Samasthiti offers a unique retirement product for Indians, developed after three years of extensive research and covered extensively by the media

On a mission to make India retirement ready!

We live in a pension-less society. Apart from employees in the public sector who receive a pension, the vast majority of the population has no such luxury. For those without any pension, generating a monthly income themselves from their savings can prove to be very challenging.

Since our operations in 2020, we have helped numerous investors design their retirement plan. For the young clients, we have put in a place an investment program through which they can save month-on-month to accumulate a large retirement corpus that can see them through more than 30 years of retirement. At the same time, for clients in their retirement, we are helping them get a regular sustainable income from their savings.

The right retirement planning can make a world of difference to your retirement years. We are on a mission to make India retirement ready and if you would like us to design your retirement plan, do drop us a note and we would love to get in touch with you.

Read on to know more about our product and the story behind why we developed this unique offering.

The neglected financial goal

Retirement is by far the most neglected financial goal. For the young, it’s too distant a goal to think about. And for the elderly, it may feel like planning for it is a lost cause. 70% of Indians still depend on either family wealth or their children to finance their retirement. That’s a glaring statistic made worse by the fact 1 in 3 urban Indians worry that they will deplete their savings withing five years of retirement[1].

The curious few do visit online retirement calculators to get an inkling of the retirement corpus they need to accumulate. However, these online calculators are too simplistic. They may be a good starting point, but retirement computations require an in-depth understanding of investment returns, inflation, tax and life expectancy.

An added confusion in retirement planning is that retirees have multiple investments – fixed deposits, EPF, PPF, NPS, mutual funds, stocks, bonds, etc. A key challenge is how to look at all these investments together and craft a withdrawal strategy that gives the retiree a pension income for the rest of their lives.

Lack of retirement planning research in India

When we set out to address the above challenges, we noticed that there was very little research available on how to design an efficient retirement plan in India. While globally, financial planners had produced a fair amount of research on tackling these issues, there was an abject lack of research focused on India. In the absence of India-specific research, we were mindlessly importing international retirement planning design and applying it to the Indian context.

So we set out to create a body of India-specific research that can help not only investors but also other planners in designing retirement plans. In 2022, we published our first research paper on this topic titled “Computing the Safe Withdrawal Rate for a Retirement Portfolio in India”.

This research, for the first time, calculated what is the safe level of withdrawal to make from your retirement portfolio without exhausting it prematurely. This study was widely covered in the media and made an important breakthrough for retirement planning in India.

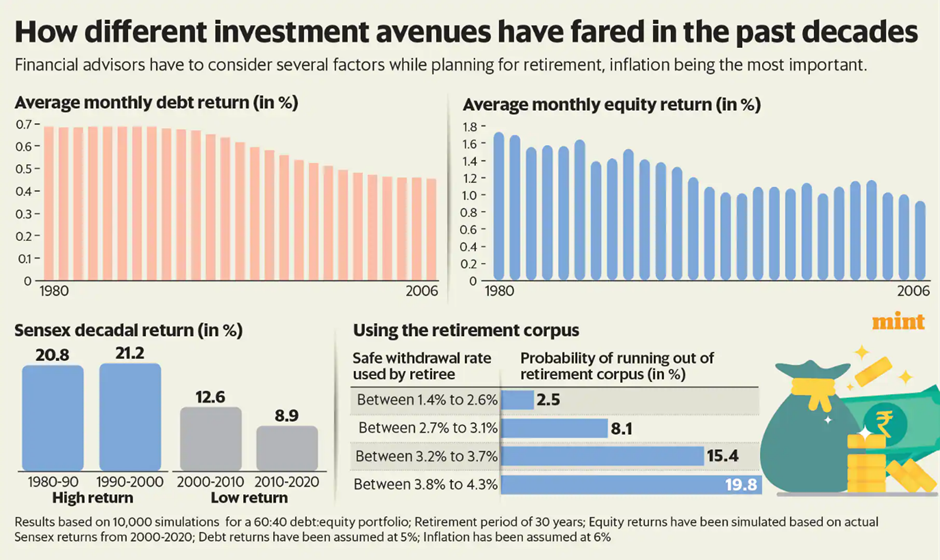

The 2022 study highlighted several important points like how the return on both equity and debt investments have been falling, and this must be factored into retirement planning. The study also calculated that a 3% withdrawal rate is suitable for a typical Indian retiree.

In a subsequent co-authored research released recently titled “, we upgraded the analysis to make it more robust. We looked at different mix of equity and debt investments, as well as different number of retirement years to account for both early and late retirement. This study also received generous media coverage and helped in increasing retirement awareness.

Our unique approach to retirement planning

Our approach to retirement planning, based on our extensive research, is unique. Most retirement plans assume a constant rate of return for investments and a constant inflation. In reality, however, the return that your portfolio earns will fluctuate based on market conditions. Inflation will also vary from year to year. A retirement plan which ignores this can go horribly wrong.

Our research enables us to account for such volatility while drafting retirement plans for our clients. Our plans are based on historical investment return and inflation, and hence are closer to reality.

Using our research, we also guide retirees on how to optimally use their different investments to generate a regular monthly income. This requires taking a portfolio view of the retiree’s savings, which may include EPF, PPF, NPS, fixed deposits, mutual funds, etc., and designing an efficient withdrawal strategy.

Combining different investments and transforming them to a regular monthly income

Our methodology

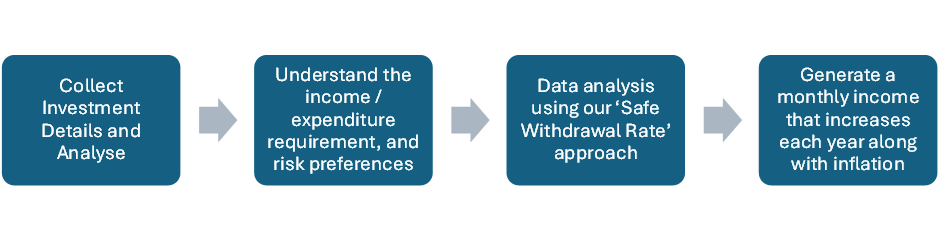

We follow the below steps to help a retiree generate a stable monthly income during their retirement,

- Collect various investment details and analyse them. A typical retiree will have different investments that form a part of their retirement corpus – EPF, PPF, fixed deposits, mutual funds, stocks, bonds, etc. Each of these investments have different return expectations and different risk, which need to be factored while drawing up a plan

- Understand the income and expenditure profile of the retiree along with their risk preferences

- Analyse the investment details, income/expenditure profile and risk preferences using our ‘Safe Withdrawal Rate’ approach and arrive at a robust retirement plan

- Using the analysis in the retirement plan, put in place a mechanism for generating a monthly income for the retiree that increases every year along with inflation

We believe our retirement planning solution can help retirees generate higher income. The withdrawal strategy that we design optimizes on various parameters including taxation to ensure that we are getting the maximum benefit out of our retirement savings.

[1] India Retirement Index Study 3.0, Max Life-Kantar, 2022-23

0 Comments