If you are waiting for the right moment to invest – well, there is no such thing

You have heard it so many times, it kills me to repeat this for you. But let me do it anyway,

Invest for the long term and don’t try to time the markets

The above advise sounds practical when markets are “normal”, but even an ardent believer in this long-term no-market-timing hypothesis will dither to invest when markets are at an all-time high.

At the time of writing this, the Sensex is in unchartered territory, scaling one peak after another. To put it mildly, the equity market is on fire! So, should you sit on the fence and wait for the equity markets to correct before investing?

Let’s forget all the rhetoric and look at data for hint.

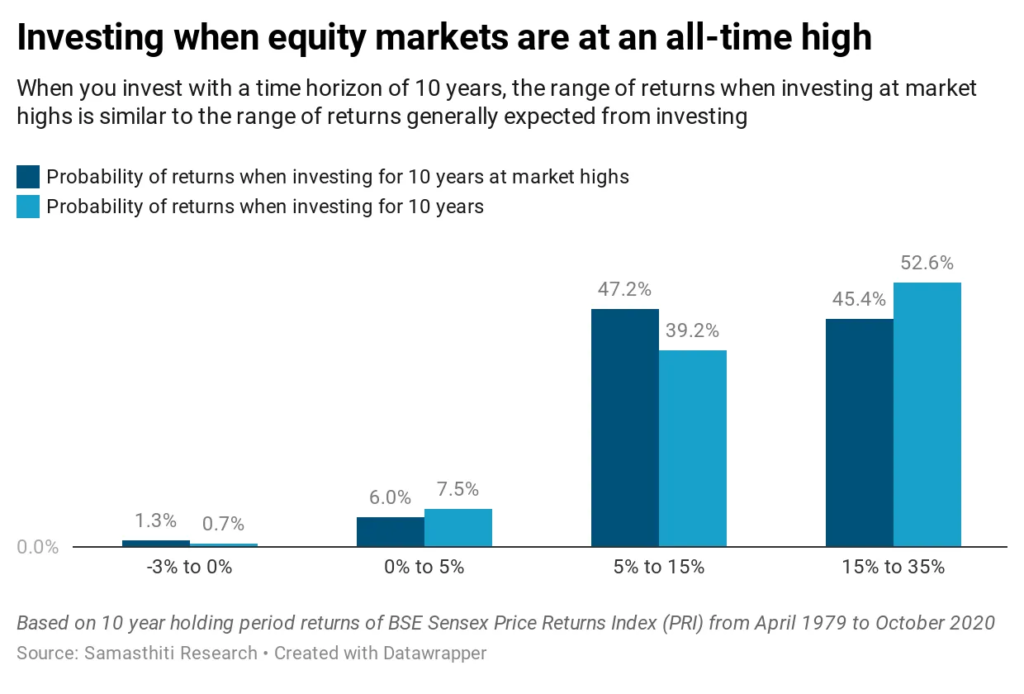

The data below represents the range of returns you can expect from investing in equities with a time horizon of 10 years. It contains a fascinating insight – if you invest in equities with a time horizon of 10 years, the return you can expect is the same irrespective of whether the markets are at an all-time high or not.

The dark blue and the light blue bars in the above chart broadly correspond to each other, highlighting that there is not much to distinguish the range of returns when investing at market highs or otherwise.

The data shows that when investing at market highs,

the probability of earning less than 0 percent return increases only marginally from 0.7 percent to 1.3 percent

the probability of earning low returns (0 percent to 5 percent) increases only marginally from 6 percent to 7.5 percent

the probability of earning mid-range returns (5 percent to 15 percent) increases (surprisingly!) from 39 percent to 47 percent

the probability of earning high returns (15 percent to 35 percent) declines from 53 percent to 45 percent

So, what should you takeaway from the above analysis?

Apart from a marginally reduced possibility of earning very high returns, there are no disadvantages of investing at market highs

The data speaks for itself – if you are investing for the long term in equities, it doesn’t matter if markets are at an all-time high.

0 Comments