outlook deteriorates

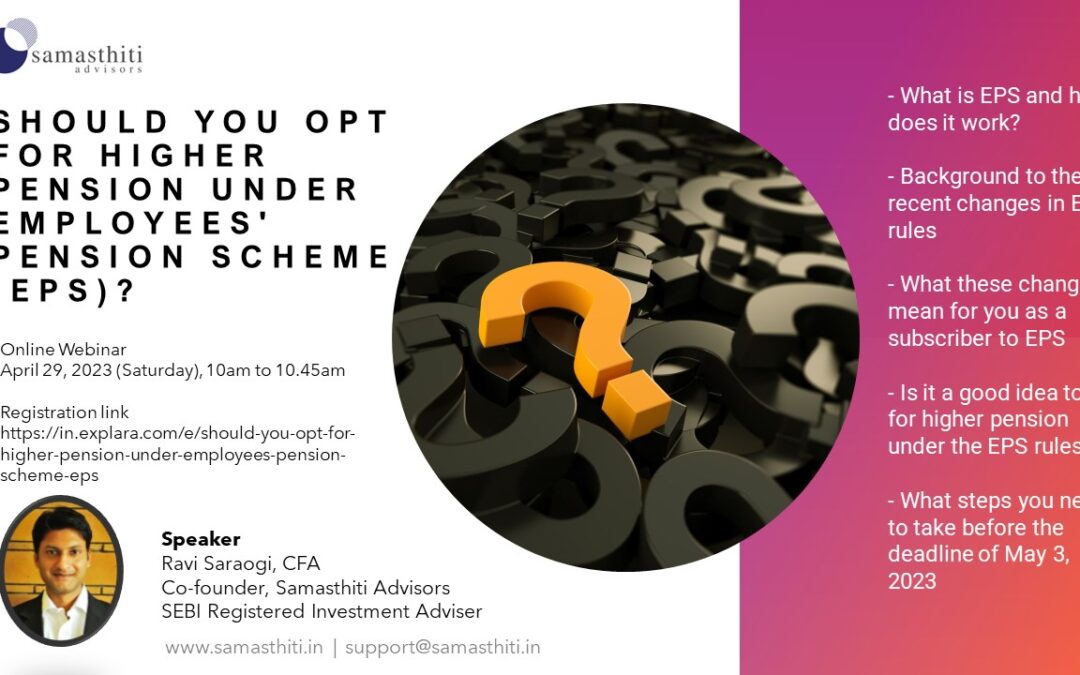

And more importantly – why your investments need to be platform agnostic by making your investments completely “platform proof”

Register for Samasthiti Advisor’s webinar on this important question before its too late!

It has been brought to our attention that unknown individual(s) have used our identify and/or that of Ravi Saraogi to provide stock tips and lure investors to trade/speculate in stocks. It is hereby clarified that we do not provide any stock tips and do not reach out to investors through WhatsApp groups/chats for dissemination of such tips.

Please be careful about such impersonations which might use our social media DPs/identity to fraudulently reach out to you. Our communication channels have been provided below for your information and for you to verify the authenticity of any such purported communication.

* Website: www.samasthiti.in

* Email: @samasthiti.in / support[at]samasthiti[dot]in

*Mobile: As intimated through email

* LinkedIn: https://www.linkedin.com/in/saraogiravi/

* LinkedIn: https://www.linkedin.com/company/samasthiti-advisors

* Twitter: https://x.com/ravisaraogi

*Twitter: https://x.com/team_samasthiti

*YouTube: http://www.youtube.com/@samasthitiadvisors5115

* WhatsApp : https://whatsapp.com/channel/0029VagUtzxLdQeaxVDm623D

Please verify the authenticity of any communication purportedly received from us with the above-mentioned channels. We will not be responsible for any unauthorized and unofficial communications through our identify theft and impersonation.

Recent Comments