(A condensed version of this post was published in Economics Time Wealth on 29th Dec 2025 and can be accessed here )

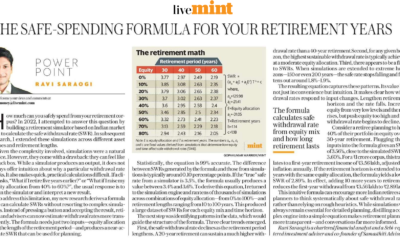

It’s not easy to suggest a 3.5% withdrawal rate to a retiree. Particularly when equity markets have historically delivered double digits returns and debt returns are double the quoted withdrawal rate. It can be confusing—why is the safe withdrawal rate stuck at such a low level if investment returns are substantially higher? Here, we will unravel this mystery by using a series of back-of-the-envelope calculations.

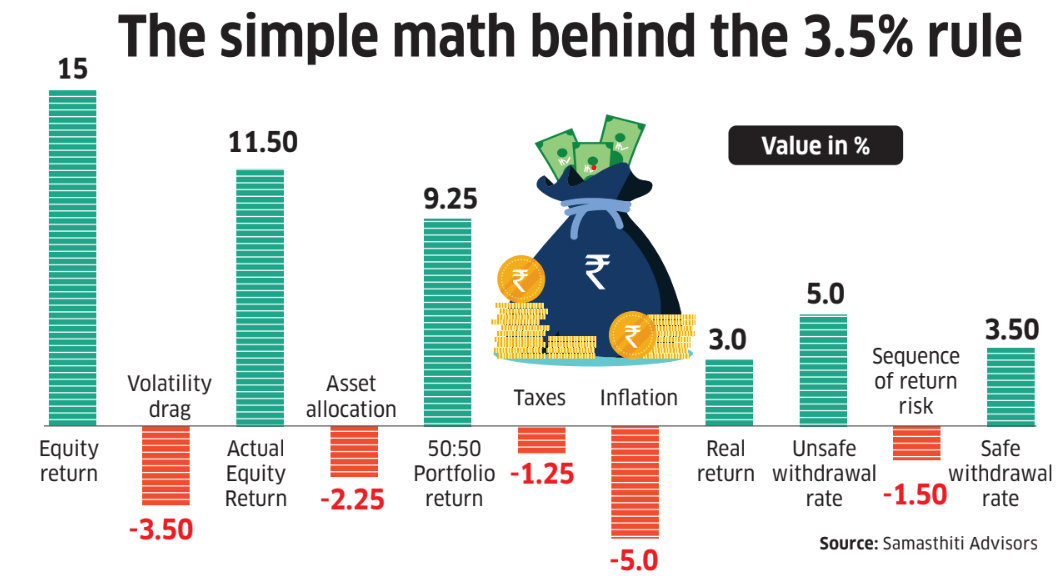

Let us start with an equity return assumption. Most investors look at historical returns and project that return going forward. Over the last 25 years, equity has delivered an average annual return of 15%. However, it would be inappropriate to project this return going forward as averages lie. If you lose 50% in one year and gain 50% the next, your average return is 0%, but you have actually lost money.

The right metric to use for estimating returns from a volatile asset is the geometric mean, and not the arithmetic mean. Based on the geometric mean, which accounts for the “volatility drag”, the true return earned by equity investors over the last 25 years is 11.5%. Let’s take this as an estimate of future equity returns.

Equity may fetch 11.5% returns going forward, but unless your retirement corpus is following a 100% equity allocation strategy (I hope not!), it will not earn the full equity return. This may be too obvious, but you will be surprised how many people substitute their portfolio returns with equity returns. Assuming a 50:50 (equity: debt) portfolio, and debt returns at 7%, the blended portfolio return comes to 9.25%.

This 9.25% return is gross of tax. To get the post tax numbers, we need to factor a tax rate. For equity, assuming the gains will be booked as long-term capital gains, the tax rate will be 12.5%. For debt, the tax rate will depend on the income slab of the retiree and can go as high as 30% (ignoring the even higher tax bracket applicable for high earners). However, let us assume debt taxation also at 12.5% assuming the retiree uses hybrid funds or arbitrage funds. Assuming a tax rate of 12.5% on the portfolio, the pre-tax portfolio return of 9.25% translates to a post-tax return of around 8%.

Understanding real returns

If you have a retirement corpus of Rs 1 crore, which is earning a post-tax return of 8%, you can withdraw Rs 8 lakh each year without disturbing the principal. That would be an initial withdrawal rate of 8% on your portfolio. However, you would want your withdrawal of Rs 8 lakh to increase with inflation each year. So, we will need to adjust the nominal portfolio return with inflation to arrive at the real return. If we assume an inflation rate of 5%, the nominal portfolio return of 8% comes down to a real return of 3%, which is 8% less 5%. This is not an accurate way to adjust nominal returns for inflation, but let’s not complicate things as it is broadly right.

Accounting for sequence risk

A simple calculation in Excel will reveal that a Rs 1 crore portfolio, earning a 3% real return, can support a withdrawal of Rs 5 lakh in the first year, with this withdrawal being increased by 5% inflation each year for 30 years. For arriving at this number, we have assumed that the portfolio’s future value can go down to zero.

Now, a withdrawal of Rs 5 lakh on a portfolio of Rs 1 crore corresponds to an initial withdrawal rate of 5%. In the perfect world, where your portfolio would have been earning a 3% real return consistently, year after year, the initial withdrawal rate would indeed have been 5%. However, we don’t live in a perfect world. Your portfolio may on average earn 3% real return, but this will come with substantial volatility, exposing the portfolio to sequence of return risk.

So, as a last step, we need to adjust the 5% withdrawal rate for sequence of return risk. This is tricky because there is no closed-form mathematical way to do it. We will need to rely on simulations. As per my research, the adjustment needs to be broadly about 1.5%, though this depends on many factors. Adjusting the 5% rate with sequence of return penalty, we are down to the 3.5% withdrawal rate. Sounds familiar? This is broadly the rate I have arrived at in my research (https://bit.ly/3JZVHFb) using extensive simulations. But in this article, we have reverse-engineered the 3.5% rate using simple to understand calculations! Would it convince the naysayers? I certainly hope so. The 3.5% rule isn’t pessimistic — it’s what survives the math.

–Ravi Saraogi, CFA, is a SEBI Registered Investment Adviser and Co-founder of Samasthiti Advisors

0 Comments