When it comes to retirement planning, one of the most dangerous yet misunderstood risks is Sequence of Return (SOR) risk. This refers to the order in which your portfolio earns its returns. While it may seem that average returns alone should determine your portfolio’s longevity, the sequence in which those returns occur can significantly impact how long your retirement savings last.

For instance, if the market takes a downturn in the early years of your retirement, followed by a recovery later, the impact of those initial losses could be devastating. Even if your portfolio eventually earns the same average return as someone who retired in a better market environment, your portfolio might still run out of money sooner due to the timing of those early losses.

A Simple Illustration of SOR Risk

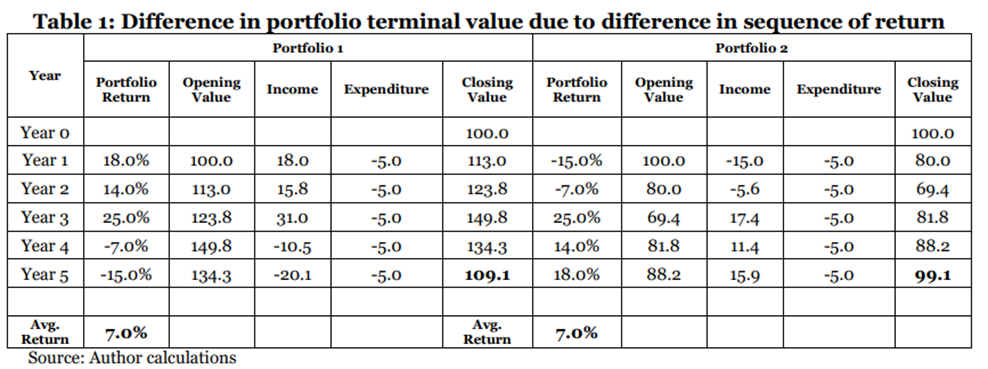

Imagine two retirees with identical portfolios, both expecting an average return of 7% over five years. The difference? Retiree 1 experiences higher returns in the early years, while Retiree 2 sees a reverse sequence—lower returns early on, with higher returns coming later.

Although both portfolios achieve the same average return, Retiree 2’s portfolio will be worth significantly less after five years than Retiree 1’s. This difference becomes even more pronounced over a 20- or 30-year retirement horizon. The earlier losses faced by Retiree 2 mean less money in the portfolio to benefit from future growth, leading to a shorter portfolio lifespan.

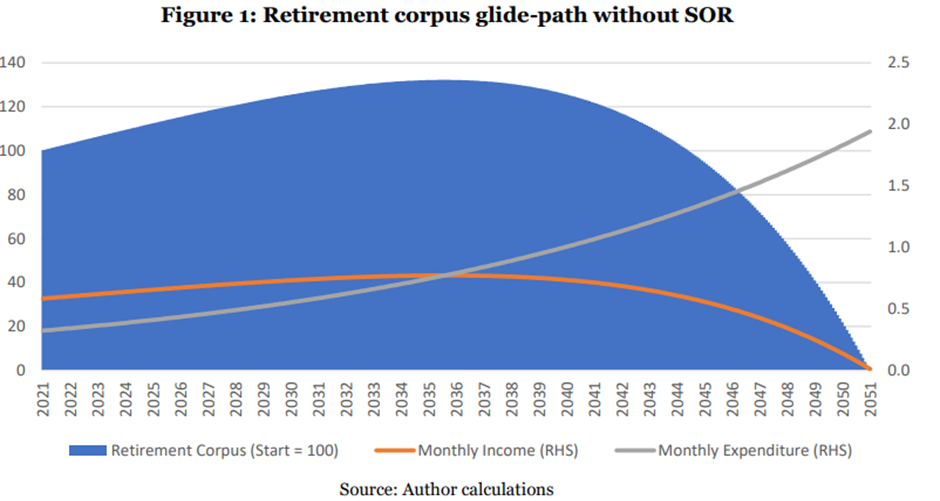

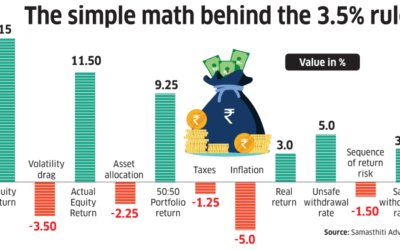

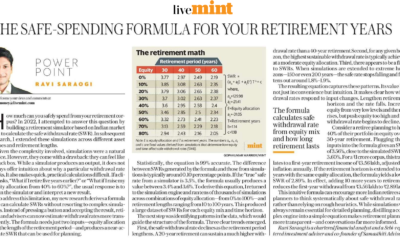

Let’s consider a practical example. A retiree wants her savings to last from age 60 to 90, with her expenses inflating at 6% per year. Her financial planner estimates an average debt return of 5% and an equity return of 12%, suggesting that a Safe Withdrawal Rate (SWR) of 4% should be adequate. The below graph depicts this scenario.

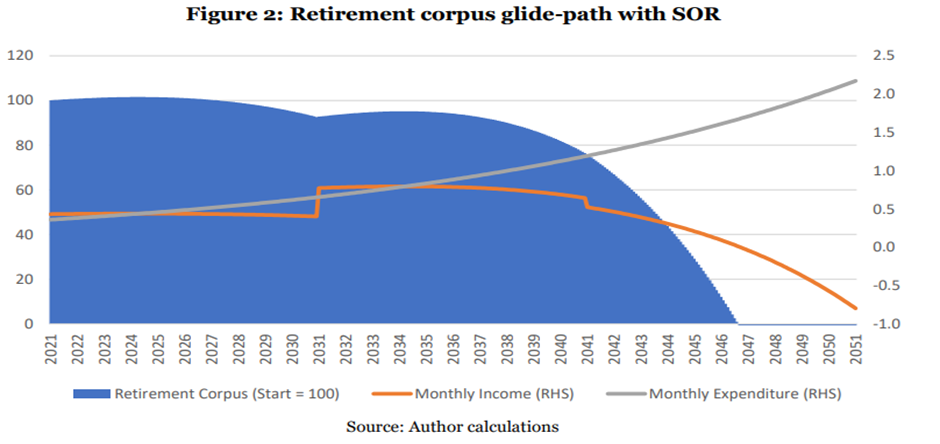

However, market returns are never perfectly linear. For example, someone who retired in India in 1992 would have faced three distinct decades of market performance:

- 1992-2002: A disappointing equity return of just 5.5%.

- 2002-2012: Equity markets surged with returns exceeding 17%.

- 2012-2021: Moderate returns of 12%.

Although the average return over these 30 years was 12%, the retiree would have run out of money by age 85—not 90 as initially expected as depicted in Figure 2. Why? The poor returns in the first decade weakened the portfolio early on, and despite strong returns later, there was not enough left in the portfolio to sustain withdrawals through the entire retirement period.

Mitigating SOR Risk with a Safe Withdrawal Rate (SWR)

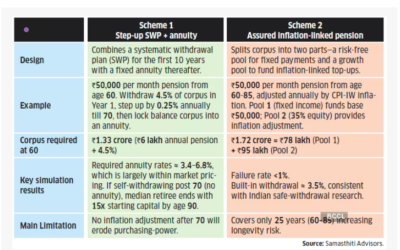

Now that we’ve identified the dangers of Sequence of Return Risk, how can retirees protect themselves? This is where the concept of the Safe Withdrawal Rate (SWR) comes into play.

The SWR is a strategy designed to manage withdrawals from a retirement portfolio without depleting it prematurely. Essentially, the SWR determines how much you can safely withdraw each year, starting with a fixed percentage in the first year, and adjusting for inflation in subsequent years. For example, if someone retires with a corpus of INR 1 crore and follows a SWR of 4%, they would withdraw INR 4 lakhs in the first year. In the next year, assuming inflation of 10%, they would withdraw INR 4.4 lakhs, and so on.

The beauty of the SWR approach is that it helps retirees avoid drawing down too much of their portfolio too soon, giving their assets a chance to recover during down markets. By adhering to a disciplined withdrawal strategy, retirees can mitigate the damage caused by poor early returns and preserve their portfolio’s longevity.

Sequence of Return Risk is one of the most critical, yet often overlooked, risks in retirement planning. The timing of market returns can have a profound impact on how long your retirement savings will last. While average returns are important, they don’t tell the full story. To safeguard against this risk, retirees should consider adopting a Safe Withdrawal Rate (SWR) that takes into account both market volatility and inflation. With a properly calculated SWR, you can better manage your retirement portfolio and enjoy financial security in your life.

We appreciate your paper on Safe Withdrawal Rate in the Indian Context. However, what is not clear is how to withdraw from the corpus.

e.g. As per my calculation, My monthly expenses, multiplied by 33 years is 1Crore.

I am having 1 crore in my retirement kitty and below is the asset allocation.

Equity – 60L

Debt – 40L

Q1. Should I rebalance my portfolio to 40% – Equity and 60% Debt? and then withdraw @3%?

Q2. How should I withdraw? Should I withdraw money from both Debt and equity (1.5% from Equity and 1.5% from Debt) together or withdraw money only from Debt OR withdraw money only from equity?

Thanks, glad you found it useful. Yes, you will need to rebalance – annual rebalancing frequency will work well. Regarding withdrawals, you can use a bucket strategy. Withdraw from debt bucket, and keep rebalancing gains from the equity bucket to the debt bucket. This is one way, but of course, there are several other withdrawal methods.

Sequence of return risk can quietly drain your retirement—plan smart to stay secure.

Very informative. Thank you for sharing.

Can sequence of return risk be mitigated by following an equal allocation strategy to 3 buckets, namely Conservative assets (senior citizen savings scheme, bank FD, liquid funds), Hybrid assets (Balanced advantage funds, dynamic asset allocation funds) & Equity assets (large cap or flexicap at best) ? All withdrawals can be done from the first bucket (conservative assets). Once this bucket has emptied it can be replenished from partial sale of hybrid and /or equity assets. What do you think ?

Thanks for your comment and glad you found the post useful.

No, sequence of return risk cannot be mitigated by following a bucket strategy. You can think about your portfolio as a pie – how you slice and dice it, doesn’t matter. If it has a significant allocation to equities, it will experience sequence of return risk. There are two ways to mitigate this risk – lower equity allocation, or pursue a dynamic withdrawal strategy. Our next research on dynamic withdrawal strategies will throw more light on this (expected to be out in July 2025).

Regards

Ravi