Markets hit a speed breaker

Samasthiti Advisor’s Weekly Market Tracker – For the week ended Jan 19, 2024

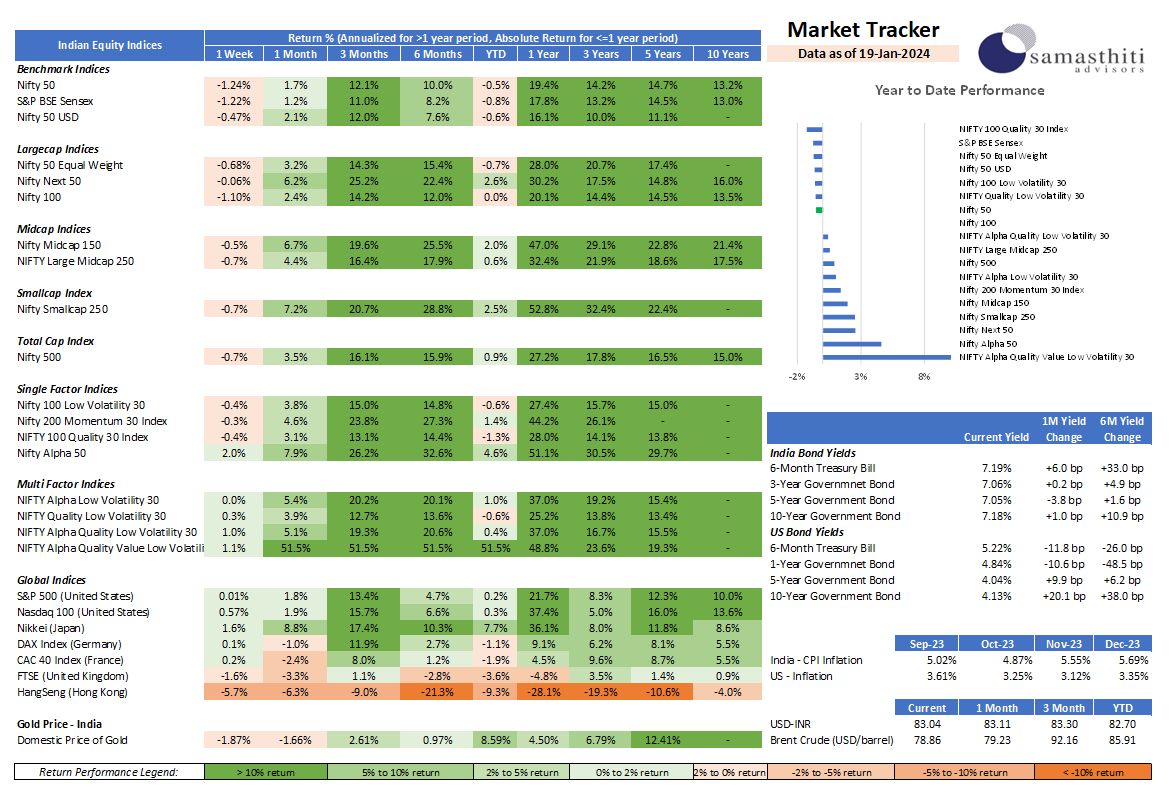

•📉 Nifty 50 (-1.24%) and Nifty Next 50 (-0.06%) reported negative weekly returns amid lower than expected earnings of HDFC Bank, global concerns including growth concerns from China 🌐, coupled with rise in UK and US inflation.

•📈 Nasdaq (0.57%) and S&P 500 (0.01%) saw modest gains as US economic indicators presented a mixed picture. 📉 Weekly jobless claims hit a 16-month low and uptick in inflation has dampened rate cut expectations. Rising treasury yields in the US reflect market scepticism.

•📈 Nikkei rose 1.6% 🤑 fuelled by Japan’s positive economic landscape. 📉 In December, Japanese inflation slowed to 2.3%, easing pressure on the Bank of Japan. 💹 Nikkei’s 34-year high has been boosted by a weaker yen.

•📈 Gold 🪙 faces short-term pressure as the US inflation rate rises, diminishing hopes for an early central bank rate cut.

•📉 Chinese stock rout accelerates as foreign investors sell, having unloaded about 90% of the $33 billion Chinese stocks purchased in 2023.📉 Hang Seng was down -5.7% over the week. 🚢 Red Sea attacks heighten pressure on China’s exporters with mounting delays. 📈 China’s Q4 GDP grows 5.2%, missing market expectations.

•📈 Indian 10-year yield is at 7.18%, up 10.9 basis points; 🇺🇸 US 10-year yield at 4.13%, rising by 38.0 basis points. 🌐 Rising US treasury yields follow central bankers’ resistance to imminent rate cuts. 📈 Higher-than-expected US CPI reduces hopes for an early 🏦 Fed rate cut. 💰 A $510 billion federal deficit for Q1 2024 adds fiscal pressure😥.

•📉 USD-INR at 83.04 reflects rupee depreciation amid a strong dollar and weak domestic markets. 🛢 Rising crude oil prices add downside pressure. 💵 US dollar gains as a safe haven, boosted by global trade disruption concerns and reduced expectations of a March rate cut after strong labour market data.

•📈🛢 Brent crude at $79.09 rises as IEA and OPEC project robust global oil demand, foreseeing a 1.24 million bpd growth in 2024, up by 180,000 bpd from earlier estimates, exacerbated by cold weather impacting US crude output. A substantial weekly draw in crude inventories adds to the bullish sentiment. Geopolitical risks in the Middle East, exemplified by Pakistan’s strikes inside Iran, heighten market concerns.

•Until next time, 👋 bye! 🌟 Enjoy your weekend and have a well-deserved break! 🌞

0 Comments