Occasionally, clients send us details of portfolio management services (PMS) product offerings for our feedback. Our general view is that all PMS offerings are guilty unless proved innocent. This is because it’s difficult to decipher their investment strategy and compare their performance against the right benchmark. If PMS providers can disclose the historical net asset value (NAV) in a convenient manner, it can make the job of evaluating them much easier.

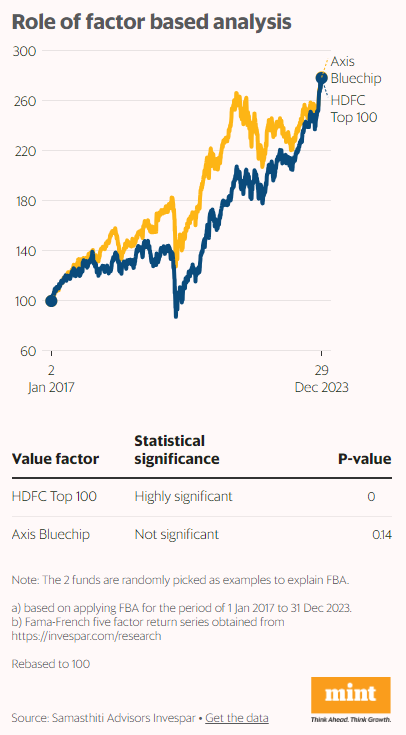

But is historical NAV really needed if a PMS provider supplies information on past return performance? Yes, since past returns hide more than they reveal. If you want the return data to reveal all its secrets, you will need to undertake a factor-based analysis (FBA) for which historical NAV is needed. Let’s take the example of two mutual fund schemes to see how powerful FBA can be. Between January 2017 and December 2020, the Axis Bluechip Fund returned a 20% CAGR (compounded annual growth rate). During the same period, the HDFC Top 100 Fund returned only a 11% CAGR. Starting in 2021, the tables turned. From January 2021 to December 2023, HDFC Top 100 returned a 23% CAGR whereas Axis Bluechip lagged at a 10% CAGR.

To understand what was going on, you would need to look at the funds’ detailed portfolio holdings—not only current, but historical as well. This portfolio holdings data will need to be analysed to check the investment strategy of the fund—growth or value tilt, mid- and small-cap exposure, sectoral exposure, etc. Such an exercise can be challenging for even an expert, let alone the average investor.

This is where FBA comes to the rescue as it can do all the above by relying solely on a fund’s historical NAV. This is because the fund NAV already encapsulates all the information like investment strategy, portfolio construction, market cap exposure, etc. FBA is a statistical technique that can magically extract all this information from the historical NAV data. Using the Fama-French ‘five-factor model’, FBA breaks down the return earned by a fund into five factors—market risk, size, value, profitability and investment. If the FBA analysis shows that the market risk is significant, it means the fund in question is a closet indexer. If the size factor is significant, it means the manager has a small-cap tilt in the portfolio. And if the value factor is significant, the fund is running a value strategy.

Coming back to our example, applying FBA over the period 2017 to 2023, we see that the value factor was highly significant for HDFC Top 100, and not so for Axis Bluechip. Value stocks were having a terrible run until 2021, post which they made an impressive recovery, and this in turn explains the performance of the two funds. Armed with this analysis, you can judge whether the outperformance of a fund is due to superior stock selection or due to being at the right place at the right time.

With FBA, the investor can self-determine the exact strategy the PMS manager is following and choose an appropriate benchmark. For instance, if the analysis of the historical NAV suggests that the size factor is significant, the manager’s performance needs to be benchmarked to small- or mid-cap indices. Regulations have made good progress in mandating various disclosures to make PMS more transparent. Including a requirement to provide time-series data of historical NAV will further improve transparency. This single data point can be more illuminating than the bulkiest marketing presentation.

(This article first appeared in LiveMint on April 29, 2024 and can also be read here)

0 Comments