Higher than expected inflation in the US makes more interest rate hikes a certain

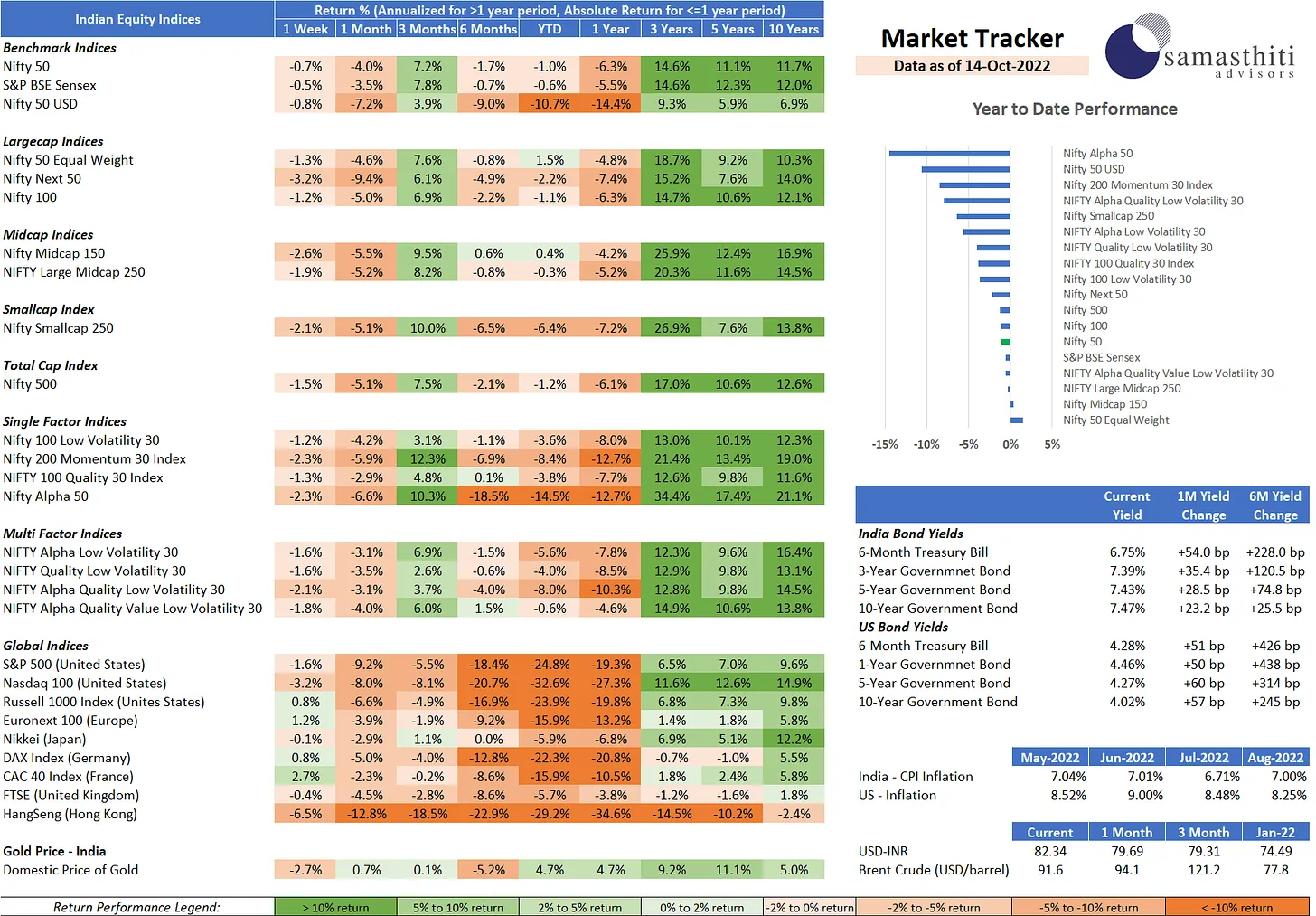

Samasthiti Advisor’s Weekly Market Tracker – For the week ended Oct 14,2022

• The most talked about data-point last week was the higher than expected inflation numbers for the United States which has pretty much sealed the outcome of the next Federal Reserve meeting in November – more interest rates hike😱!

• Core Consumer Price Inflation (CPI) in the US increased 0.6% month-on-month in Sep, higher than the expected 0.4%. Year-on-year, the CPI stood at 8.2% in Sep, higher than the expected 8.1%.

• The S&P500 was down 1.6% last week and the NASDAQ100 was down 3.2% in the same period. Year-to-date (YTD), S&P500 is now 25% down and NASDAQ100 is down more than 33% 😳.

• Both the Nifty and the Sensex closed the last week slightly lower by about 0.7% – is it the calm before the storm? We don’t know 🤐, everyone is keeping their eyes on the global economy.

• US govt bonds are now all above 4% 🤒for each maturity – 6 months, 1 year, 5 year and 10 year. 10-year US govt bond yields are at 4.02%, lower than the 6-month treasury bond yield at 4.28%. Steep yield curve inversion is pricing in a recession and hawkish short-term rates.

• Bond markets in other countries not looking so good as well. Bond vigilantes are giving UK bonds a tough time, prompting UK PM Liz Truss to fire😪 her Finance Minister Kwasi Kwarteng.

• Interest rates in India continues to be elevated. Global headwinds will make it very difficult for RBI to ease interest rate hikes. The yield on benchmark 10-year Indian govt bond is close to 7.5%😑 – high oil prices make it more difficult for the yields to soften.

• INR, like other currencies, continue to face significant pressure. INR-USD has breached 82 with more downside pressure. RBI has asked banks to stop building forex positions in the offshore market to take off some pressure on the INR.

• The Saudis are making US uncomfortable😥. No sign that they will back down from their decision to cut oil production. Oil prices continue to be above USD 90 a barrel, making it more difficult for US (and global) inflation to moderate.

• Until next time, goodbye and have a great weekend🎪!

We have re-opened our WhatsApp subscription 😁 for this Tracker. If you would like to get this Tracker delivered to your WhatsApp every week, subscribe here – https://bit.ly/3SZqelW

0 Comments