“There are decades where nothing happens; and there are weeks where decades happen”

Samasthiti Advisor’s Weekly Market Tracker – For the week ended Sep 23,2022

• Have you heard the quote – “There are decades where nothing happens; and there are weeks where decades happen”. Lenin said that describing the Bolshevik Revolution more than a century ago and allow us to be a little over-dramatic😊, but the events of last week were pretty tumultuous. Let’s unravel why.

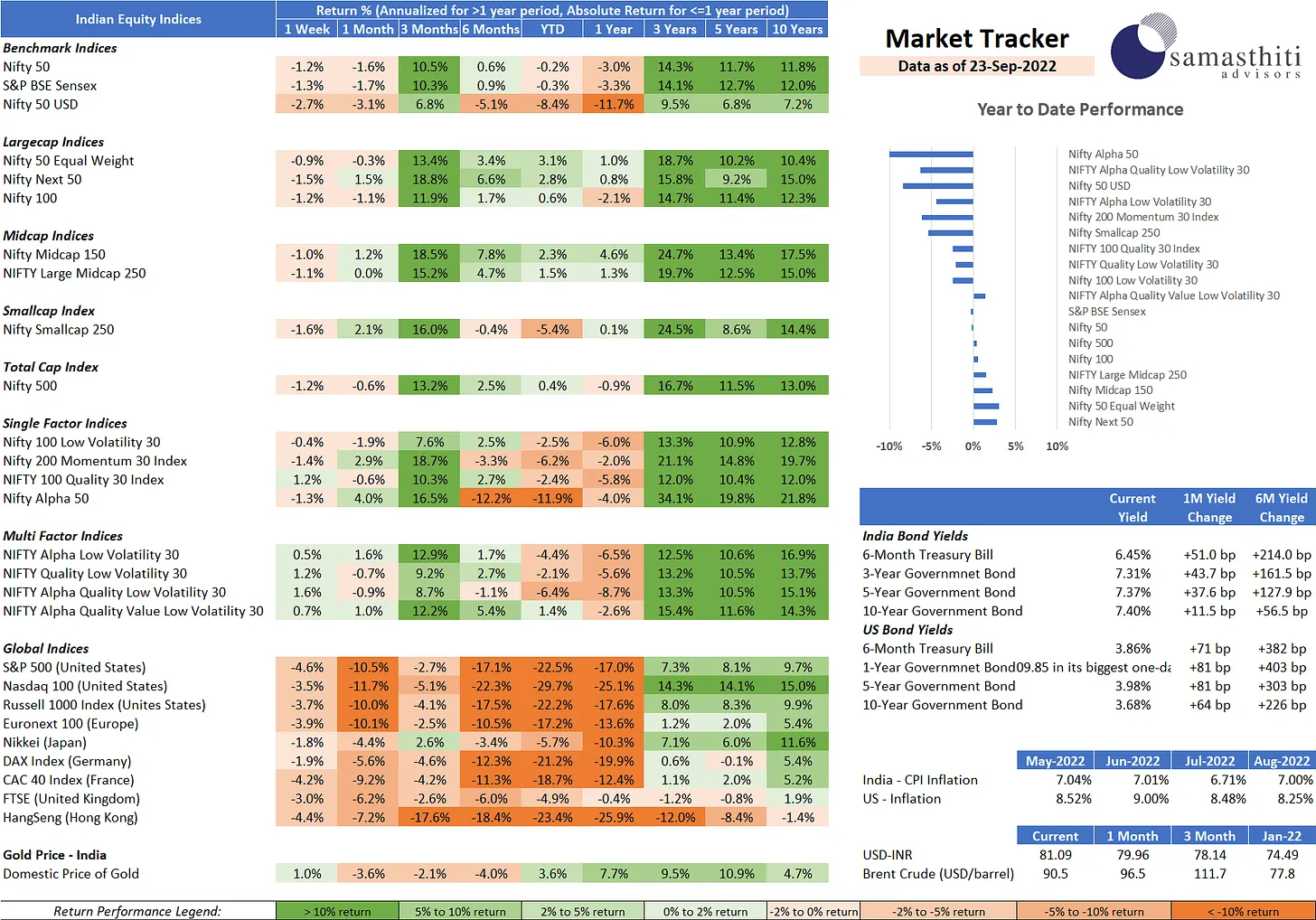

• The Federal Reserve hiked interest rates by 0.75% last week, taking the federal funds target rate to 3.00-3.25%. This was the third consecutive 0.75% rate hike, and the fifth-rate hike since the start of the year. If this was not enough, the guidance given by the Fed suggests more hikes are in the pipeline😭.

• The hawkish commentary from the Federal Reserve has sent interest rates skyrocketing😳. US 2-year government bond yields shot up to 4.2%😣 (up from 3.9% in our previous tracker), a level last seen in 2007. The US 10-year government bond yield is now at 3.68% – a decadal high😶!

• Bears were smelling blood in our previous tracker- now they are slurping😈. The S&P500 was down 4.6% and the NASDAQ100 was down 3.5% last week. YTD, S&P500 is now 22% down and NASDAQ100 is down 30% 😳. If you look at the other global indices in the tracker, there’s a splatter of red everywhere!

• Given the rout in global equities and debt markets, the Indian markets are holding up pretty well😎. Both the Nifty and the Sensex closed the last week lower by about 1.2% – relative outperformance! India is the only oasis in the desert of emerging markets🤡.

• Following the global trend, bond yields went up in India as well. India 10-year government bond yield is up to 7.4% from its 7.2% levels. Bond yields factoring in further tightening by RBI? RBI is meeting next week and there is expectation of a 50bps rate hike😪.

• In our previous tracker we highlighted that the USD is set to reach the moon🤑. Well, it’s not stopping there! The dollar continues to tug higher, leaving other currencies in a pool of dust. The UK pound is at a 37-year low against the dollar. The Euro is at a 20-year low. And our very own INR has breached the level of 81 against the dollar😧.

• The movement in USD has been so strong lately that the Bank of Japan has been forced to break its zen like stoicism 😮and intervene in the currency markets to salvage the Yen. After watching the Yen lose nearly 20% of its value against the USD, Bank of Japan, for the first time since 1998, threw a gauntlet at the sinking Yen. Hold on Yen🤒, helps on its way!

• Brent crude has fallen sharply, from USD 90 per barrel to 81 now😘. Commodities are factoring in a serious decline in global output. Good news for oil importers but ominous sign on the health of global industrial activity!

• Thankfully the markets are shut on Saturdays and Sundays! So, relax and sleep well, who knows what’s in store next week 😁. Until next time, goodbye and have a great weekend🎪!

We have re-opened our WhatsApp subscription 😁 for this Tracker. If you would like to get this Tracker delivered to your WhatsApp every week, subscribe here – https://bit.ly/3SZqelW

0 Comments