A primer on the most important metric to track when investing in debt mutual funds

Karthik, a conservative investor, had invested in debt mutual funds to avoid the volatility of equity. While his daring friends who had invested in equity are losing sleep over the fall in equity markets, Karthik sleeps comfortably, reassured that his investments are safe.

One morning, he checks how his portfolio is doing, and much to his horror, sees that some of his debt mutual fund investments are giving him a loss? How can that be?

He had heard how unsuspecting investors in some debt mutual fund had lost their savings due to defaults. To avoid these kinds of painful surprises, he had consciously chosen to invest in Gilt funds. Gilt funds are debt mutual funds which invest in Government Bonds (commonly referred to as Government Securities, or G-Secs). Investing in G-Secs is practically risk free- after all, if you can’t trust the government to pay back on its bonds, who can you trust at all?

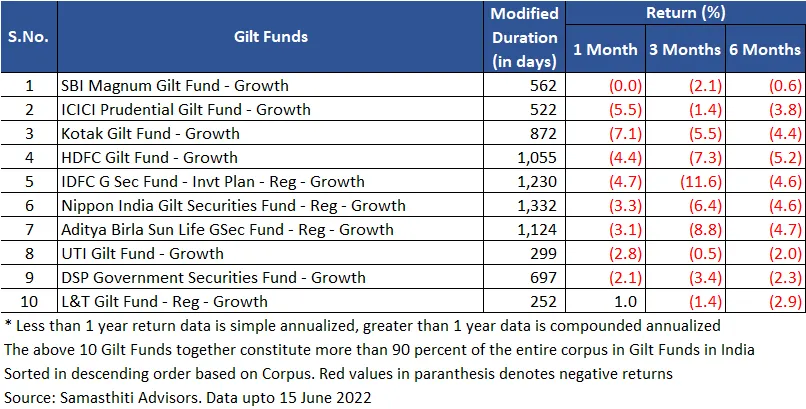

Last he checked, the government had not defaulted on any of its bonds- then what explains the fall in his debt mutual funds? He pulls out the data for the ten largest Gilt funds in India and grudgingly notes that not only his Gilt fund, but many others have given negative return to investors.

It appears that Karthik’s debt mutual funds, with their innocent looking demeanour, trapped him into something called “interest rate risk”. Interest rate risk can make debt mutual funds as volatile as equity mutual funds. Investing in a debt mutual fund without understanding this risk can be a serious overlook – as Karthik will now attest.

Understanding Interest Rate Risk

First, the basics. Debt mutual funds invest in bonds and bonds carry a fixed rate of interest and a fixed tenure (there are exemptions to this but let’s not complicate the discussion). In this respect, debt mutual funds are similar to fixed deposits which also carry a fixed interest rate and a fixed tenure. But this is also where the similarity ends. This is because a debt mutual fund is a marketable investment whereas a fixed deposit is not.

What do we mean when we say “marketable”? When you invest in a fixed deposit, you cannot sell that fixed deposit to someone else. You open a fixed deposit with a bank and you can either hold on to it till maturity or pre-maturely close the fixed deposit. Similarly, you cannot buy a fixed deposit from someone else – you will have to go to a bank and open a fixed deposit. Hence, a fixed deposit is not a marketable investment – you cannot transfer it, sell it, or buy it from an existing holder of fixed deposits.

Debt mutual funds are very different. You buy a debt mutual fund from a mutual fund company, and when you want your money back, you have to sell your debt mutual fund investment back to the mutual fund company. However, the price at which the mutual fund company will buy back your debt mutual fund is not fixed. This is because a debt mutual fund is a marketable investment and the mutual fund company will buy back the debt mutual fund from you at market prices.

This brings us to the crucial point– how is the market price of a debt mutual fund determined? A debt mutual fund is a collection of bonds, hence the value of a debt mutual fund is based on the value of the bonds it holds and the value of a bond is determined by market interest rates.

This may appear to be confusing. Why should the value of a bond be determined by market interest rates and not by interest rate that the bond fetches?

To understand this, we need to look at an example.

Let’s say there is a bond which you can buy for INR 100 and which pays an interest of 5 percent. Now, lets assume that the market interest rate is also 5 percent. In this case, someone will be indifferent between buying a bond from the market or buying your bond – as both will give him 5 percent interest.

Now, let’s assume that the market interest rate goes higher to 6 percent. In this case, an investor will prefer to buy a bond from the market which gives 6 percent return rather than your bond which only gives 5 percent return. If you want to sell your bond when market interest rates are higher than the interest rate on your bond, you will have to settle for a lower price, which will bring down your return, or you might even have to sell at a loss.

This risk – that the value of a bond might fall based on changes in market interest rates is called interest rate risk. There is an inverse relationship between bond prices and interest rates. When market interest rates go up, bond values fall, and when market interest rates go down, bond values increase.

Not all bonds are equally touchy

All bonds do not react in the same manner to changes in market interest rates. The values of some bonds change more vigorously to changes in market interest rates as compared to others.

Without going into the math, a bond which has a longer tenure will react more to market interest rates than a bond with shorter tenure. A 10-year bond will have higher interest rate risk as compared to a 2-year bond. Accordingly, a debt mutual fund which holds many long-tenure bonds will have higher interest rate risk compared to a debt mutual fund which holds short-tenure bonds.

Is there an easy way to figure out whether a debt mutual fund has high or low interest rate risk?

Yes, there is – before investing in a debt mutual fund, check the fund’s “Modified Duration”. Modified Duration is a measure of interest rate risk. A debt mutual fund with high Modified Duration will have high interest rate risk and vice-versa.

If you look at the data for Gilt funds, you will see that we have provided the Modified Duration for each Gilt fund, which ranges from 252 days and goes up to 1,332 days. This represents high interest rate risk. If interest rates were to increase, such funds will witness rapid erosion in their valuation. This is exactly what happened over the last six months.

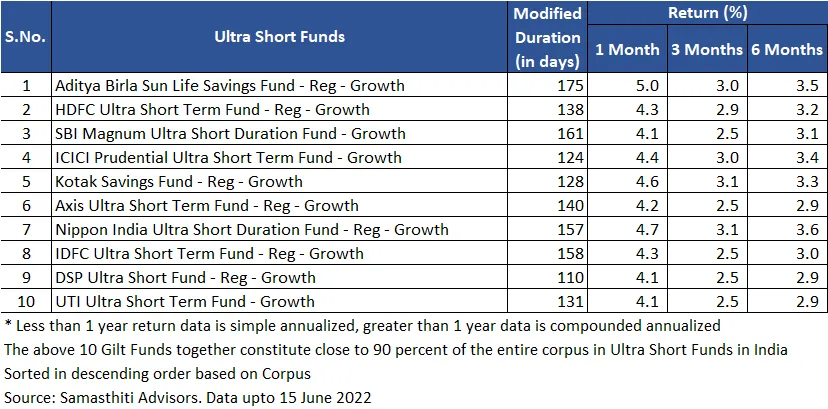

If you want to limit the interest rate risk in your debt mutual fund portfolio, make sure you do not invest in any debt mutual fund with Modified Duration above 180 days. If you look at the return performance of debt mutual funds which maintain Modified Duration below this limit, you will see that these funds are better able to insulate themselves from changes in market interest rates.

For instance, if you look at the last six month return data for Ultra Short funds (which are a type of debt mutual fund with Modified Duration below 180 days) you will see that the increase in market interest rates has not pulled down their returns.

Karthik, now wiser, has reshuffled his portfolio – he has moved out of Gilt funds and invested in Ultra Short funds. His portfolio is now free from the blemish of interest rate risk. In fact, Karthik now checks for Modified Duration of a debt mutual fund even before glancing at the historical return.

A habit worth emulating.

Good that you have mentioned an important factor to track in a debt mutual fund. what is modified duration? how is it calculated?