What does the future have in store for investors?

There are times when the financial markets make you a little uncomfortable. At such moments, it feels like the markets have come to a strange crossroad– when it must decide which path it will traverse, and whether it will maintain its previous characteristics or take on a completely new form. We are currently in one such period. If you look around closely, there are palpable signs of both excitement and fear. Excitement to be witnessing the transition to something new, and fear of seeing how the excesses of the past will unravel, if at all.

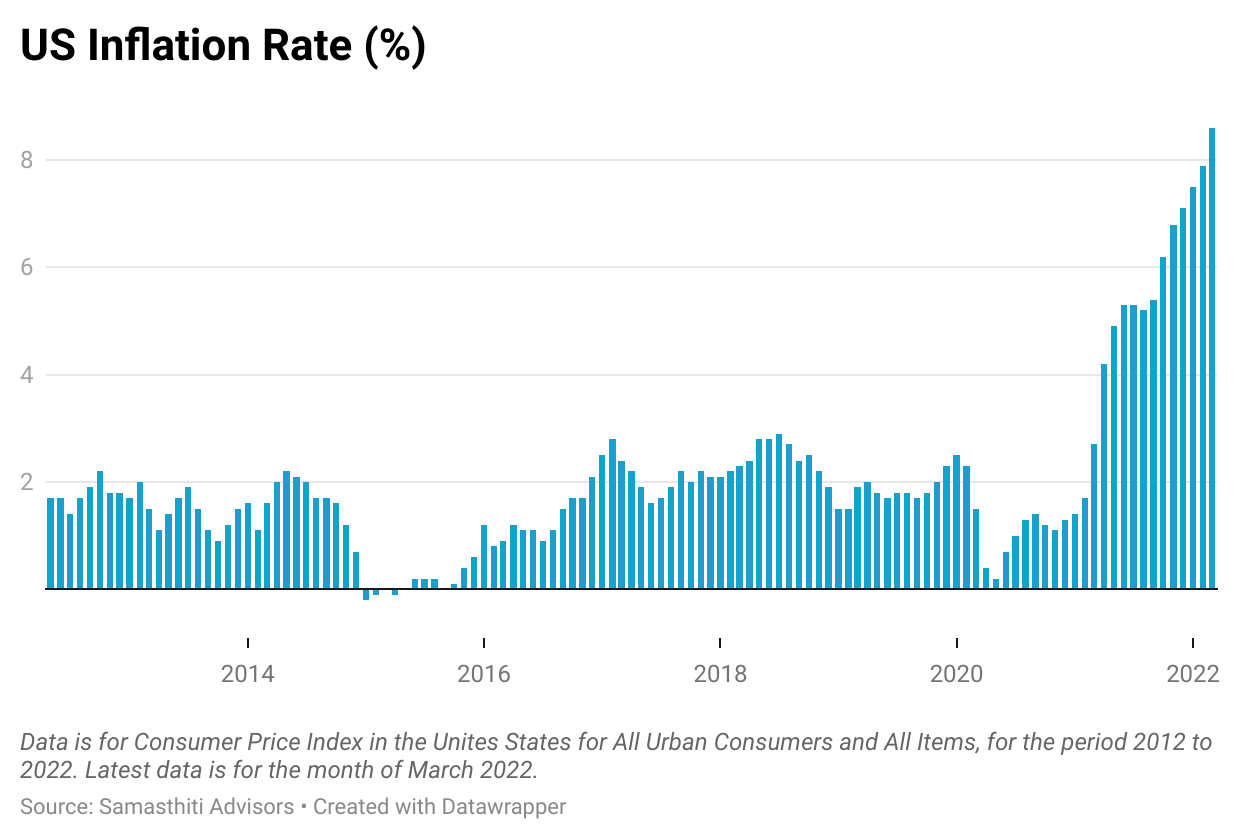

After over a decade of close-to-zero interest rates in the Unites States (US), the Federal Reserve (the central bank of US) has finally started to increase interest rates. Given the rapid increase in inflation in the US, the Federal Reserve did not really have an option. In March 2022, US inflation increased to 8.5 percent, hitting a 40 year high.

Low interest rates make it easier to borrow money and spend, which adds to economic growth. For the same reason, a policy of low interest rates also invigorate the equity markets. Now that rates are on the rise, both the economy and the financial markets need to adjust to newer realities. This adjustment will not be geographically limited to the US. You must have heard the saying – when the US economy sneezes, the world catches a cold.

In India, a similar story is playing out. Prior to Covid, India’s central bank, the Reserve Bank of India (RBI), held the interest rates at a low level to boost economic activity. During Covid, the low interest rate regime was reinforced to prevent the economy from going into a recession. Now that economic activity is back to pre-Covid level and inflation is increasing, RBI’s hands are tied. In March 2022, inflation in India spiked to 6.95 percent, and is expected to increase further.

In an unscheduled meeting on May 4, RBI increased its benchmark interest rate (called the Repo Rate) from 4.0 percent to 4.4 percent– and this is expected to be just the beginning of a rate increase cycle. One thing is clear: In India, as well as globally, we are moving towards a higher interest rate regime.

Any adjustment can be uncomfortable, and this also holds true for financial markets adjusting to new realities. After being cheered and egged on by low interest rates for more than a decade now, the equity markets will find their cheerleaders’ stand empty. Apart from higher interest rates, the equity markets also need to contend with higher geo-political risks due to the Russia-Ukraine war.

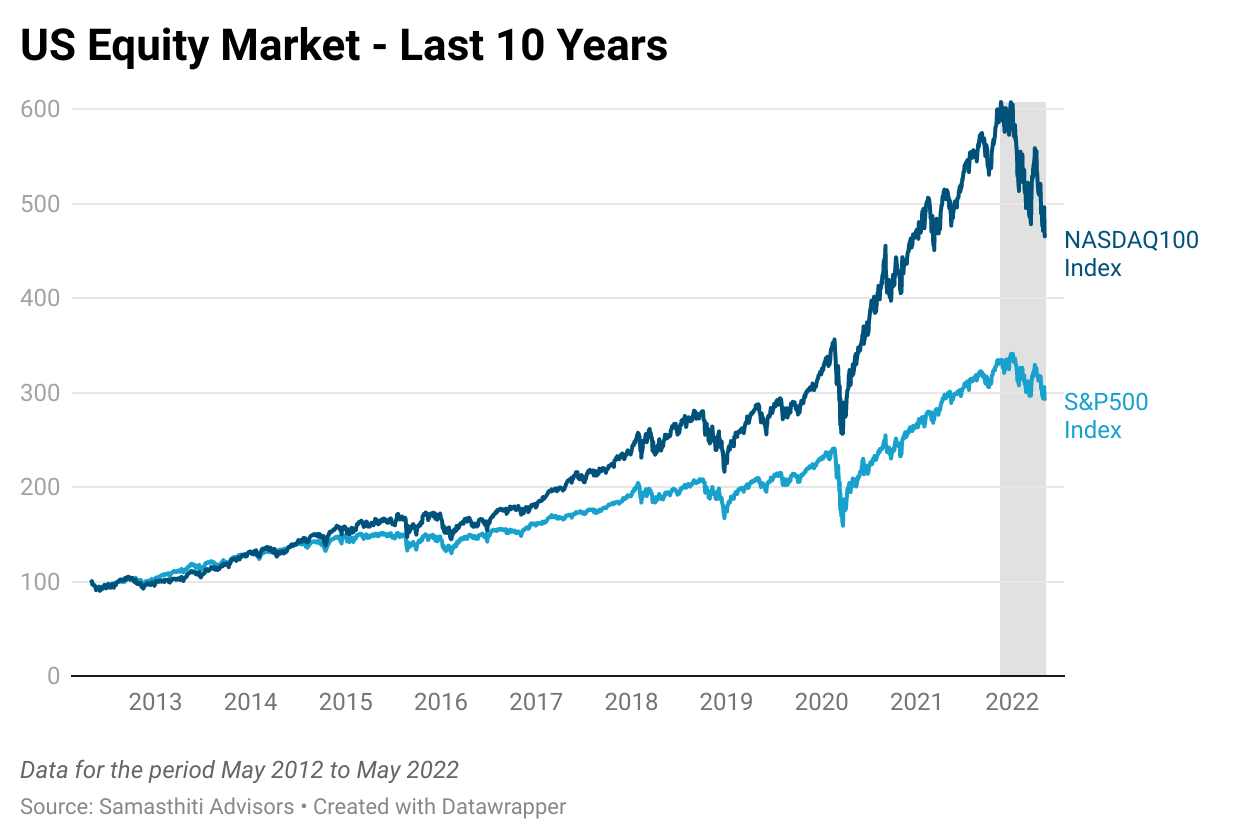

So, what has been the reaction of the equity markets to all this? If we look at the US, the S&P500 Index, which is a broad measure of how US equity market is performing, has fallen 14 percent in the current calendar year. The NASDAQ100 Index, which is an indicator of how the technology stocks in the US are performing, has fallen 22 percent in the same period. The fall, particularly in US technology stocks, is enough to cause grief to faint-hearted investors.

However, if we look at the performance of US equities over the last 10 years, the current fall is barely a blip. Even after factoring in the current fall, NASDAQ100 is up about 5 times since 2012, and the S&P500 is up 3 times. Thus, a long-term investor in US equities, who invested more than a decade ago, can simply brush off the current fall in equities as another market tantrum which is best ignored.

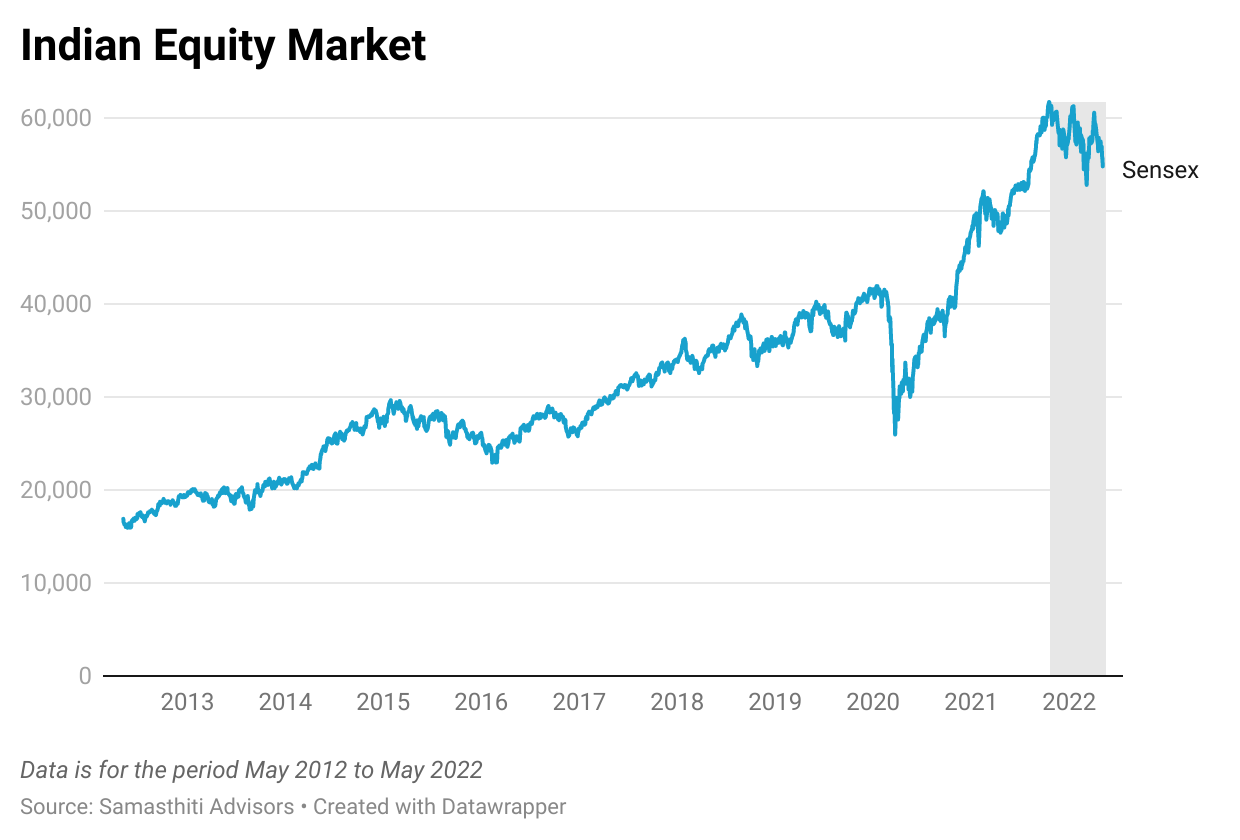

In India too, the equity markets have corrected. The Sensex Index (which is the most widely tracked Index to measure the performance of Indian equites) has fallen 6 percent in the current calendar year. That’s barely a blip. Even if we look at the fall of the Sensex from the highest point this calendar year (on January 17), the Sensex has fallen 11 percent. By any standard, this is a moderate fall. Remember, the second name of equity is volatility.

Again, like we did for US equity, if we look at the performance of Indian equity over the last 10 years, the current downturn is really a non-event.

So, looking at the big picture, the current fall in equity markets does not seem extraordinary. This is not to suggest that the equity markets cannot fall further – we don’t know. Trying to predict market movements is a futile activity as its movement is fundamentally unpredictable.

Without wasting any more words on something as fickle as the financial markets, let us ask a pertinent question – what can investors do to brace themselves for whatever is in store? Well, at the cost of sounding incredibly boring, the answer is – stick to the asset allocation in your financial plan.

As an investor, your best weapon against the vagaries of the market is to follow a proper asset allocation. This may sound complicated but in reality is a simple concept to understand. Asset allocation means how you split your investments between different categories– like equity investment and debt investments (if you are not sure what these terms mean, check out our video here and here). If you have got this split right in your portfolio, you can look at the volatile market in the face and not blink an eye.

For long term goals, a proper asset allocation should be overweight equities and underweight debt investments. For instance, a young worker saving for retirement should have significant exposure to equity investments so that she gets superior long-term equity returns. Given that our young worker will need her retirement corpus decades down the line, she need not worry about the current market fall. In fact, our young worker should be happy if markets fall as she will be acquiring her investments at a cheaper price.

For short term goals, a proper asset allocation should be underweight equities and overweight debt investments. For instance, a parent saving to pay for her child’s college fee in the next two years, should have nearly the entire education savings in debt investments. With most of her education savings in debt investments, our parent could not care two hoots how the equity markets are behaving.

Thus, whatever the situation, a proper asset allocation can frustrate any attempt by the market to unsettle your investments.

So, get your asset allocation in place, and then, sit back, relax, and enjoy the show. Or better still, ignore the show altogether.

0 Comments