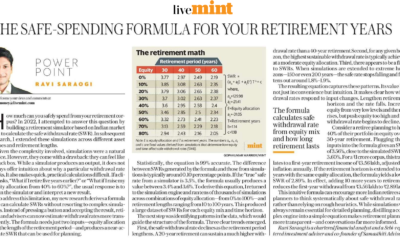

A frequent source of confusion in retirement research is the interpretation of the safe withdrawal rate (SWR). Many assume that an SWR (say 3% or 4%) represents the proportion of the portfolio withdrawn each year of retirement. This is not the case.

The SWR refers to only the initial withdrawal in year one, expressed as a percentage of the starting portfolio. In subsequent years, withdrawals are adjusted upward for inflation, while the corpus fluctuates with market returns. Accordingly, the withdrawal rate (annual withdrawal ÷ current portfolio value) for subsequent years will deviate from the SWR.

To illustrate this, consider a retiree with INR 1 crore corpus, beginning her retirement in 1994 with a 30-year horizon (1994–2024). The retiree plans for a SWR of 3.5%. This would mean that in the first year of retirement, the retiree will withdraw INR 3.5 lakhs, or a monthly amount of close to INR 30,000. Thereafter, withdrawals will increase with inflation, independent of portfolio value.

If markets do well and the retirement corpus swells, the subsequent withdrawal rates will fall below 3.5%. If markets are poor and retirement corpus falls, the withdrawal rate will shoot above 3. 5%.

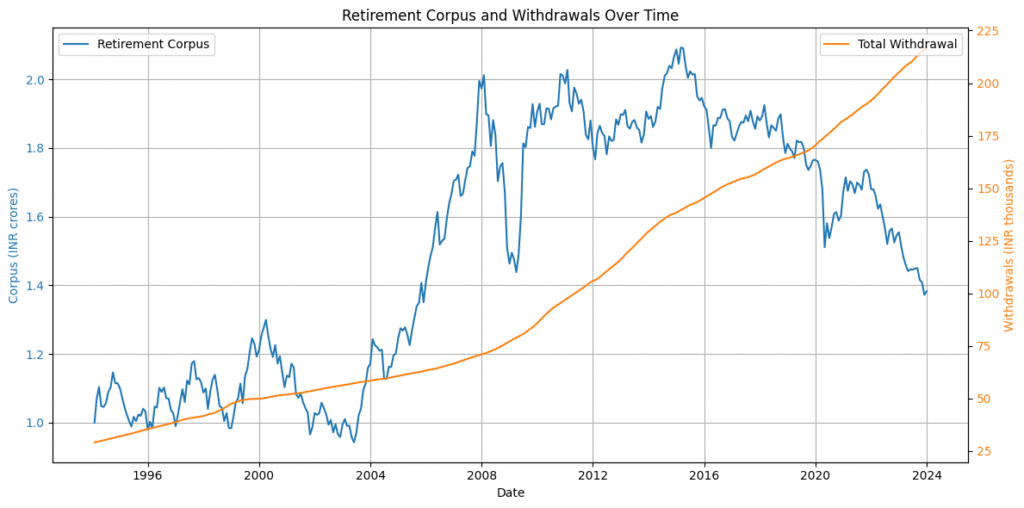

The chart below traces the evolution of the retirement corpus alongside the withdrawals amount based on actual market data. The corpus increases in the first half of the retirement and then starts to fall in the second half. However, it lasts the full 30 years, with a large inheritance at the end. In hindsight, the SWR of 3.5% turned out to be too conservative for our 1994 retiree.

The withdrawals, irrespective of the corpus movements, increases at a (nearly) linear fashion with inflation.

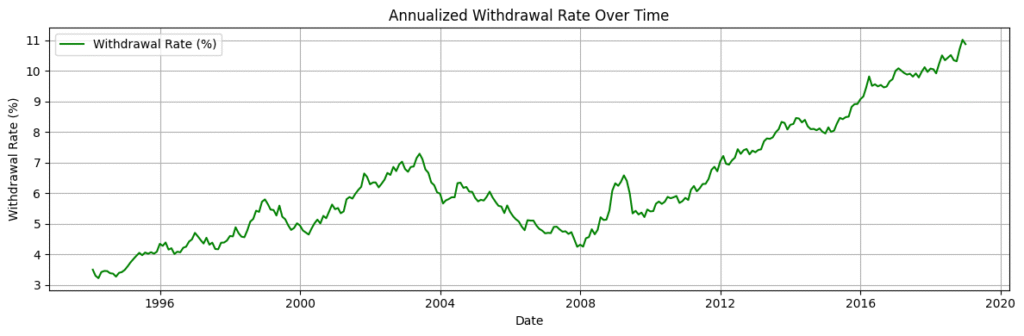

Based on the above actual market movements, the below graph traces the annualized withdrawal rate over the retirement period.

Starting from 3.5%, the realized withdrawal rate oscillates. It touches a local maximum of 7% around 2003. The 2003 to 2007 equity market rally swells the retirement corpus, helping to pull down the withdrawal rate closer to 4% by 2008. Post this, the withdrawal rate shows a continuous increase.

Around 2019, which is after 25 years of retirement, the retiree is withdrawing more than 10% annually from their corpus. In fact, as you approach 30 years of retirement, this number increases further (to avoid scaling issues in the graph, I have not plotted the same).

Thus, SWR is only the initial withdrawal rate or the first withdrawal rate. Subsequent withdrawal rates will be dependent on corpus and withdrawal movements, and can diverge substantially from the SWR.

When we talk about a “3%” or “4%” safe withdrawal rate, we mean that starting from such a withdrawal rate, and adjusting withdrawals for inflation thereafter, would have sustained a retirement portfolio with high probability. It does not imply that the retiree withdraws exactly 3% or 4% of the corpus in each year.

Many a mishaps and confusions can be avoided if we note this crucial aspect of SWRs.

0 Comments