Indian equities continues to outperform even as the global equity outlook deteriorates

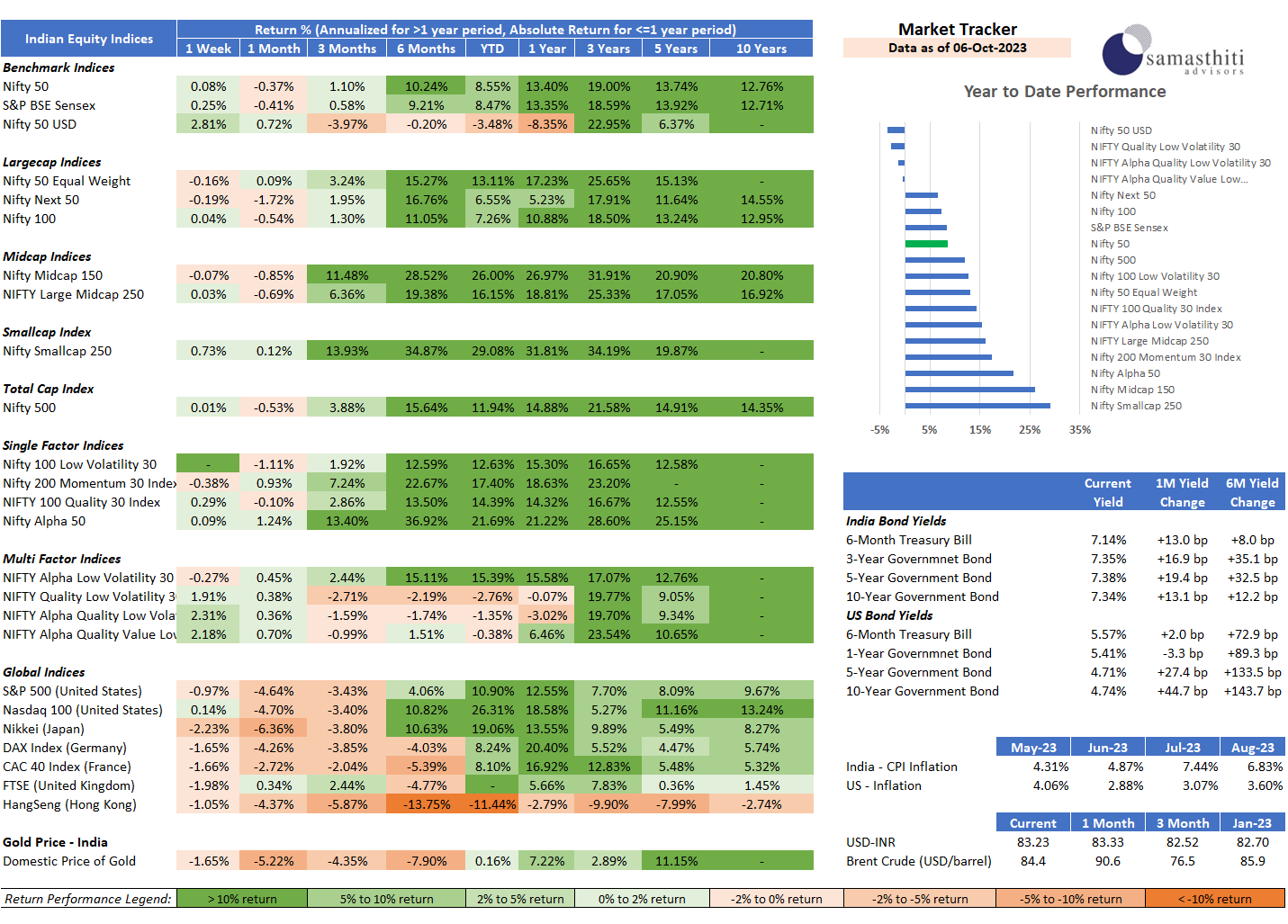

• The strong performance of Indian equities continues😊. The Nifty 50 Index has delivered an impressive absolute return of 10.5% over the last 6 months. The Nifty Next 50 Index has staged a comeback, delivering a return of 16.8% in the same period.

• Smallcap and Midcap continue to be on fire🔥. The Nifty Smallcap 250 Index has delivered a return of nearly 35% over the last 6 months, while the Nifty Midcap 150 Index has delivered a return of 28.6% in the same period!

• Global equity markets have been weak😟. The S&P500 and the Nasdaq 100 have both declined by close to 5% over the last one month. Equity indices in other major economies show a similar trend. With consumer spending data in the US looking weak and no visibility on easing of interest rates by the Fed, the global equity market outlook looks bearish.

• The latest US job reports has come in better than expected – causing interest rates in the US to harden. The yield on the US 10-year Government bond stands at 4.75% which is a multi-decade high. Short term yield on 6-month US treasuries remain elevated as well at 5.57% 🤯

• With interest rates in the US being unusually high, the differential between Indian and US interest rates has narrowed significantly. At the short end of the curve, the interest rate differential between India and the US stands at less than 2%! This could put the INR under pressure😓.

• Until next time, goodbye and have a great weekend🎪!

0 Comments