Bears smelling blood!

Samasthiti Advisor’s Weekly Market Tracker – For the week ended Sep 16,2022

• Federer’s retirement 😭 sent the FedEx shares crashing- oops, sorry, the real culprit 🧐 was a weaker profit guidance given by the company due to weak global demand. On Friday, shares of FedEx collapsed by more than 20% 🥵!

• Adding to the bearishness 😥 was the higher than expected US inflation numbers releases last week. August inflation in the US clocked 8.3%, lower than 8.5% in the previous month, but still higher than expected. The one good thing 🙄about this is it makes our job easier of what to expect in the FOMC meeting of the Federal Reserve next week. 75bps hike😶?

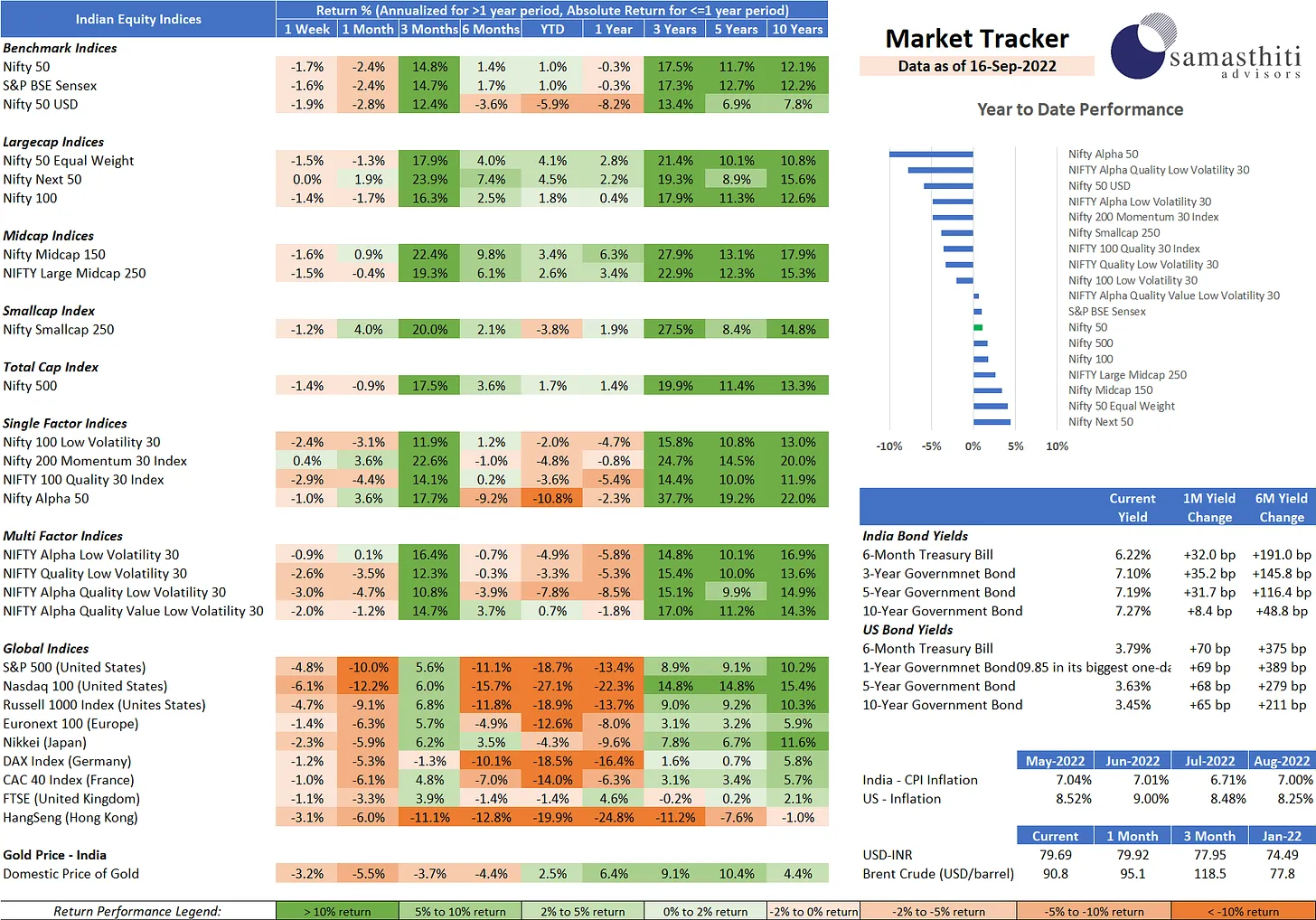

• Bears are smelling blood😡 – the S&P500 was down 4.8% and the NASDAQ100 was down 6.1% last week. Equities pricing in a steep rate hike by the Fed next week? Keep your eyes open 😳.

• Interest rates in the US hardened substantially (particularly short-term interest rates) on expectation of a rate hike in the coming week. US 2-year Treasury Bond closed the week at 3.9%, its highest level since 2007😐!

• Not a great “decoupled” week for the Indian equity indices🤣. Morose news from the US have fogged the windshield of Indian equity investors. Both the Nifty and the Sensex closed the last week lower by about 1.7%.

• Nifty Next 50 is the top performing index 🙌 YTD, up 4.5%, while Nifty Alpha 50 continues to be the worst performer – down 10.8% YTD.

• Not much action in the Indian debt markets – apart from the fact that impatience is growing on the expectations of India government bonds being included in JPM’s Index. God, the wait can be killing😪!

• USD is set to reach the moon🤑. If the US economy is from Mars, the US currency is from Venus. Every bad news from the US tugs the dollar higher🤨. The Dollar Index, which tracks the performance of the USD against other major currencies, shot up 1.5% on Sep 13, its largest one-day percentage gain since Mar 2020. It is still trailing though below its two-decade peak. Bring in more bad news and let’s shatter this record😅!

• Brent crude continued to trend downward to USD 90 per barrel😘. Expectations of higher interest rates and dampening economic activity is putting pressure on oil prices. Good news for oil importers!

That’s it for this week. Until next time, goodbye and have a great weekend🎪!

We have re-opened our WhatsApp subscription 😁 for this Tracker. If you would like to get this Tracker delivered to your WhatsApp every week, subscriber here – https://bit.ly/3SZqelW

0 Comments