Register for Samasthiti Advisor’s webinar on this important question before its too late!

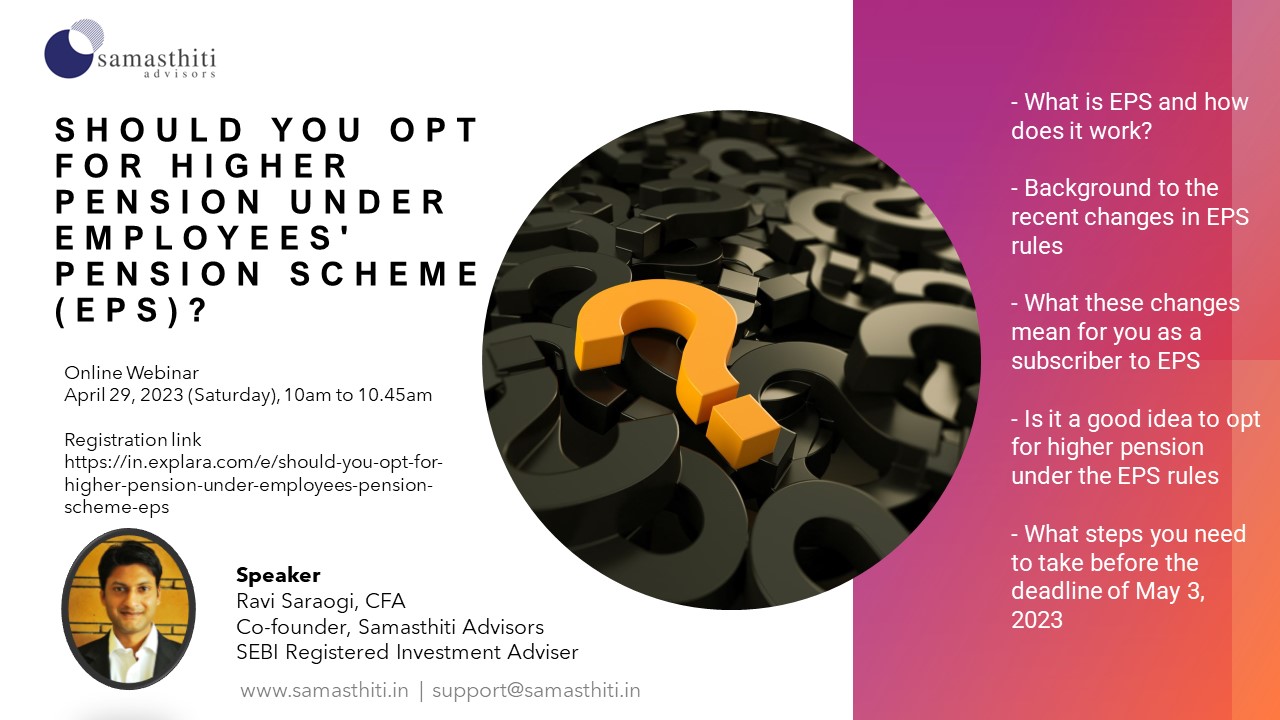

As per the recent Supreme Court order, eligible employees have a right to enroll for higher pension under the Employees’ Pension Scheme (EPS). The last date to intimate your employer and the Employees Provident Fund Organization (EPFO) for this is May 3, 2023. However, is it a good idea to opt for higher pension under EPS? In this webinar, we take a deep dive into this question and guide you on how to make an informed choice.

We will be covering,

– What is EPS and how does it work?

– Background to the recent changes in EPS rules

– What these changes mean for you as a subscriber to EPS

– Is it a good idea to opt for higher pension under the EPS rules

– What steps you need to take before the deadline of May 3, 2023

Register for this upcoming webinar and make an informed decision before the deadline,

https://in.explara.com/e/should-you-opt-for-higher-pension-under-employees-pension-scheme-eps

0 Comments