We are delighted to share that our co-authored paper with Rajan Raju, “Balancing Acts: Safe Withdrawal Rates in the Indian Context,” was awarded First Prize at the 1st International Research Conference on Pension (IRCP 2025), held on April 3–4, 2025, in New Delhi.

Read the Press Information Bureau’s release here for more details:

https://www.pib.gov.in/PressReleasePage.aspx?PRID=2119157.

Organized by the Pension Fund Regulatory and Development Authority (PFRDA), this pioneering conference brought together global experts, policymakers, and researchers to reimagine the future of pensions and old-age income security in India.

The conference was inaugurated by:

- Mr. Pankaj Chaudhary, Hon’ble Minister of State for Finance, Government of India (Chief Guest)

- Mr. Nagaraju Maddirala, Secretary (Financial Services), Government of India

- Dr. Deepak Mohanty, Chairperson, PFRDA

- Prof. Bharat Bhasker, Director, IIM Ahmedabad (Keynote Speaker)

Other notable attendees included senior officials from SEBI, EPFO, IRDAI, and international pension experts from South Africa, Nigeria, Hong Kong, and the World Bank.

Key Takeaways from Our Paper

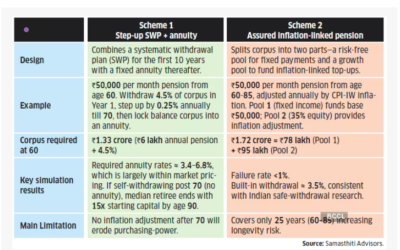

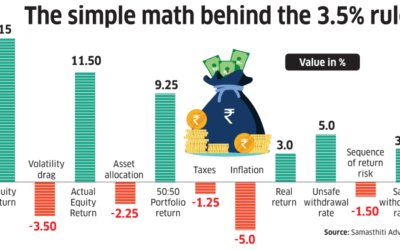

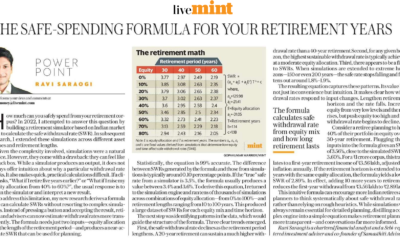

Our paper addresses a pressing issue for India’s emerging class of retirees: how much can you safely withdraw from your retirement savings without running out of money? The key takeaways from the paper includes,

- Conventional U.S. based rules like the “4% rule” may overestimate sustainable withdrawals in India due to higher inflation, more volatile returns, and longer retirements.

- Our simulations, using Indian asset returns and inflation data, suggest that lower withdrawal rates around 3% may be more prudent, depending on asset allocation and time horizon.

- The paper explores portfolio design, rebalancing strategies, and buffer rules to manage uncertainty in post-retirement income.

- We advocate for a more nuanced, India-specific framework to guide retirement drawdowns under schemes like NPS and mutual fund portfolios.

Advancing Our Mission

At Samasthiti Advisors, our mission is to promote research on social security in India and to make retirement planning accessible, informed, and reliable. Winning this award is both an honor and a reminder of the importance of evidence-based retirement guidance in a country where longevity is rising and pension systems are evolving. We remain committed to bridging the gap between policy, practice, and personal finance, so that every Indian can retire with dignity and security.

— Team Samasthiti Advisors

0 Comments