Looking at the DXY Index which is at a 20-year high, you could hardly guess the US is facing economic headwinds!

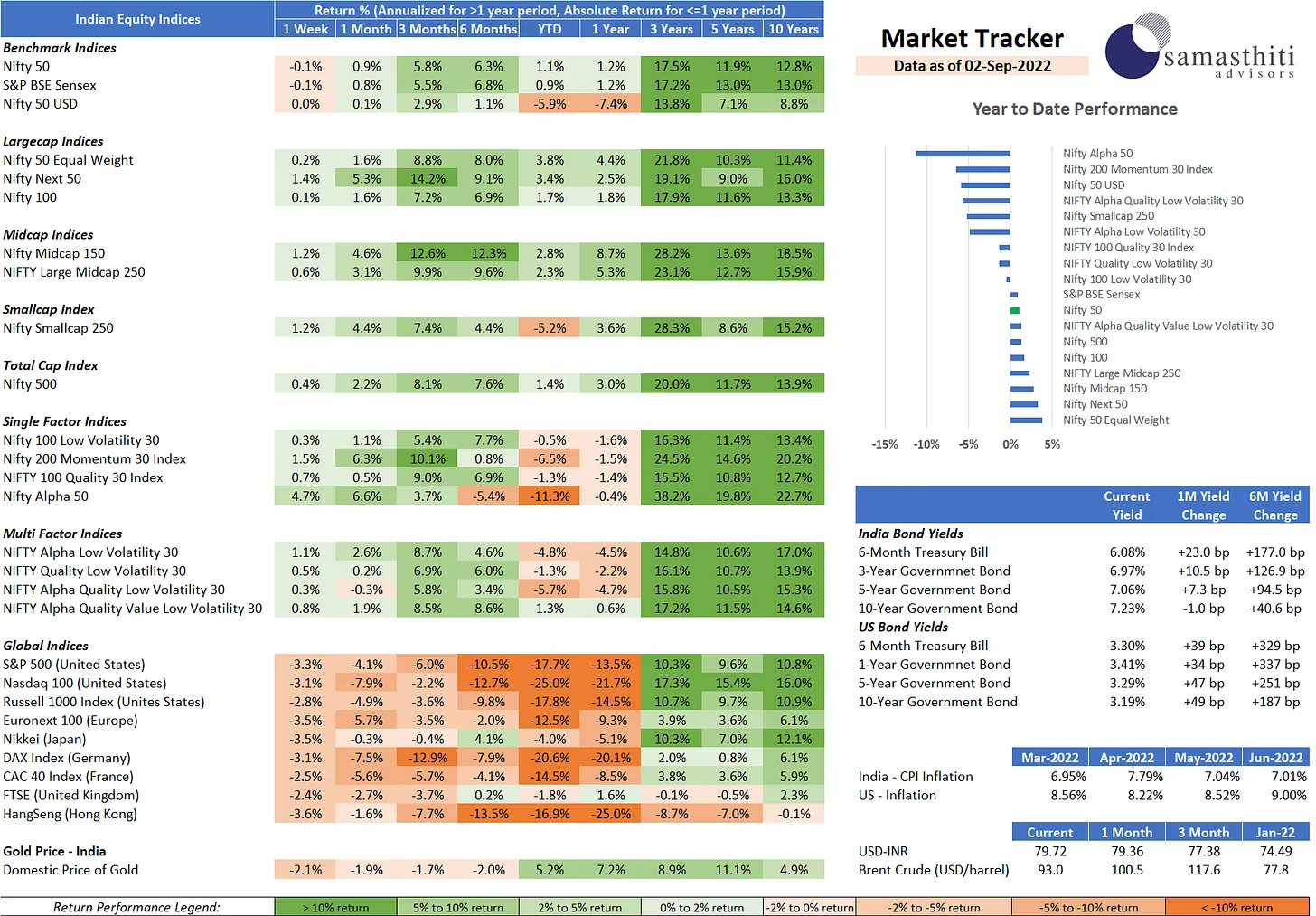

• The US markets continued to reel 🤒under the effects of the hawkish stance taken by Powell in his Jackson Hole speech. The S&P500 and the NASDAQ100 were down by more than 3% last week. Year-to-date (YTD), the NASDAQ100 is down 25% and the S&P500 is down 17%.

• The bearishness in the US equity markets is carrying over to its debt markets as well 😬. Interest rates on US government securities continued to rise by 10-15 bps over the last week.

• The Indian equity indices closed the week flat. After a sharp fall on Monday 😬, it looked like the week was a write-off, but the markets sprung a nice comeback. Both the Nifty and the Sensex closed last week only marginally down 🙃

• The Dollar Index (DXY) closed at a 20-year high😲. If you ever had a doubt on who the boss is- it’s clearly the USD 🤑. The INR is withstanding the strength of the USD due to support by RBI and foreign fund flows. Call it the TINA effect or whatever- we will take it 😉!

•That’s all for now 👋. Have a wonderful weekend 😀

0 Comments