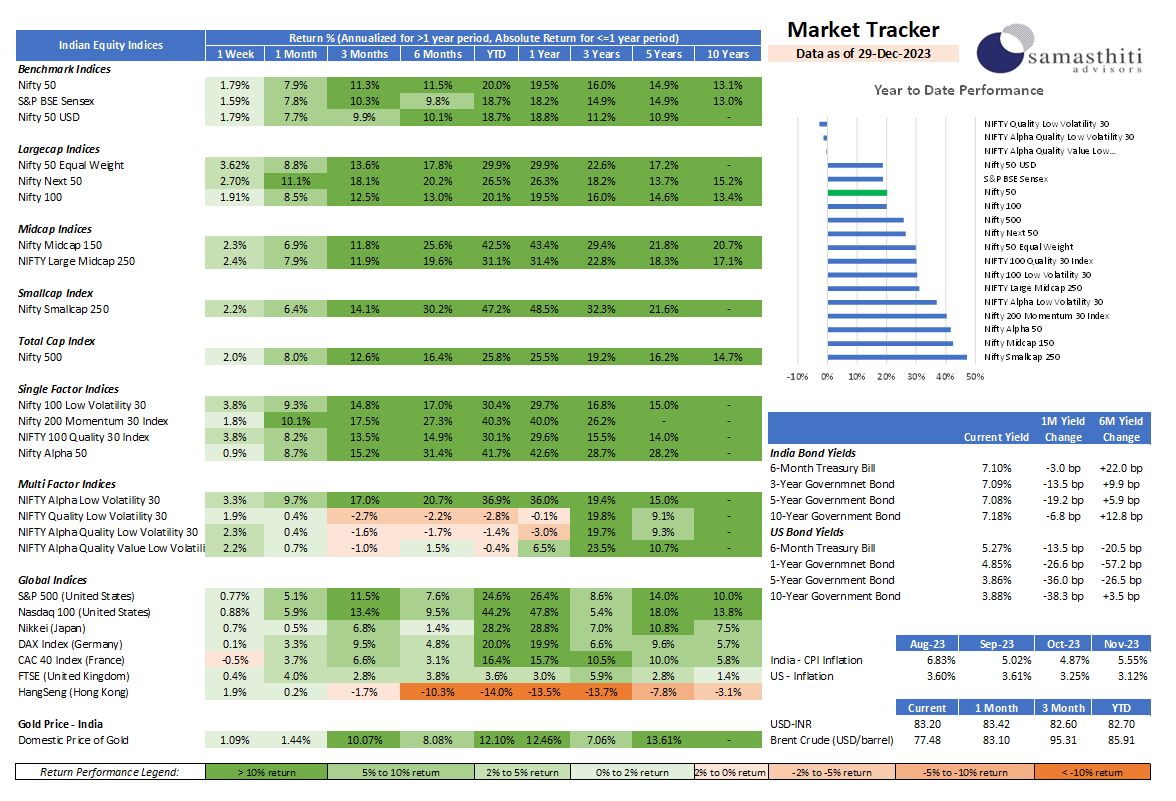

Sea of green!

Samasthiti Advisor’s Weekly Market Tracker – For the week ended Dec 29, 2023

•📈 Nifty 50 and Nifty Next 50 exhibit robust performance, with Nifty 50 gaining🔥 20% over the past year and 7.9% in the last month, while Nifty Next 50 boasts returns of 26.3% and 💪11.1%, respectively. The bullish trend in Indian equities with all time highs has been supported by strong domestic macro data and foreign investment inflows🚀

•US markets have also been on an impressive upswing, exemplified by S&P 500’s 26.4% 1-year and 5.1% 1-month gains, and Nasdaq’s remarkable returns of 🎆47.8% in 1-year and 5.1% in 1-month.

•The bullish US 🌐 equities has been accompanied by an expected decline in US bond market rates. Dip in inflation, a robust 4.9% Q3 GDP increase and the resilience of the US economy has defied a recession prediction for 2023. 🚀

•🌟 Gold gears up for its best year in three, fuelled by US rate cut expectations and global tensions. Forecasts hint at a continued upward trajectory. 📈

•📉 Bond yields have come down significantly. The 10-year US government bond yield stands at 3.88%, which is a decline of 38bps over the last 1 month. The 10-year Indian government bonds stands at 7.18%, with a milder decline of 6.8bps over the last 1 month. The decline in US bond market yields is attributed to the market front-running the Fed’s anticipated interest rate cuts in 2024.💹

•USD-INR continues to hover around the 83 mark💵 – this has been the story over the last 1 year. The strong resurgence of investment markets in the US could have put more pressure on the INR 🤔 had it not been for strong domestic foreign inflows.

•📉 Brent crude has crashed to USD 77 to a barrel now, down from USD 83.4 to a barrel a month back. Crude has fallen even more despite the heightened geopolitical risks in the middle east. Who would have thought🔴!.

•Until next time, 👋bye! May the coming year be filled with joy, success, and countless wonderful moments! Happy New Year! 🎉

0 Comments