(A condensed version of this post was published in Mint on 20th Jan 2026 and can be accessed here )

How much can you safely spend from your retirement corpus? In 2022, I tried to answer this by building a retirement simulator based on Indian market data and calculating the Safe Withdrawal Rate (SWR). In subsequent research, I extended the simulations to different asset classes and retirement lengths.

My analysis relied on simulations, which is appropriate given the complexity of the computations. However, the problem with simulations is that they can feel like a black box. To solve this problem, my new research derives a formula that can calculate SWRs effortlessly without resorting to complex simulations.

While simulations have globally been the preferred way for arriving at SWRs, a key issue with this approach is that it’s not intuitive. You press a button and the computer spits out a number, but it is not obvious to a retiree why the number is what it is. It is also difficult to do back-of-the-envelope calculations. If a client asks, “What if I retire five years earlier?” or “What if I increase my equity from 40% to 60%?”, you usually have to go back to the simulator, rerun everything and then interpret the new output.

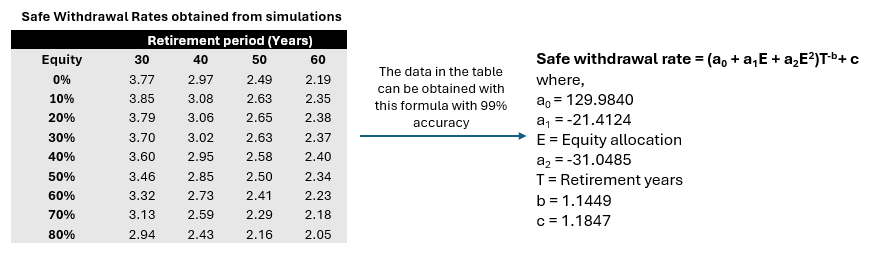

Instead of simulations, if SWRs could be computed by using a formula, it would make things simpler. This is exactly what the formula in my new research does (see graphic). It needs only two inputs – equity allocation and the length of the retirement period, and it will output a near to accurate SWR which a retiree can use.

From Simulations to Simplicity: A Formula for Safe Withdrawal Rates

Source: Samasthiti Advisors

Statistically, this equation is 99% accurate and the difference between the SWRs obtained from the formula and the simulated SWRs is only around 0.10 percentage points. If the “true” safe rate from the simulator is 3.5%, the formula is usually between 3.4% and 3.6%.

To derive this formula, I started by going back to the simulation engine and running tens of thousands of simulations for many combinations of equity allocation (from 0% to 100%) and retirement length (from 10 to 100 years). The output was a large table of SWRs for each equity mix and horizon.

The next step was to observe patterns in this data. This is important as the formula would need to be structured in a way which can replicate these patterns. There were three clear patterns that stood out in the simulated SWRs.

First, the safe withdrawal rate falls as the retirement period gets longer. A 20-year retirement can support a much higher rate than a 40 year one. Second, for any given horizon, the safest rate is usually achieved at a moderate equity allocation. Lastly, there seems to be a floor to SWRs. When the simulations are extended to extreme time horizons like 150 or 200 years, the safe rate for a balanced portfolio stops falling and flattens out around 1.8%–1.9%.

The next step was to fit an equation that captures the above trends. The equation is useful not only because it is convenient, but also because it builds intuition. It makes clear how the safe rate responds when you change the inputs. Lengthen the retirement horizon and the number falls. Increase equity from very low levels and the withdrawal rate rises but push equity higher and the rate starts to drop again.

Using this equation is straightforward. Let’s say you plan to keep 40% of your portfolio in equity and want to plan for a 30-year retirement. Plugging these inputs into the formula gives a SWR of 3.56% (very close to the simulated SWR of 3.60%). For someone with a ₹1 crore corpus, that translates to a starting income of ₹3.56 lakh in the first year of retirement, with this amount being increased with inflation each year.

If you would now like to check the withdrawal rate for a 40-year retirement, keeping the equity allocation the same, the formula yields a reduced SWR of 2.89%. Extending the retirement period by 10 years causes the withdrawal in the first year to fall from ₹3.56 lakh to ₹2.89 lakh.

This intuitive formula will hopefully encourage more Indian retirees and planners to think in terms of safe withdrawal rates rather than relying on rough guesses. Simulations will always have a place in serious retirement planning, but when a complex engine can be distilled into a simple formula, it becomes much easier to have informed conversations.

-Ravi Saraogi, CFA is a SEBI Registered Investment Adviser and Co-founder of Samasthiti Advisors

Thanks for sharing with us. However, I am still not convinced that it is practical. Let’s say, For 50 year retirement with 50% Equities formula is yielding 2.5% as SWR which is similar to 0% Equities for same case. This means you can live without equities for 50 years of retirement. Could you please make it more practical? SWP with yearly increase – using any equity oriented fund, you can safely withdraw more than 5% in all scenarios (assuming 6% inflation & yearly increase), could you please help with more realistic SWR’s?